“Cryptocurrency Is Threat to Financial Stability”- Indian Central Bank Governor

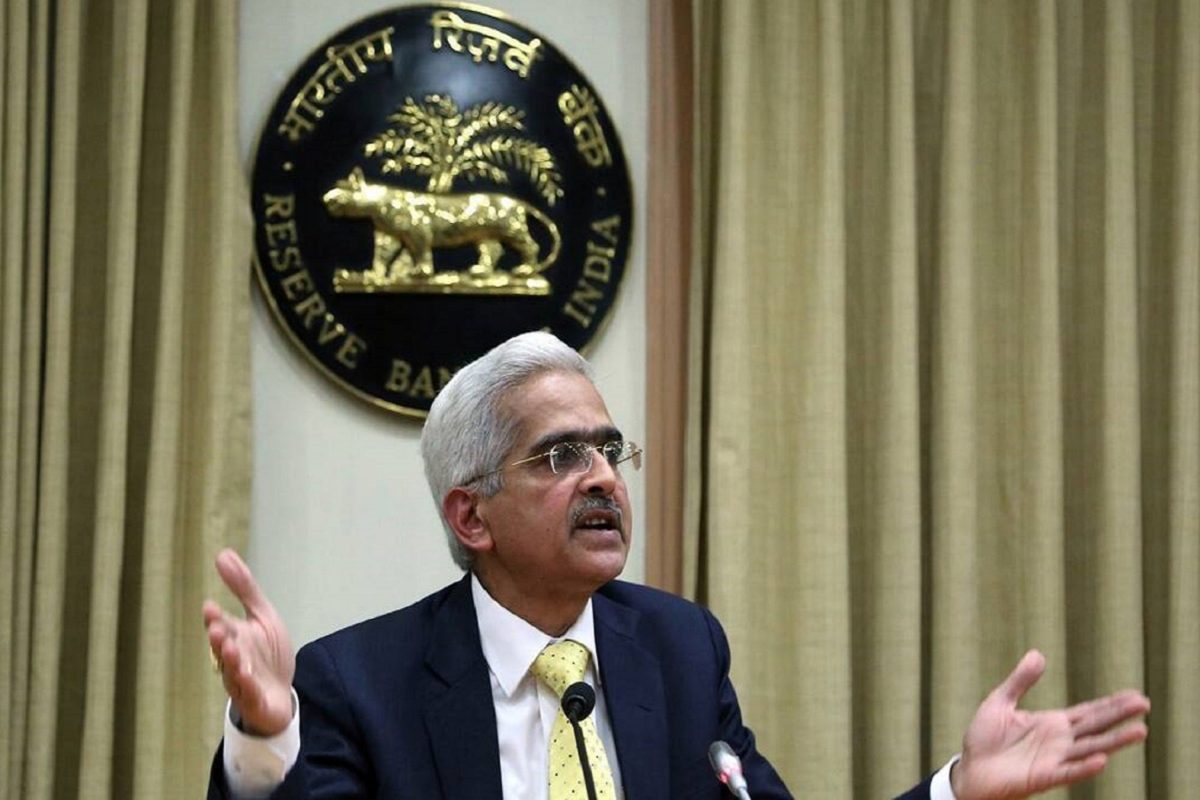

RBI Governor Shaktikanta Das has once again dropped some bombs over the future of cryptocurrencies in India. In a post-monetary policy briefing, he termed crypto a threat to macroeconomic and financial stability. He warned investors to invest at their own risk.

Indian Central Bank Governor Mr. Das has always been reluctant to the adoption of cryptocurrencies. The central bank is worried about capital controls of Cryptocurrencies as anyone from anywhere can create them. Issues like money laundering and terrorism financing have been the concern of the government regarding the use of digital tokens.

RBI Governor warns Crypto investors

In his new strike, Das said that Digital tokens don’t have any underlying value and are a threat to financial stability.

As far as cryptocurrencies are concerned, the RBI had made its stance very clear. Cryptocurrency is privately created & it is a threat to our financial and macroeconomic stability, said RBI Governor Das

Investors in cryptocurrency should keep in mind that they are investing at their own risk. The cryptocurrency has no underlying, not even a tulip, added RBI Governor Das

#RBIPolicy | #Cryptocurrencies are a big threat to macroeconomic and financial stability, reiterates #RBI Governor @DasShaktikanta as he warns #crypto investors of risks@RBI #CryptoNews #Cryptos pic.twitter.com/oUs9uEWe1D

— ET NOW (@ETNOWlive) February 10, 2022

When will RBI launch Digital Rupee?

Governor Das’s somehow dropped some hints over the launch of the RBI Digital Rupee (CBDC).

RBI Digital Rupee will be launched in the year 2022-23. We can’t predict a timeline for its release yet. There’ll be no difference between Digital Rupee & the normal rupee, says RBI Governor Shaktikanta Das; Reports ANI

Elaborating on the CBDC, T Rabi Sankar, RBI Deputy Governor, said that, the digital rupee will be exactly like a normal paper rupee as it will be one to one convertible, however, the form of digital rupee will be digital or electronic.”

“Digital rupee will be same like you keep rupee in your pocket or purse, you can keep digital rupee at you device like mobile. Digital rupee or normal paper rupee will have no difference and will be issued by RBI. Banknote or rupee note has a liability of RBI, cryptocurrency is a privately created currency,” said T Rabi Sankar, reports ANI

However, Governor Das’s these comments come days after the Indian government took its first steps to recognize crypto trading. In the Union Budget speech on Feb 1, Finance Minister Nirmala Sitharaman announced a 30% tax over revenue generated from crypto trading.

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Analysts Warn BTC Price Crash to $10K as Glassnode Flags Structural Weakness

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown