When ‘crypto-winter’ is due to arrive and how to make money off it

In the digital asset market, growth phases are followed by periods of decline. At the same time, experienced crypto community participants know you can make money regardless of whether prices are rising or falling.

We are going to be talking about ‘crypto-winters’ – prolonged periods when the digital asset market is in decline – and the possibilities for extracting maximum profit during them.

What exactly is a ‘crypto-winter’?

To understand what a crypto-winter is, it is important to discover what causes it. To do this, you need to plunge into the technical aspects of the most capitalized cryptocurrency – Bitcoin (BTC) – whose behavior affects the entire digital asset market.

The ultimate quantity of bitcoins is limited: about 21 million will be issued in all. At the same time, the cryptocurrency network periodically reduces the rate of coin release in a process called ‘halving’.

Halving occurs in the Bitcoin network approximately once every 4 years (every 210,000 blocks mined by cryptocurrency miners). Consequently:

- The reduction in the mining speed for Bitcoin, whose supply is already limited, results in a shortage of BTC on the market.

- The limited supply of cryptocurrency, as digital assets increase in popularity, leads to growth in the value of coins.

Three halvings have already taken place in the Bitcoin network:

- November28, 2012

- July 9, 2016

- May 11, 2020

After every halving, Bitcoin’s price entered a period of rapid growth:

The behavior of Bitcoin’s exchange rate after halvings. Halvings are marked by blue lines. Chart: TradingView

The behavior of Bitcoin’s exchange rate after halvings. Halvings are marked by blue lines. Chart: TradingView

On the chart, you can see that after each 2-fold decrease in the rate of BTC’s release, the coin set new record highs. At the same time, after peaking as a result of the halvings of 2012 and 2016, the cryptocurrency saw a prolonged period of decline (a crypto-winter). This phenomenon can be explained as follows:

- After the cryptocurrency hits new highs, many investors begin to take profits by selling bitcoins that they had purchased at a lower price.

- The sale of large volumes of BTC causes prices to decline, and many investors begin to sell their assets for fear of losing their money. As a result of these panic sales, many crypto-community members exit the market.

During such periods, sellers become the main drivers of the market. At the same time, the history of Bitcoin shows that, with limited supply and periodic halvings, sooner or later a deficit emerges, which pushes BTC’s price back up again.

Estimated date of Bitcoin’s next halving. This date could be adjusted if the cryptocurrency’s network experiences significant changes. Source: bitcoinblockhalf.com

Estimated date of Bitcoin’s next halving. This date could be adjusted if the cryptocurrency’s network experiences significant changes. Source: bitcoinblockhalf.com

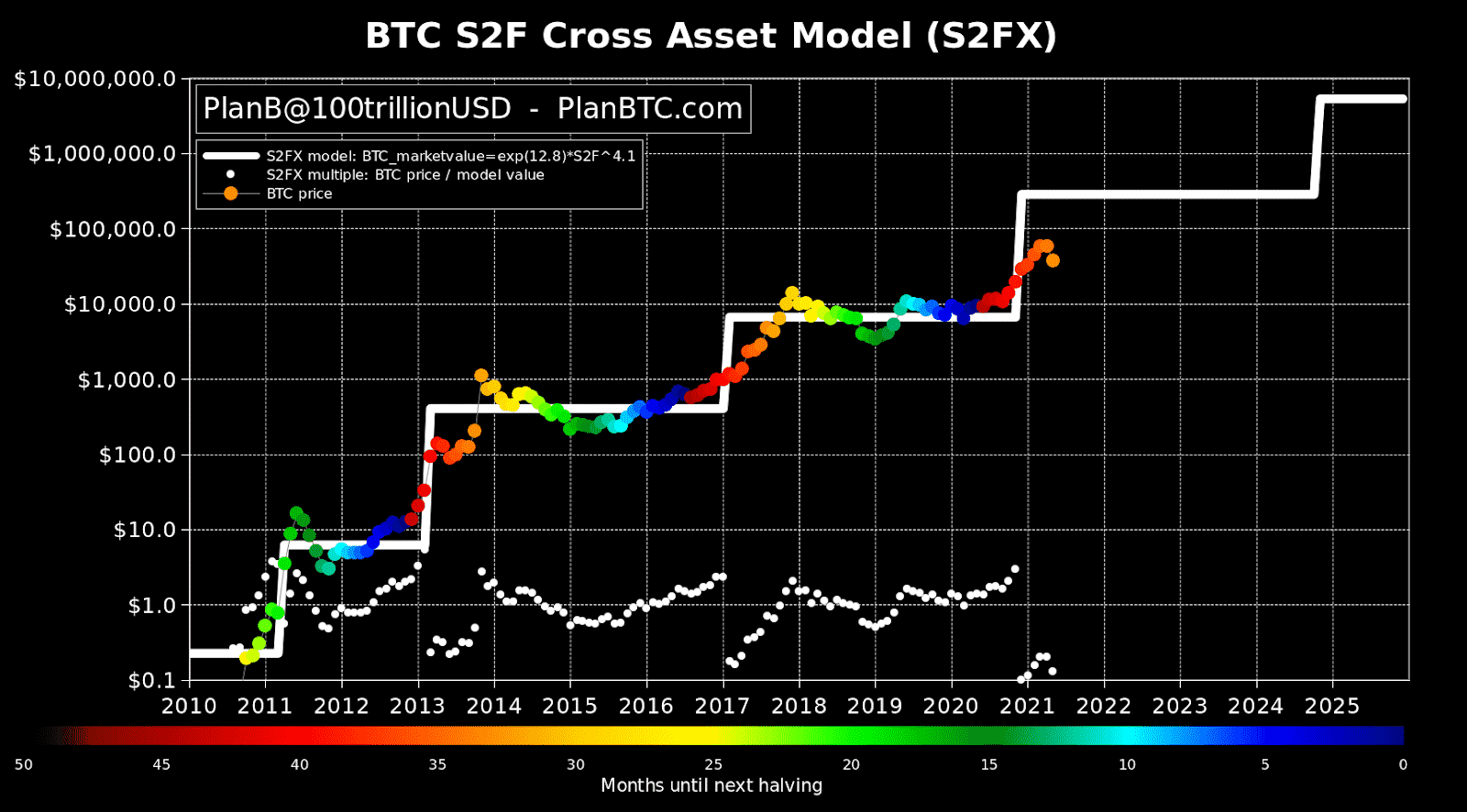

A popular analyst in the crypto community, PlanB, created a model for predicting the movement of BTC by analyzing Bitcoin’s price patterns in the periods that followed previous halvings and adding information about how fast the cryptocurrency is being released to the system.

Here’s how it works:

- PlanB has broken down Bitcoin movement periods by color. For example, peak values fall in the bright orange or yellow phase, crypto-winters in the light and dark blue one. By focusing on BTC’s previous behavior patterns and color, you can make predictions about the cryptocurrency’s future price trends. For example, if the coin has entered the green phase, a crypto-winter is likely looming in the near future. On the contrary, the appearance of a red dot signals that a growth phase can be expected soon.

- The white line is a frame you can use to make color forecasts. It is built on the basis of calculations of BTC’s rate of growth in the market and of the scale of deficits provoked by halvings. You may notice that the colored dots do not exactly stick to the lines of the frame. At the same time, in the long run, they still generally follow it.

PlanB Model for Predicting Bitcoin Movement

PlanB Model for Predicting Bitcoin Movement

According to PlanB’s model, Bitcoin is now on the verge of reaching a new high. Based on its history of behavior, the coin needs to break through the white line to do this. After this happens, presumably in 2022, the cryptocurrency should begin to move into a crypto-winter phase.

It is worth noting that during periods of prolonged BTC decline, its exchange rate falls below the white line. Price movement under this line can be a signal for investors who want to buy Bitcoin profitably.

How to make money during a crypto-winter

Now we know that Bitcoin’s behavior is cyclical. In particular, BTC is retracing the patterns of previous years. Thanks to a technical analysis of its history, it is possible to identify promising entry points for investment.

Crypto-winter, a period in which prices fall to local lows, is one of the most attractive periods for buying cryptocurrency for long-term investment.

It is important to understand that time is as important a resource for investors as money. Competent management makes it possible to earn good money. You can explain this thesis with a couple of examples:

- Knowing that the cryptocurrency has the potential for further growth, you refuse to take quick profits and wait for the coin’s price to rise even further.

- If you buy a coin during a crypto-winter and its price falls even lower, there is no need to panic. Knowing that ahead, under the influence of halving, the cryptocurrency will likely grow, you can wait for the right moment to sell.

The PlanB color scheme shows that, during periods of growth, as well as during crypto-winters, BTC’s price moves unevenly. These fluctuations can be explained by the high volatility of cryptocurrencies, due to which the coin can quickly skyrocket or plummet due to news events. Let’s look at some examples:

- In September 2017, Chinese authorities banned ICOs and restricted cryptocurrency transactions. Despite the fact that Bitcoin was already in an active growth phase during this period according to PlanB’s forecasting model, the cryptocurrency lost almost 40% of its value in just a few days.

- Panic-prone investors began to sell off cryptocurrency amid pressure from the authorities of the People’s Republic of China – one of the largest crypto centers at that time.

- Three months later, in December of 2017, after a number of positive developments in the digital asset market, as well as growth in the BTC deficit, the cryptocurrency’s price hit an absolute high of $20,000.

Bitcoin chart. The oval marks the fall of BTC as a result of China’s ICO ban and restrictions on crypto operations. The lower green lines show Bitcoin’s range of movement after China’s announcement. The upper green line shows Bitcoin’s maximum value in 2017, which the cryptocurrency only managed to reach again 3 years later – in December of 2020. Chart: TradingView

Bitcoin chart. The oval marks the fall of BTC as a result of China’s ICO ban and restrictions on crypto operations. The lower green lines show Bitcoin’s range of movement after China’s announcement. The upper green line shows Bitcoin’s maximum value in 2017, which the cryptocurrency only managed to reach again 3 years later – in December of 2020. Chart: TradingView

Thus, you should not be guided by emotions when working with cryptocurrencies. You need to track the phases of market movements in order to identify promising entry points for buying assets. Analyzing cryptocurrencies’ previous behaviors can help investors make accurate projections for the future. At the same time, the best period for purchasing coins is during a crypto-winter.

Where to buy cryptocurrency when the time is right

There are many platforms where you can buy Bitcoin, as well as other cryptocurrencies. Unfortunately, not all sites offer favorable conditions without pitfalls.

For example, to buy cryptocurrency on most popular exchanges, you need to go through a long registration process that includes verification. At the same time, these platforms’ commissions and operating procedures often come as unpleasant surprises.

Exchangers have become a modern alternative to unwieldly crypto exchanges. With their help, you can quickly buy any cryptocurrency at a good price. For example, Alfacash is one such platform.

With Alfacash, you can anonymously buy cryptocurrency in various ways. For example, the platform allows you to pay for coins with bank cards. Users praise Alfacash for its low fees, high transaction speeds, user-friendly interface, and prompt customer support.

To Sum Up:

Crypto-winter is a period that opens up a lot of opportunities for investors to profitably purchase cryptocurrencies. The maximum profit from coins purchased during this time can be extracted by those who plan to buy digital assets as long-term investments.

It is profitable to buy cryptocurrency on various trading platforms, if you purchase at the right time. Among all of the places where you can buy digital assets, one of the most popular is Alfacash. This platform attracts market participants with low commissions, its simple interface, and a lot of other advantages.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why Is Crypto Market Crashing Today (Feb 28)

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs