Data Shows Large Institutions Are Accumulating Bitcoin Amid Correction

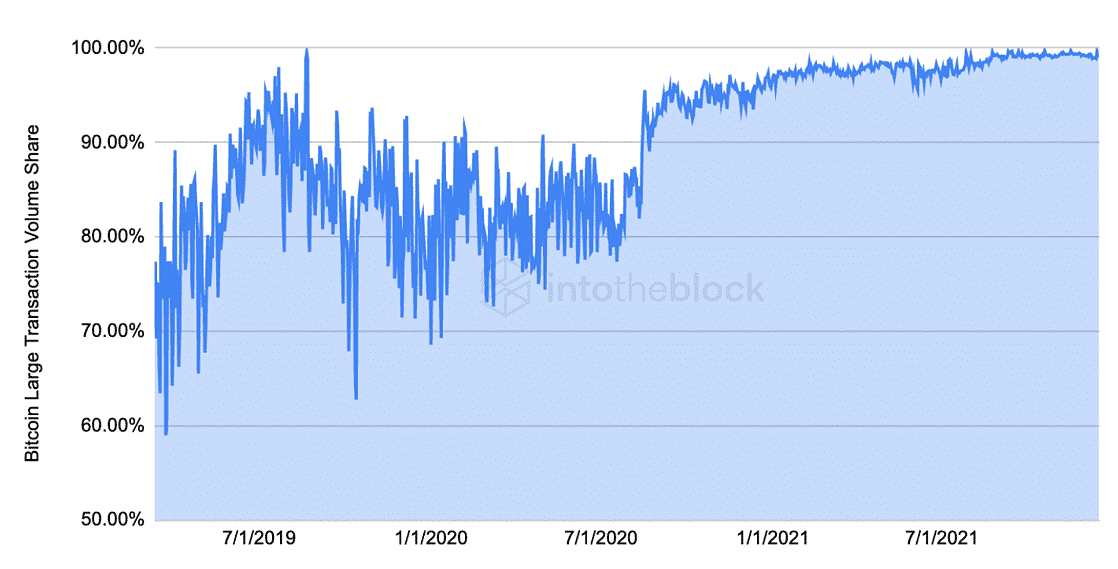

Nearly all of Bitcoin’s trading volumes consist of transactions above $100,000. A report from blockchain research firm IntoTheBlock shows how billion-dollar institutional trade has come to dominate the token’s liquidity since 2020.

According to a recent report, large transactions-what the firm calls deals above $100,000- have consistently made up more than 90% of Bitcoin’s trading volumes since 2020.

It attributes this to growing institutional demand for the token, be it from new entrants to the market or even existing players injecting more money. 2020 was a pivotal year for Bitcoin, where several major trading houses and hedge funds recognized the token’s viability as a store of value.

Organizations such as Tesla, Block and Paypal had also begun investing in Bitcoin in 2020.

The average transaction size for Bitcoin has ballooned as a result. According to Into The Block, the average Bitcoin transaction has been more than $500,000 since August 2021, peaking at $1.2 million when the token hit a record high in November.

Institutional interest in Bitcoin keeps growing

Despite immense market volatility in 2022, institutional interest in the token has shown little signs of slowing. Recent data from Coinshares showed crypto markets saw seven consecutive weeks of institutional capital inflows this year.

Investment house Bain Capital raised a $560 million crypto fund earlier this month, while Pantera Capital received over $1 billion in commitments for a blockchain fund.

The belief of crypto being an uncorrelated asset class may be fading, but it does not seem to be deterring interest from traditional finance and tech institutions. The main players in crypto are evolving and there are signs that institutional demand continues to grow even if it is not reflected in prices.

-Lucas Outumuro, Head of Research at Into The Block

This increases crypto’s correlation to stocks

The trend has made Bitcoin and the crypto market begin trading more in line with conventional equities. For example, Bitcoin is trading down about 15% this year, largely in line with losses in the S&P 500 and the Nasdaq indexes.

Recent volatility in the crypto market has also been attributed to panic trading by institutions, in reaction to the economic disruption caused by the Russia-Ukraine conflict.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act