Crypto fees can look simple on the surface, but they make a big difference in how much money Nigerian traders actually keep. Whether you’re using a global platform like Binance or Kraken, or local players like Quidax, Luno, and Yellow Card, every exchange uses its own fee model.

We always advise traders to understand the difference in fees before choosing an exchange. Here’s a clear breakdown of the types of fees to watch for and understand before deciding which exchange suits you.

Types of Fees Investors Have to Pay on Nigerian Exchanges

1. Maker/Taker Fees

Most centralized exchanges in Nigeria, such as Binance and Quidax, use the maker/taker system.

- Maker fees reward you for adding liquidity by placing limit orders.

- Taker fees apply when you accept existing orders on the book.

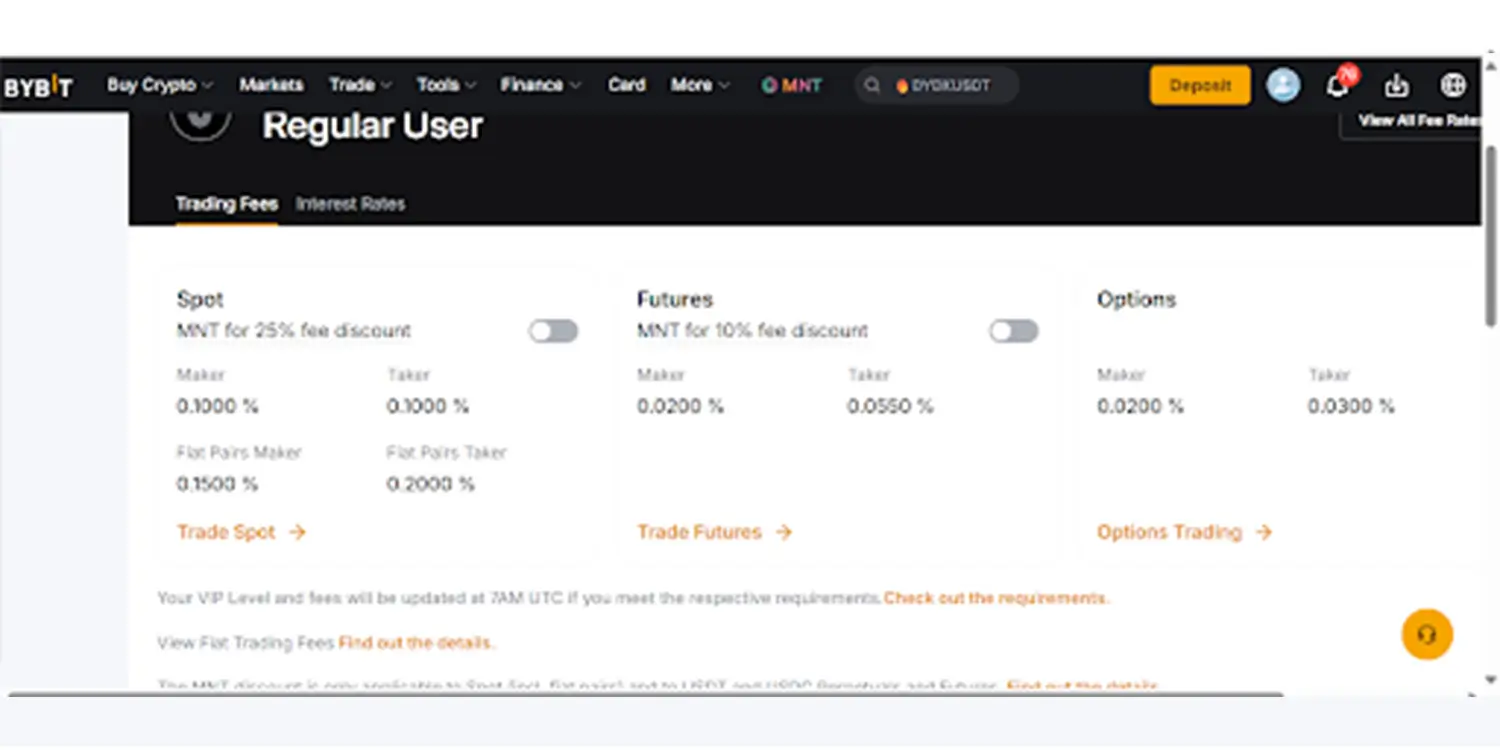

On major exchanges, these usually range from 0.1% to 0.5%, depending on your 30-day volume. High-volume traders and VIP tiers get discounts.

2. Deposit and Withdrawal Fees (NGN Charges)

Local NGN deposits and withdrawals come with different fee structures depending on the exchange and the payment provider.

Example:

- Luno charges ₦150 for bank transfer deposits, plus ₦500 for withdrawals.

- Some global exchanges don’t support NGN directly, so users rely on P2P or stablecoin deposits.

NGN fees matter the most for day-to-day Nigerian users who deposit and cash out frequently.

3. FX Spreads / Conversion Fees

When you buy crypto with NGN, exchanges apply a foreign exchange spread. This means the difference between the buy and sell price.

- This can be as low as 0.5% on the best platforms.

- On less transparent exchanges, spreads can exceed 3%, even if “zero fee” is advertised.

This is why understanding the hidden fees you probaly missed on exchanges is important.

4. Inactivity Fees

Some platforms charge small monthly fees if your account stays dormant for long periods.

This is more common on international fintech platforms and less common on local NGN exchanges.

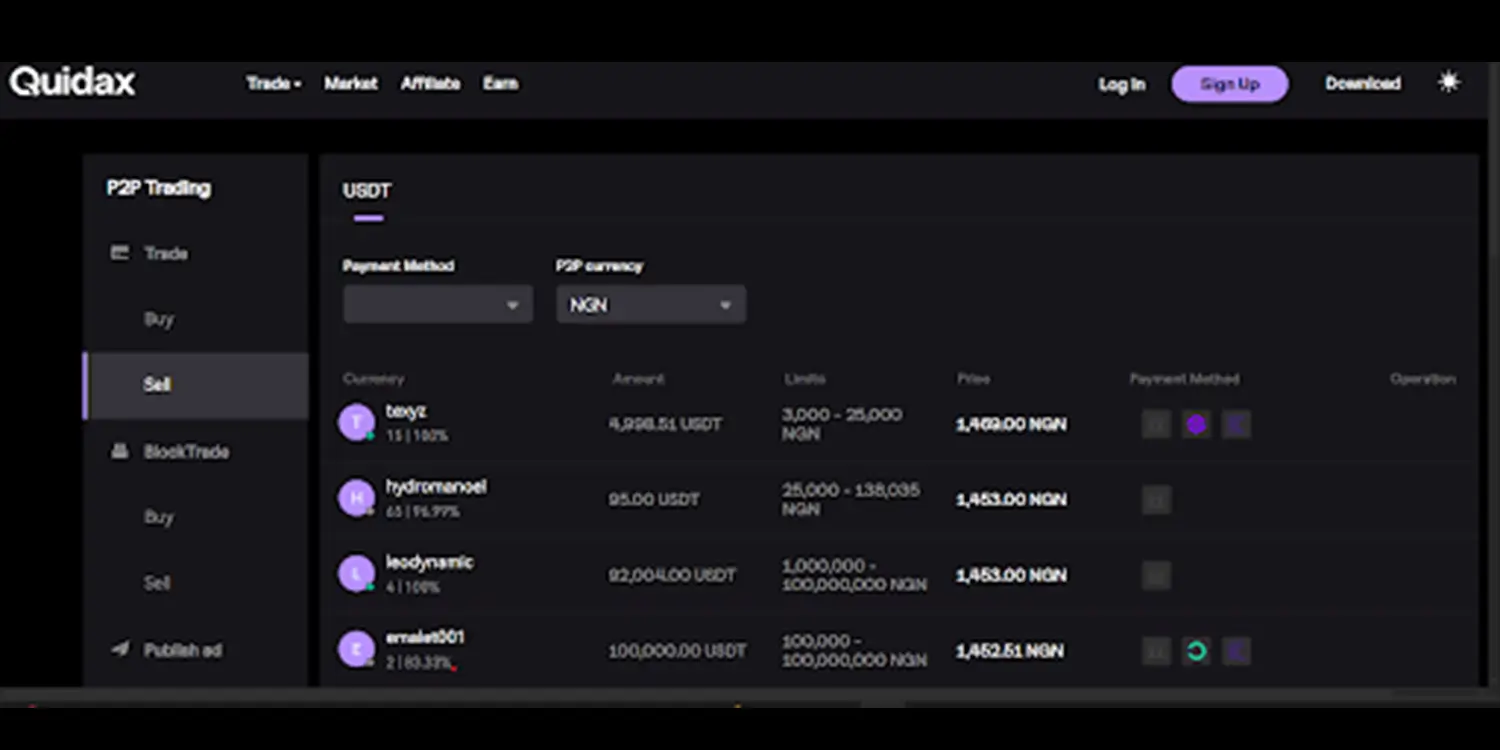

How Fees Differ in P2P and Direct NGN Platforms?

P2P Marketplaces:

Platforms like Binance P2P (before it was disabled in Nigeria) or OKX P2P allow users to buy and sell crypto directly between each other.

Pros:

- No platform trading fees,

- Access to flexible rates,

- Multiple payment methods

Cons:

- You pay indirectly through merchant premiums, which can add 1%–4% to the real cost.

- Rates fluctuate rapidly due to market demand.

Direct NGN Platforms:

Exchanges such as Luno, Quidax, Yellow Card, and Breet provide structured NGN deposit and withdrawal systems.

Pros:

- Transparent, fixed fees.

- Instant settlement and fewer price shocks.

Cons:

- You pay direct charges for deposits and withdrawals.

Fee Comparison Table

| Exchange |

Trading Fees (maker/taker) |

Deposit Fees |

Withdrawal Fees |

| Binance |

0.1% / 0.1% |

None |

Varies by crypto |

| Quidax |

0.1% |

Flat NGN 100 |

Flat NGN 200 |

| Busha |

Zero trading fees for NGN to crypto trades |

No deposit fees |

Low |

| Breet |

No trading fees |

Zero deposit fees |

No withdrawal fees |

Hidden Costs and Transparency

After years of trading, I’ve learned that most exchanges claiming “low fees” rarely tell you the full story. The real costs often hide in slippage, spreads, and unofficial NGN FX rates, especially during market volatility. For Nigerian traders, these hidden fees matter even more because currency fluctuations quickly add up.

My simple advice: always check the real FX rate, withdrawal fees, and instant swap costs before funding your wallet. Some platforms like Quidax publish clear fee pages, but many don’t. A quick check can save you money every time you trade.

What are the Top Low-Fee Crypto Exchanges in Nigeria?

For Nigerian traders interested in saving costs, using the best low-fee crypto exchanges is a smart move. Below are some of the best low-fee options for the Nigerian market. These exchanges offer competitive fees, free deposits, or loyalty perks that cut costs for active users.

Here are the top low-fee platforms in 2026:

- Yellow Card: Best for Stablecoins and FX Rates – Yellow Card keeps costs low by focusing on stablecoins. Deposits and withdrawals in NGN are free, and spreads are competitive. Businesses also enjoy discounted treasury fees.

- Quidax: Low Maker/Taker + Zero Instant Swap Fees – Quidax charges 0% on Instant Swap and a flat 0.1% maker/taker fee. NGN deposits are free, and users enjoy discounted internal transfers.

- Luno: Affordable for Beginners – Luno’s ₦150 deposit fee and transparent pricing make it beginner-friendly. It occasionally runs free promos during market events or new asset listings.

- Binance (Global): Low Trading Fees for Stablecoin Users – While Binance no longer supports NGN P2P, Nigerians who trade with USDT or USD still enjoy 0.1% trading fees and periodic discounts for BNB holders.