DAI Stacked In DeFi Hits All-Time High; Coinbase Rolls Out Dai Rewards

San Francisco-based cryptocurrency exchange, Coinbase bolsters the DAI network via the recent addition of the Dai Rewards. While the entire DeFi space has been witnessing eventful activities, the total DAI locked in DeFi hit an all-time high.

For those who feared the volatile nature of cryptocurrencies, stablecoins entered the market as a blessing. Decentralized Finance [DeFi] has undoubtedly taken the crypto-verse by storm. DeFi’s star child, lending, and borrowing platform, Maker’s very own stablecoin DAI has been quite popular among cryptocurrency exchanges. With a market cap of $352,270,304, Dai stands as the 38th largest crypto asset.

Earning rewards via cryptocurrency exchanges has been the latest attraction of the crypto sphere. Prominent cryptocurrency exchange, Coinbase has been offering various range of rewards to its users. In more recent updates, the exchange revealed that it would offer Dai Rewards with up to 2 percent Annual Percent Yield [APY]. However, this offer was limited to the users from Australia, France, Netherlands, Spain, United Kingdom as well as the United States.

The exchange took to Twitter to announce the same to the crypto community. The tweet read,

Dai Rewards with 2% APY is now available for Coinbase customers in the US, UK, Netherlands, Spain, France, and Australia.https://t.co/FGkFHBxZVM

— Coinbase (@coinbase) July 29, 2020

The customers who are eligible for avail this would be sent rewards soon after a total of $1 worth Dai is present in their account. The exchange’s blog post elaborated on the same and said,

“With yields on savings accounts and government bonds at record lows, earning rewards on stablecoins like Dai and USDC stands out as an alternative way to passively generate income using crypto held on Coinbase.”

These rewards would be distributed into the accounts of the eligible customers every day. The users would be allowed to withdraw their rewards as desired.

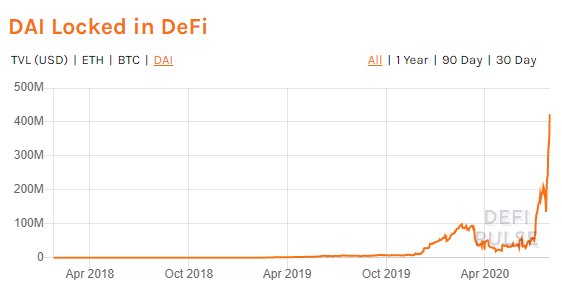

DAI Locked In DeFi Hits All-Time High

Over the last few weeks, DeFi has been garnering gains in large numbers. The DeFi space is home to several applications and almost all of them brought in immense funds. This fueled the total value locked in the space and pushed it to a whopping high of $4 billion. Maker was even touted as the first DeFi platform to hit $1 billion. Along with this, the total DAI locked in DeFi had been observing an upward trajectory. During press time, a total of 422.5 million DAI was locked in DeFi. Maker undoubtedly dominated the platform by almost 30 percent.

- Breaking: Binance, Franklin Templeton Launch Tokenized Fund Collateral for Institutions

- Mysterious Activity Detected in Bitcoin Address Linked To Nancy Guthrie Ransom Note

- Bitget Cuts Stock Perps Fees to Zero for Makers Ahead of Earnings Season, Expanding Access Across Markets

- South Korea’s Bithumb Probed by Lawmakers as CEO Blames Glitch for $40B Bitcoin Error

- Robinhood Launches Public Testnet for Ethereum Layer 2 ‘Robinhood Chain’

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks