CoinGape has been covering cryptocurrency and blockchain markets since 2017. Our editorial team evaluates projects and platforms using structured review frameworks focused on transparency, utility, and risk assessment. You can explore our review methodologies to see how we assess and rate different categories. We maintain clear editorial standards and disclose advertising or affiliate relationships where applicable.

In 2026, leverage trading in crypto has surged in popularity, as both retail and professional traders seek to amplify potential profits in the volatile crypto market. Amid this growing interest, choosing the best crypto leverage trading platform is a pivotal step towards success.

The decision isn’t just about finding a crypto trading platform with the highest leverage; it’s a strategic move that involves weighing crucial factors like fees, security, and user-friendliness to suit your individual trading style and risk tolerance.

To save your time, we have selected the top crypto leverage trading platforms for you based on our ranking and review methodology.

Key Takeaways:

As of Q3 in 2025, combined spot and derivatives volumes on centralized exchanges reached a record $9.72 trillion, with derivatives alone accounting for about 75.7% of that activity.

So, if you’re searching for a trading platform that offers 100x leverage or more with low fees and a good interface, this guide is made for you.

We’ll walk you through what leverage trading means (from 10x to 200x), how fees differ, which assets you can trade, and, importantly, how to choose a leverage trading platform wisely.

| Exchange | Max Leverage | Cryptocurrencies Supported | Leverage Fees | Rating |

|---|---|---|---|---|

| Up to 200x | 180 | 0.00% / 0.03% | 4.9 |

|

| Up to 125x | 500 | 0.02% / 0.04% | 4.5 | |

| Up to 125x | 360 | 0.02% / 0.05% | 4.6 | |

| Up to 100x | 50 | 0.02% (maker) and 0.065% (taker). | 4.3 |

|

| Up to 500x | 50 | Maker 0.01% / Taker 0.02% | 4.1 |

|

| Up to 50x | 50 | 0.04%/ 0.06% | 4.8 |

|

| Up to 100x | 100 | 0.1% | 4.8 |

|

| Up to 125x | 100 | 0.02% (options) and 0.055% (futures) | 4.3 | |

| Up to 125x | 100 | 0.02%/0.06% | 4.7 |

|

| Up to 50x | 100 | 0.02% | 4.3 |

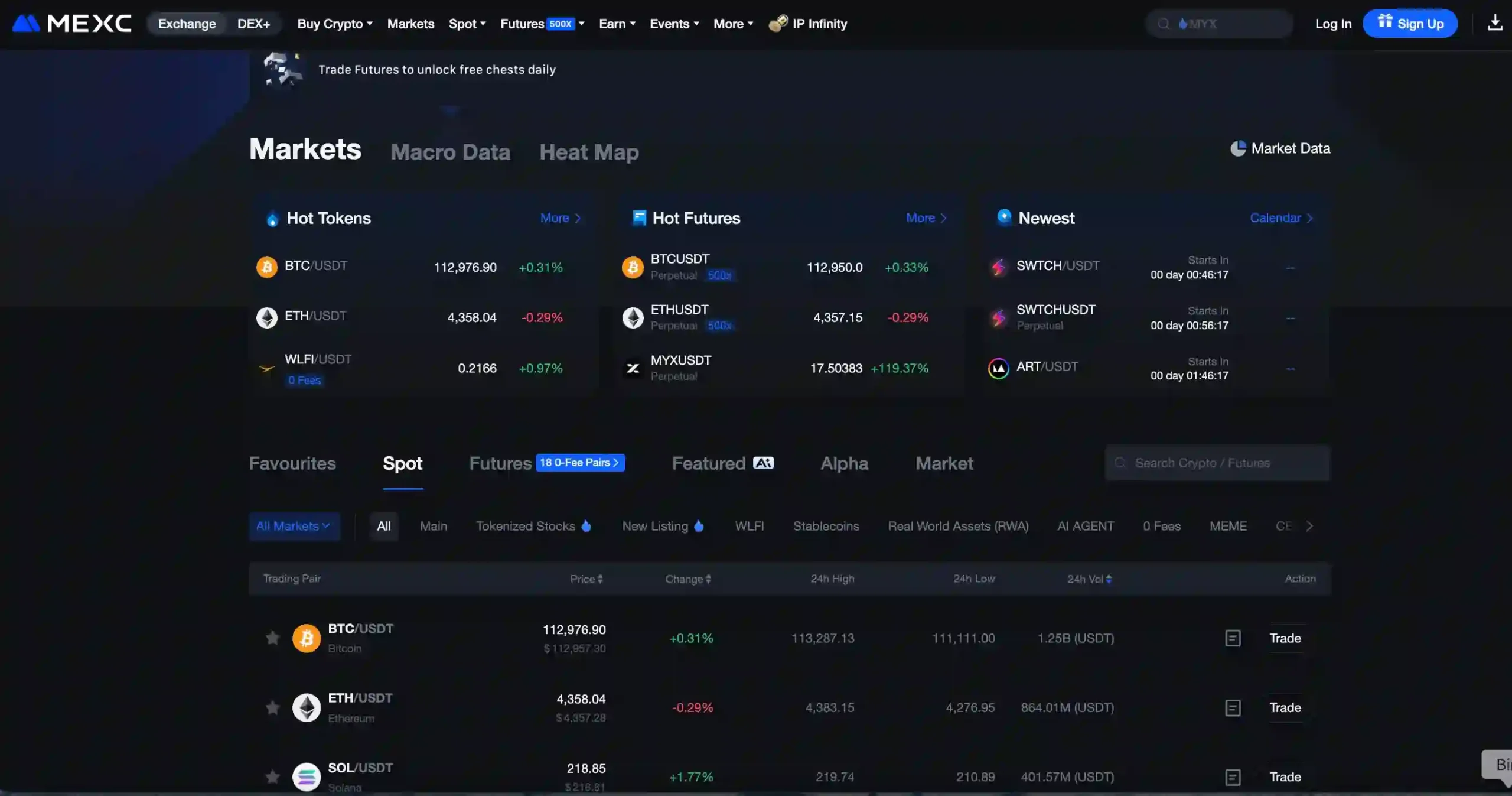

MEXC:A secure and user-friendly crypto leverage trading platform with up to 200X leverage.

Binance:Known for the highest liquidity and widest range of assets, making it the go-to platform for both retail and institutional traders.

OKX:A platform with the potential for high leverage and advanced trading tools.

PrimeXBT:Up to 100x leverage on most crypto pairs and a top choice for professional traders

Coinbase:Popular for being the most beginner-friendly and regulatory compliant for US traders.

KuCoin:Platform with innovative trading tools and support for a wide range of cryptocurrencies. Also offers up to 100x leverage.

Bybit:Advanced Crypto Leverage Trading platform with trading up to 100X leverage and high transaction speed.

Bitget:Built its brand around copy-trading, letting beginners easily follow top-performing traders in leveraged markets.

Kraken Pro:One of the most secure and reliable leverage trading platforms with trading up to 50X leverage for expert traders.

Bitfinex:Long-standing exchange with deep liquidity, especially in Bitcoin margin markets, catering to professional and institutional traders.

When you are looking for the best crypto leverage trading platforms in 2026, it’s essential to find those that offer the right balance of features, security, and leverage options.

With the global crypto market expected to reach a market volume of USD 71.7 Billion by 2028, platforms offering up to 100X leverage are becoming increasingly popular among traders. Considering these points, let’s start with the list of the best crypto leverage trading platforms:

MEXC is one of the few leverage trading platforms where you can push leverage as high as 200x, making it a good option for traders who want to take big positions with small capital. Launched by John Chen, MEXC has been around since 2018 and serves over 40 million users in over 170 countries.

On MEXC, you’ll find more than 2,200 crypto assets and close to 2,800 trading pairs, which is far more than most exchanges offer. That range alone makes it appealing for traders who like to explore beyond Bitcoin and Ethereum.

What makes MEXC even more attractive is that it offers a zero maker fee policy on both spot and futures markets, while taker fees remain low at 0.03%. There are also discounts available for MX token holders, according to an MEXC post. This cost structure makes it stand out against competitors like Binance and OKX.

On the Google Play Store alone, the platform has over 10 million downloads. A driving factor behind these numbers is the platform’s focus on offering massive exposure to multiple assets.

Looking at all these features, CoinGape scores MEXC 4.9 out of 5 because it perfectly combines ultra-high leverage (200X) with a massive token catalogue of over 2,000 assets/pairs.

| Max leverage | 200x adjustable on select COIN-M and USDT-M futures |

| Cryptocurrencies Supported | Bitcoin, Ethereum, and other altcoins and memecoins |

| Fees | 1,800-2,300 coins and over 2,000 trading pairs, according to CoinGecko |

| Countries available | Has a major market presence in most countries, with a few regional limitations. MEXC is available in over 100+ countries. |

| License | Operates through regional entities (Seychelles / Singapore listings). However, MEXC is not uniformly licensed for derivatives in all jurisdictions. |

| User base | 40 million |

| Platforms | Web and mobile apps (iOS/Android) |

Binance is arguably one of the top crypto exchanges in 2026, known by both new and experienced traders. Launched in 2017 by Changpeng “CZ” Zhao.

In terms of leverage, Binance offers up to 125× on certain perpetual futures contracts (major pairs like BTC, ETH). That’s less than MEXC’s 200x but still high enough for aggressive position sizing. For traders who don’t want the extreme risk of ultra-high multipliers, Binance often strikes a better balance of risk vs reward.

For fees, Binance uses a maker-taker model that’s common on some of the best centralized exchanges. Maker fees on Binance start at 0.02%, while taker fees are around 0.04% on many futures and spot trades, depending on tier/VIP level. Binance, like MEXC, offers discounts for holders of its BNB token. So, high-volume traders can use this to reduce trading costs.

Binance has grown into an exchange with over 270 million users, according to the company’s announcement. With users in 180+ countries and reporting daily volumes that consistently lead the market.

Binance has also rolled out expanded fiat on-ramps for users in some regions, like Europe. Plus, the exchange is making serious regulatory adjustments in jurisdictions like the UK and EU.

CoinGape gives Binance a user rating of 4.5 out of 5. We score them high because Binance perfectly combines a massive leverage of up to 125x with good coin selection and great customer support.

| Max leverage | Up to 125× on select perpetual futures |

| Fees | 0.02% / 0.04% (with volume/BNB discounts) |

| Supported cryptos | 500+ coins; large number of futures/spot pairs |

| Countries available | 180+ (but product availability, especially derivatives, varies by region) |

| License | Operates through multiple regional entities; holds licenses or registration in some, but is restricted in others |

OKX supports adjustable leverage up to 125x on select futures or perpetual contracts for major pairs. This means it appeals more to traders who want serious exposure with risk controls. Launched in 2013 by MingXing Xu, OKX has grown into one of the top low-fee crypto exchanges, operating in 180+ countries, with over 20 million active users.

One of OKX’s strengths is its broad crypto offering: 360+ supported cryptocurrencies, with extensive spot, margin, and derivatives markets. Fees are competitive: for many futures pairs and high-volume traders, maker fees can go as low as 0.02% and taker fees around 0.05%.

OKX also supports cross and isolated margin modes, with advanced tools such as conditional orders, trailing stop, and risk controls built into its user interface. The platform has also been making moves to improve its offerings for traders.

For example, maximum contract amounts and maintenance margin ratios on certain ALCH/USDT perpetuals were tweaked for tiered futures positions. This shows that OKX is actively managing leveraged products risk without reducing leverage caps on many popular pairs.

Recently, OKX said that it had adjusted the position tiers of several futures contracts to improve liquidity and risk management. Considering all of its leverage trading offerings, CoinGape gives OKX a user rating of 4.6 out of 5.

| Max leverage | Up to 125× on selected futures / perpetual contracts |

| Cryptocurrencies Supported | 360+ cryptocurrencies across spot, margin, derivatives |

| Leverage fees | 0.02% / 0.05% on many futures contracts |

| Countries available | 180+ |

| License | Multiple regional licenses |

| User base | 20 million+ |

| Platforms | Web, mobile (iOS and Android), desktop; advanced tools (conditional orders, trailing stops, etc.) |

Bitfinex ranks as one of the top leverage trading exchanges thanks to a combination of good maximum leverage, global presence, deep liquidity, transparent fee structure and flexibility.

The exchange was launched in 2012 by Raphael Nicolle, serving over a million traders in over 50 countries. The platform supports up to 100x leverage on select futures contracts.

Why is Bitfinex popular among leverage traders? The exchange offers a lot of really cool features. One of the features is its Peer-to-Peer (P2P) Margin Funding, which enables traders to borrow funds directly from other traders to open positions with up to 10x leverage.

In addition, Bitfinex supports multiple advanced order types, including limit, market, stop-limit, trailing stop, fill-or-kill, and scaled orders. All of these allow you to deploy different strategies and not be stuck in a box.

For newcomers or those testing strategies, Bitfinex offers a paper trading environment where traders can simulate leveraged trades without risking real capital. This tool comes in handy for practising risk management and testing high-leverage strategies before going live with real funds.

How are fees on Bitfinex? Quite competitive: 0.02% for makers and 0.065% for takers, making it appealing for active traders. Bitfinex earns a CoinGape rating of 4.3 out of 5 thanks to its strong focus on compliance, multiple order types and flexible margin funding.

| Max leverage | 100x |

| Cryptocurrencies supported | Bitcoin, Ethereum, Bitcoin, Ripple, Cardano and 50 other altcoins |

| Fees | 0.02% for makers and 0.065% for takers |

| Countries available | 50+ |

| License/ Regulation | Strong KYC compliance |

| User base | 1 million+ |

| Platforms | Web and mobile |

PrimeXBT launched in 2018, and while the founder isn’t well publicized, the platform has grown to become a go-to place for high-leverage trading. PrimeXBT, with over 1 million users, according to its “About page,” is available in 50+ countries and supports both crypto, forex, commodities and indices under one roof.

With leverage of up to 500x on Bitcoin and Ethereum, PrimeXBT is best suited for traders who want big exposure with smaller capital. Fees are straightforward and competitive. Maker fees are around 0.01%, and taker fees are at 0.02%. This keeps costs low compared to many other derivatives platforms.

PrimeXBT has also recently upgraded its tools, according to its blog post. The changes improved its PXTrader and MetaTrader 5 interfaces and added over 100 new assets, including global stocks.

CoinGape gives PrimeCBT a user rating of 4.1 out of 5. We rank it this way, considering that it caters to advanced traders. However, we note that PrimeXBT is not the most beginner-friendly place for leverage trading.

| Max leverage | Up to 500x |

| Supported cryptocurrencies | Bitcoin, Ethereum and 50 more cryptocurrencies |

| Leverage fees | Maker: 0.01% / Taker: 0.02% |

| Countries available | 50+ |

| License | Operates offshore (not authorized in many regions) |

| User base | 1 million+ |

| Platforms | Web and mobile |

Coinbase has become popular as one of the best crypto leverage trading platforms for beginners. Coinbase is arguably the biggest and most popular crypto exchange for US traders. The platform was launched in 2012 by Brian Armstrong and Fred Ehrsam, and has since grown to serve over 100 million verified users in 100+ countries worldwide, according to its “About Page.”

First, leverage for US traders is at a low, and safe 10x, while the exchange has increased the maximum leverage to 50x for perpetual futures contracts for users outside the U.S. Coinbase strives to stay compliant with local laws, which explains why U.S. traders can access a max leverage of 10x.

Beyond leverage, Coinbase is popular for having beginner-friendly features, such as a “Learning Hub” where new users can quickly get up to speed. In addition, Coinbase offers perpetual futures contracts mostly for BTC and ETH with no expiry dates. This means you can enjoy flexible leverage positions. Fees are also very cheap, around 0.04% maker / 0.06% taker for margin trades.

Looking at all these, CoinGape assigned a user rating of 4.8 out of 5 to Coinbase. We also like that there’s been good expansion to improve its leveraged trading. For example, it recently announced a $2.9 billion deal to acquire Deribit. As reported by CoinGape, the deal will make Coinbase the most comprehensive derivatives platform.

| Max leverage | 10x and up to 50x for non-US users. |

| Supported cryptocurrencies | BTC, ETH, LINK, XRP, SOL, and memecoins |

| Fees | 0.04% maker / 0.06% taker |

| Countries available | 100+ |

| License | Regulated in the US and other regions |

| User base | 100 million+ |

| Platforms | Mobile + web |

Leverage trading is a big part of KuCoin’s offerings, mostly through futures and margin trading. Interestingly, most popular pairs offer as much as 100x, depending on the asset, region and risk factors.

Fees are also competitive; spots are around 0.10% for maker/taker, while futures trading maker fees start at 0.02% and taker fees at 0.06% for many contracts. You can always enjoy discounts if you use the native KCS token.

KuCoin considers itself the number 1 in globalization, backing that claim with a reported user base of over 40 million in 200+ countries. The exchange has been around since 2017, launched by Chun Gan, Ke Tang, Michael Gan, and Johnny Lyu.

One of the reasons KuCoin stands out is its leveraged tokens (ETFs), which let traders get 3× long or short exposure to assets like Bitcoin or Ethereum without borrowing or managing collateral. This means no margin calls, no loans, and no liquidation risk. You simply buy or sell them like spot assets.

CoinGape gives KuCoin a user rating of 4.8 out of 5 for its strong altcoin exposure, wide range of assets, good maximum leverage and global presence.

| Max leverage | 100x |

| Supported coins | Bitcoin, Ethereum, Solana, Bitcoin Cash, Arbitrum, and 100 others |

| Fees | 0.1% |

| Countries available | 200+ |

| License | Based in Seychelles and operates via other regional entities. It does not fully operate in some regulated markets |

| User base | 40 million globally |

| Platforms | Web and mobile app |

Bybit, launched in 2018 by Ben Zhou, a former Forex executive, is one of the top crypto trading platforms. In terms of numbers, Bybit supports up to 125x leverage with over 100+ trading pairs. Fees are competitive, starting at 0.02% for options and 0.055% for futures, giving it an edge against rivals with higher taker fees.

So why’s Bybit unique?

We like its margin flexibility (cross and isolated modes). Bybit also has robust risk controls and transparent fees. Plus, Byit recently announced an expansion into Europe with spot margin trading that’s compliant with local laws. Together, all these make Bybit a strong option for traders who want both aggressive leverage and structured safety.

With over 40 million reported active users across 160+ countries, Bybit has a solid reputation for its smooth trading interface and strong liquidity. The platform is widely used by traders who want to push their leverage limits while staying within a safety net.

Coingape gives Bybit a 4.3 rating out of 5, reflecting its strong balance between high-performance trading and risk control.

| Max leverage | 125x |

| Supported cryptocurrencies | Provides leverage on Bitcoin, stablecoins and 100+ altcoins. |

| Fees | 0.02% for options and 0.055% for futures |

| Countries available | 160+ |

| License | EU compliant |

| User base | 40 million |

| Platforms | Mobile and web |

Bitget, launched in 2018, is headquartered in Seychelles, and now serves over 120 million users across 150+ countries. It offers maximum leverage up to 125× on many futures contracts such as BTCUSDT and XRPUSDT; lower leverage applies to other pairs. In total, Bitget supports 100+ cryptocurrencies.

Trading fees are pretty decent, around 0.02% maker / 0.06% taker, which is competitive for both regular and high-volume traders. On Bitget, traders can access multiple margin modes to accommodate different strategies.

According to Bitget, the platform supports isolated margin, where each position’s margin is calculated separately to limit risk. This tool is more suited for short-term or high-risk trades.

For traders with diversified portfolios, cross-currency margin allows multiple cryptocurrencies to be used as collateral, increasing flexibility while exposing margin values to price fluctuations.

The platform recently announced the PORTALUSDT futures contracts, which support up to 20x leverage and are fully compatible with trading bots. The launch pushed Bitget into more automated strategies. Interestingly, Bitget ranks as one of CoinGape’s best copy trading platforms.

Bitget earns a CoinGape rating of 4.7 out of 5. We score it this high for its strength in automation, product variety, and trader-friendly tools. We also like the high leverage, which could appeal more to traders with a higher risk appetite.

| Max leverage | 125x |

| Supported cryptocurrencies | Bitcoin and other 100+ cryptocurrencies |

| Fees | 0.02% / Taker 0.06% |

| Countries available | 150+ |

| License | Registered in Seychelles and operates globally. However, product access differs by region |

| User base | 120 million |

| Platforms | Web and mobile |

Kraken, launched in 2011 by Jesse Powell, provides access to both perpetual futures and traditional futures trading, offering futures contracts with up to 50x leverage.

Also, Kraken allows leveraged trading on more than 100 cryptocurrencies, providing significant flexibility for traders seeking to maximize their market exposure.

What makes Kraken stand out is its presence in 190+ countries with over 13 million users, strong regulatory compliance and conservative, transparent practices. Traders can take long or short positions, with fees starting at 0.02%, alongside a flat margin fee of 0.02%–0.025% every four hours for open positions.

Thanks to its regulatory credibility, wide asset support, and robust futures market, CoinGape gives Kraken a 4.3 rating.

| Max leverage | 50x |

| Supported cryptocurrencies | Bitcoin, Ethereum, Dash, Solana and 100 other altcoins. |

| Fees | 0.02% + 0.02–0.025% margin fee every 4 hours |

| Countries available | 190+ |

| License | Multiple global licenses |

| User base | 13 million |

| Platforms | Mobile and web |

Crypto leverage trading is a strategy where traders borrow funds to amplify their trading positions, allowing them to control larger amounts of cryptocurrencies with a smaller initial investment.

Think of crypto leverage trading as a bit different from traditional bank loans. It’s just a way to amplify your trading power. For example, with $1,000 in your pocket and a 10x leverage, you can easily control a $10,000 position.

If the market swings in your favor, you’ll enjoy profit, but if things go south, you’ll suffer losses. So high leverage means high profit or loss. Caution is key.

In general, leverage means an amplifier. There are 5x,10x, 50x, and even as much as 200x. There are different products to apply leverage.

For example, with margin trading, you can borrow funds to increase your position size, while perpetual futures allow you to speculate on the price of an asset without needing to own the underlying asset.

Other products, like leveraged tokens, support built-in amplification without a margin call; each product has its associated risks. If you’re in Australia and you’re interested in the best margin trading platforms for your region. Check out this article.

When it comes to crypto leveraged trading, we generally categorise the platforms into centralized and decentralized. Centralized platforms are names like Binance, Coinbase, MEXC that act as middlemen, hold your funds, provide advanced tools and offer high liquidity.

On the other hand, decentralized platforms allow you to trade directly from your crypto wallet and often without KYC. You’re also in full custody of your funds. Although they offer better privacy, execution is slower and even liquidity could be low.

Here’s a quick comparison table to help understand both sides:

| Feature/Factor | Centralized Exchanges | Decentralized Exchanges |

| Maximum leverage | Up to 200x (eg MEXC) | Usually around 5-20x |

| Custody and security | The platform holds the funds/ strong security measures | Users have custody of funds. Smart contract bug risks |

| KYC/ Anonymity | KYC required | Highly anonymous |

| Regulation | Heavily regulated in most regions | Largely unregulated |

| Trading fees | Usually 0.01% to 0.006 with discounts for high volume | Varies. Gas fees apply |

| Liquidity and speed | High and instant execution | Lower, depending on the pool |

| Fiat access | Multiple fiat onramps | Limited |

| User experience | Beginner-friendly | Technical knowledge required |

Your choice depends on what you consider important:

This breakdown enables you to match your risk appetite, trading styles and your overall concerns with the right platform.

It’s important to note that using such high leverage comes with serious risks. A 100x leverage means that 1% adverse price move could lead to liquidation. That’s an extreme risk. Treat this ranking as speculation, not investing.

Here are the platforms:

| Exchange | Max Leverage | Leverage Fees | Liquidity | Insurance Protection | Access |

| PrimeXBT | 500X | Maker 0.01% / Taker 0.02% | Moderate | No public details on insurance | Not available in the US and some regions |

| MEXC | 200X | 0.1% | Good altcoin liquidity | Modest insurance fund | Derivatives not supported for US traders |

| Binance | Up to 125x | 0.02% / 0.04% | High | SAFU fund, one of the highest in the industry | Restricted presence in the US and in other regions |

| OKX | 125x | 0.02% / 0.05% | Strong BTC and ETH perpetual futures liquidity | Large insurance fund | US and some regions are restricted |

| Bybit | 125x | 0.02% (options) and 0.055% (futures) | High liquidity | Large Insurance fund | Global access |

| Bitget | 125x | 0.02%/0.06% | High liquidity on growing pairs | Large insurance fund | Available in 100+ countries |

| KuCoin | 100x | 0.1% | Good altcoin liquidity | Smaller insurance coverage | Poor US presence, but available in 50+ countries |

| Bitfinex | 100x | 0.02% (maker) and 0.065% (taker). | Deep BTC/ETH liquidity | No insurance fund | Available in 50+ countries |

Since both leverage trading and margin trading entail borrowing money to strengthen trading positions, they are frequently taken. Their application, risk profile, and operating processes, however, are different. The following are the main distinctions between leverage trading and margin trading:

There are several factors to consider when choosing the best leverage trading platform for your needs. Below are some of the key considerations.

It is important to only use exchanges that are regulated. Regulatory oversight provides a good sense of safety. Furthermore, look for platforms with strong security measures such as 2 factor authentication, cold storage for funds, and encryption.

You need to ensure the platform matches your goals and the type of leverage you want. Some of the most common leverage in crypto include perpetual futures, traditional futures, options, and leveraged tokens.

Then, evaluate the range of leverage available. Platforms like PrimeXBT provide up to 200x maximum leverage on Bitcoin and Ethereum. This number could be less on some other exchange.

So, that’s something to evaluate. Higher ranges can amplify your profit or loss. Pick a range that suits your risk tolerance and trading strategy.

Consider the fees available on the platform. Some of the fees to evaluate are withdrawal fees, trading fees and other associated charges. It is best to use platforms with transparent fee structures.

Some crypto exchanges have complex interfaces which can be difficult for new traders to navigate. Always use an exchange that’s friendly to your level of experience.

Part of being user-friendly includes having tools and technical analysis to make trading easier for you. In addition, platforms with mobile apps have the extra advantage of providing ease.

Check the availability of liquidity before using any platform. Liquidity determines how easy and fast you can enter and exit trades. Platforms with high liquidity have sufficient buyers and sellers, reducing slippage. Platforms with high trading volumes like Binance have high liquidity.

Research the available cryptocurrencies supported on the exchange. Platforms that support a wide range of cryptocurrencies offer room for diversification and finding better trades. In addition, ensure the platform supports the assets you want to trade.

Crypto trading is often risky. But most platforms go the extra mile to provide risk management strategies. Popular risk management strategies include stop-loss orders, take-profit orders, and margin calls alert. These systems help in maintaining your position and ensuring you minimize your losses and maximize profits.

Although leverage trading has a lot of dangers that need to be carefully considered, it may be a very effective technique for enhancing profits.

Leverage trading is the practice of borrowing money to expand your trading position beyond what your own capital will allow. This implies that even if you can increase your profits, you run the risk of suffering significant losses.

Leverage trading’s main risk is that it increases the impact of price changes. Effective position management is essential since even minor changes in the market have the potential to result in substantial gains or losses.

The safety of leverage trading is dependent on how it is utilized; it is not intrinsically safe or risky. Strict risk management techniques, such placing stop-loss orders and keeping a careful eye on their positions, are frequently used by seasoned traders to reduce the dangers.

It’s best for novices to begin with less leverage and wait to use higher leverage ratios until they have a firm grasp of the mechanics of the market.

To find the best crypto leverage exchanges in 2026, we applied a multi-factor review framework designed to balance safety, performance, and user experience. Each platform was scored based on the following core factors:

1. Maximum Leverage and Product Variety

We looked at the highest leverage offered (10×, 100×, 500×) and whether the platform supports futures, options, perpetual swaps, or leveraged tokens. Exchanges with broader product lines scored higher.

2. Liquidity Depth and Insurance Funds

High-stakes trading requires deep liquidity to avoid slippage and strong insurance mechanisms to protect against mass liquidations. Binance and Bybit scored strongly due to their billion-dollar protection funds.

3. Fees and Funding Costs

We compared maker/taker fees, funding rates, and hidden costs. Platforms like MEXC and Kraken stood out for transparent, low-cost structures.

4. Regulation and Security

Security is non-negotiable. We considered regulatory compliance, KYC requirements, cold storage, 2FA, and proof-of-reserve audits. Coinbase and Kraken earned top marks here.

5. User Experience and Accessibility

Interfaces, mobile apps, and trading dashboards were evaluated for ease of use. Platforms like Coinbase excel for beginners, while OKX and PrimeXBT cater more to pro traders with advanced tools.

6. Geographic Availability

We factored in where the platform can legally operate. Some top-tier exchanges restrict leverage products in the U.S. and EU, which significantly impacts global accessibility.

7. Unique Features

Finally, we highlighted standout innovations. For example, KuCoin’s leveraged tokens that rebalance automatically, Bitget’s automated trading bots, and Bybit’s dual margin modes are examples of features that tilt the score.

Read More – CoinGape crypto review methodology

Leverage trading is risky, especially when high leverage is involved. So, we advise traders to understand the risks before diving in. For anyone interested in leverage trading, here are a few steps to begin:

1. Learn the basic mechanics

Take some time to understand the basic terminology of leverage trading. Understand concepts like leverage, margin, perpetuals, and funding rates. CoinGape offers a lot of explainers and materials to begin your journey.

2. Choose the right exchange

Once you’ve figured out what is what, the next thing to do is to select the right platform. We’ve already given you tips on how to choose a fitting exchange, prioritising factors like liquidity, product, fees, security, interface, and maximum leverage. For beginners, we recommend platforms like Coinbase.

3. Create an account, complete KYC

If you’re using a centralized exchange, you’ll need to create an account and complete KYC procedures. For better security, turn on 2FA, and only keep funds you want to trade with on the exchange. Move the rest to a cold storage/.

4. Start with a demo

Platforms like Bitget allow you to test your skills and strategies in a demo environment before putting real, serious funds. That’s a smart way to start, so you do not incur losses in your first trade.

5. Use conservative leverage

Don’t get greedy! For a beginner, use very low leverage, like 1-10x. This keeps you on the safer side. Don’t forget that things can go south, and you’ll lose your funds. It’s smarter to test the waters and see your result.

Other major steps to include are:

Leverage trading doesn’t only make sense when the market is going smoothly. If you’re careful and you fully understand how it works, it can be a reliable way to boost your income in a bear market. The key is knowing how to use short positions and hedging. Let’s explain:

1. Profiting from falling prices

With leverage, you don’t have to only “buy low, sell high.” You can also short-sell, which means betting that the price of a coin will drop. For example, Imagine Bitcoin is trading at $40,000. You open a 10× leveraged short with just $1,000 margin, giving you a $10,000 position.

If Bitcoin falls by 10% to $36,000, your short earns about $1,000 profit. This means you’ve effectively doubled your margin. This is why experienced traders on platforms like Bybit and Binance Futures often look for short setups in bear markets. These exchanges offer deep liquidity and clear insurance fund data, which helps manage risk during volatile drops.

2. Protecting your portfolio (hedging)

Leverage can also act as a shield, not just a sword. Let’s say you hold long-term Ethereum, but you’re worried about a short-term drop. Instead of selling your ETH, you could:

This way, you’re not forced to sell your long-term assets, but you still have some protection against a downturn.

Leverage can be an effective tool in a bear market if you learn to hedge and short. But remember, things could go south. A sudden bounce means game over for your shorts.

Choosing a good leverage trading platform is beyond multipliers. Instead, it’s about liquidity, fees, risk management, and using a platform that matches your skill level. A good choice is about opportunity and protection.

Here’s our conclusion of the best platforms by user type:

The right platform depends more on who you are as a trader, rather than how you get on a platform. By matching your trading level to the right platform, you improve your chances of making the most of crypto leverage trading.

This depends on the country, as legality varies. For example, only platforms like Coinbase Derivatives and Kraken can legally offer regulated futures products. Other regions restrict platforms like Binance and OKX to strict services depending on local regulations. So, it’s important to verify that the platform is legal in your jurisdiction.

For beginners, it’s best to start with platforms that offer a balance of leverage options with user-friendly interfaces and robust educational materials. Platforms like Kraken Futures, Binance Futures and Bybit are often recommended. These platforms offer testnets, tutorials, and adjustable leverage limits for trading without taking many risks.

Security and safety come down to factors such as custody solutions, regulatory compliance and risk management tools. Platforms like Bitstamp and Kraken are popular for their stance on compliance. Meanwhile, Binance and Bybit offer strong security features like multi-signature wallets, proof-of-reserves audits, and insurance funds to protect traders.

Liquidation is one of the major risks of crypto leverage trading. This means your entire position can be wiped off if the market moves against you. To mitigate this risk, it’s important to use measures such as stop-loss orders, start with low leverage (2x to 5x) and never risk more than you can afford to lose.

Look for platforms that offer:

These features help reduce risks beyond trading performance itself.

Yes, platforms like Bybit and MEXC allow limited leverage trading without KYC. However, withdrawals are limited, and you won’t get full access to higher leverage or some fiat services. Most global exchanges mandate KYC as part of your registration process.

Platforms like Binance Futures, OKX, BItMEX, Bybit offer up to 100x leverage, and in some cases, higher. While it may sound appealing, such high leverage is risky and recommended for new traders.

US traders are limited to a few platforms due to strict regulations. Kraken Futures and Coinbase Derivatives are two of the most used platforms for U.S. traders. U.S. residents are restricted from most offshore high-leverage platforms unless they bypass restrictions, which is not recommended.

Leverage can amplify both profits and losses. For example, with a 10x leverage, a 1% move in price becomes a 10% gain. However, the reverse is also the case, meaning a 1% drop could wipe out your position. Higher leverage reduces your margin for error, so it’s important to implement risk management strategies like stop-loss orders.