Cryptocurrency Regulations in June Says Financial Action Task Force (FATF)

Global Financial Criminal Watchdog, The Financial Action Task Force(FATF) is planning to hold discussions later this month, in June, to formulate governing rules and guidelines to govern cryptocurrency exchanges.

It will principally make sure effective countermeasures are in place to prevent activities such as money laundering and terrorist funding, according to a Japanese government official familiar with the matter.

FATF’s guidelines important to streamline crypto businesses

FATF is a Paris-based group of 37 countries as well as two organizations namely the European Commission and the Gulf Cooperation Council. The international organization was established to formulate and establish policies for combating money laundering and terrorism financing. Its members include major economies such as China, South Korea, South Africa, Argentina, India, and others. Most of these counties are major also markets for cryptocurrencies and associated blockchain technology.

The push to develop these rules comes after financial representatives from the G20 called for regulators to monitor cryptocurrencies in March. Under the current guidelines which are non-binding in nature and were brought to effect in June 2015 state that cryptocurrency exchanges must be registered or licensed and must carry out KYC of its customers to prevent money laundering. Any suspicious trading noted by the exchange is also supposed to be reported according to the guidelines.

The FATF discussions will begin on June 24 and will look at whether the rules laid down in 2015 are still appropriate. It will also look into how the existing rules can be applied to new exchanges, and how to work with countries that have moved to ban cryptocurrency trading, according to an official who spoke on the condition of anonymity, report Reuters.

Earlier this year, an official who was present at the meeting in March described the moves as follows:

“FATF discussed the need to revise its own international standards along with the revision of the virtual currency guideline created on June 2015 and agreed to present the report to the G20 finance ministers during the meeting in March.”

Also, read: SEC Talks about Registration And Nature of Tokens in its New Guide to ICOs

Japan and South Korea could play key roles

Japan was one of the first countries to legitimize registration system for cryptocurrency exchanges. It has also boldly unveiled guidelines for the legalization of the sometimes controversial fundraising method, initial coin offerings (ICOs). Japan is supposed to host the next G20 summit in 2020 and hopes to take charge of the matter on its home ground.

Another country that could play a major role is South Korea. In the FATF meeting that was held in the month of March, Korea had put forward the efforts that it has already put in to regulate cryptocurrencies. These efforts led to banning of anonymous trading and making KYC regulations compulsory for exchanges

If the policies that are to be drafted later this month are based off Japan’s or South Korea’s regulations (or a combination of the two) this is likely to be positive for the crypto ecosystem gaining confidence and trust of the investors and stakeholders in days to come.

Will regulations like this help cryptocurrencies become mainstream? Do let me know your views on the same.

- Polymarket Traders Slash Trump Tariff Odds by 26% After Justices Question Legality, Bitcoin Jumps

- Breaking: Ripple, Mastercard, Gemini Partner to Enable RLUSD Stablecoin Settlement for Fiat Cards

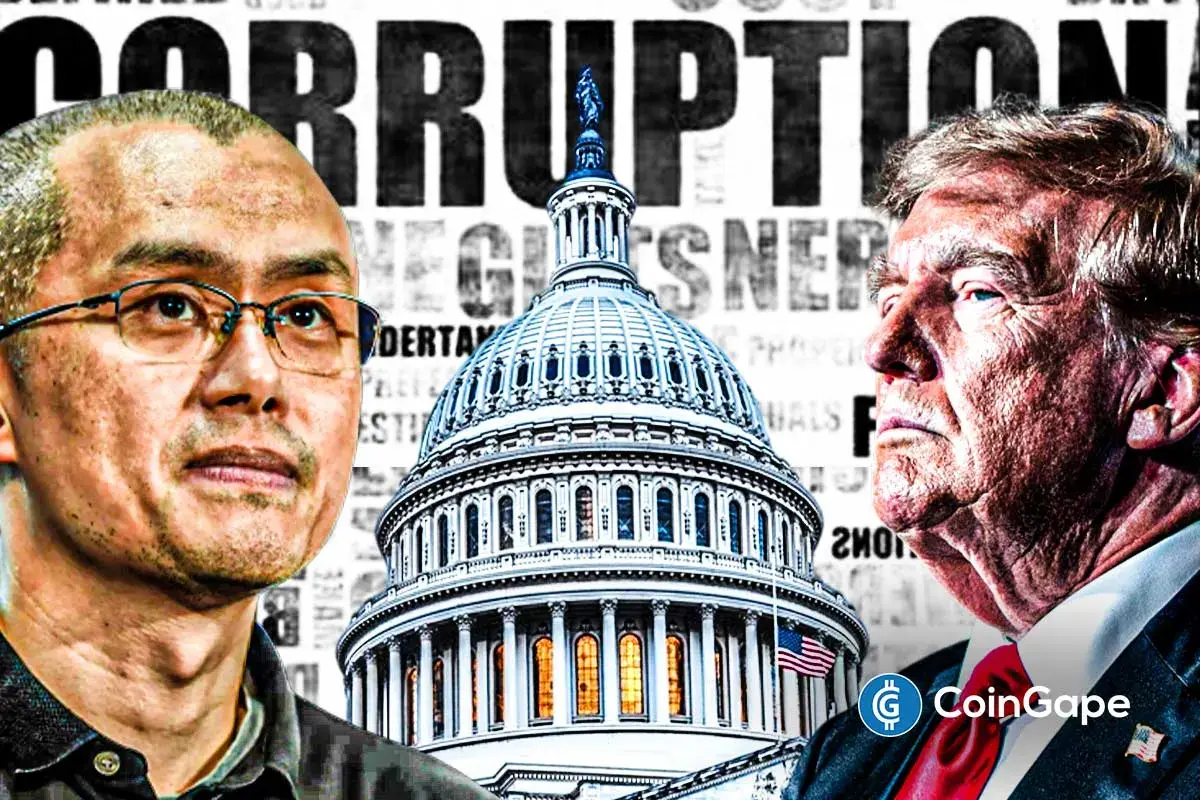

- White House Defends Trump’s Pardon of Binance Founder CZ Amid Corruption Allegations

- Ripple Secures $500M Funding Led by Fortress and Citadel Securities After Record Growth

- Teucrium ETFs CEO Says Late November Will Be ‘Big’ For XRP At Swell 2025

- Solana Price Faces Heavy Sell Pressure as $1.36B Is Liquidated: $100 Incoming?

- XRP Price Prediction: Ripple Swell 2025, ETF Hints, RLUSD Plans, and Market Outlook

- Expert Predicts Cardano Price Surge as Hoskinson Touts Midnight Potential

- Changpeng Zhao Sparks Bull Run Aster Price Jumps 10%, Eyes $2 Breakout

- Whales Scoop 323,523 ETH Amid Price Dip – Is Ethereum Price Correction Setting Up a 10K Wave?

- How Solana, XRP, and Cardano Reacting as U.S. Shutdown Becomes Longest in History

MEXC

MEXC