Days Of Big Bitcoin Pumps Are Over: Bloomberg’s Mike McGlone

Bitcoin volatility has declined immensely in the last few years, as the BTC price action shows. Bloomberg senior macro strategist Mike McGlone says Bitcoin volatility has more room to decline, making the top crypto’s relative risk to fall continuously. However, it is still higher when compared to the volatility of conventional store of value — gold.

Bitcoin to Gold Volatility Convergence

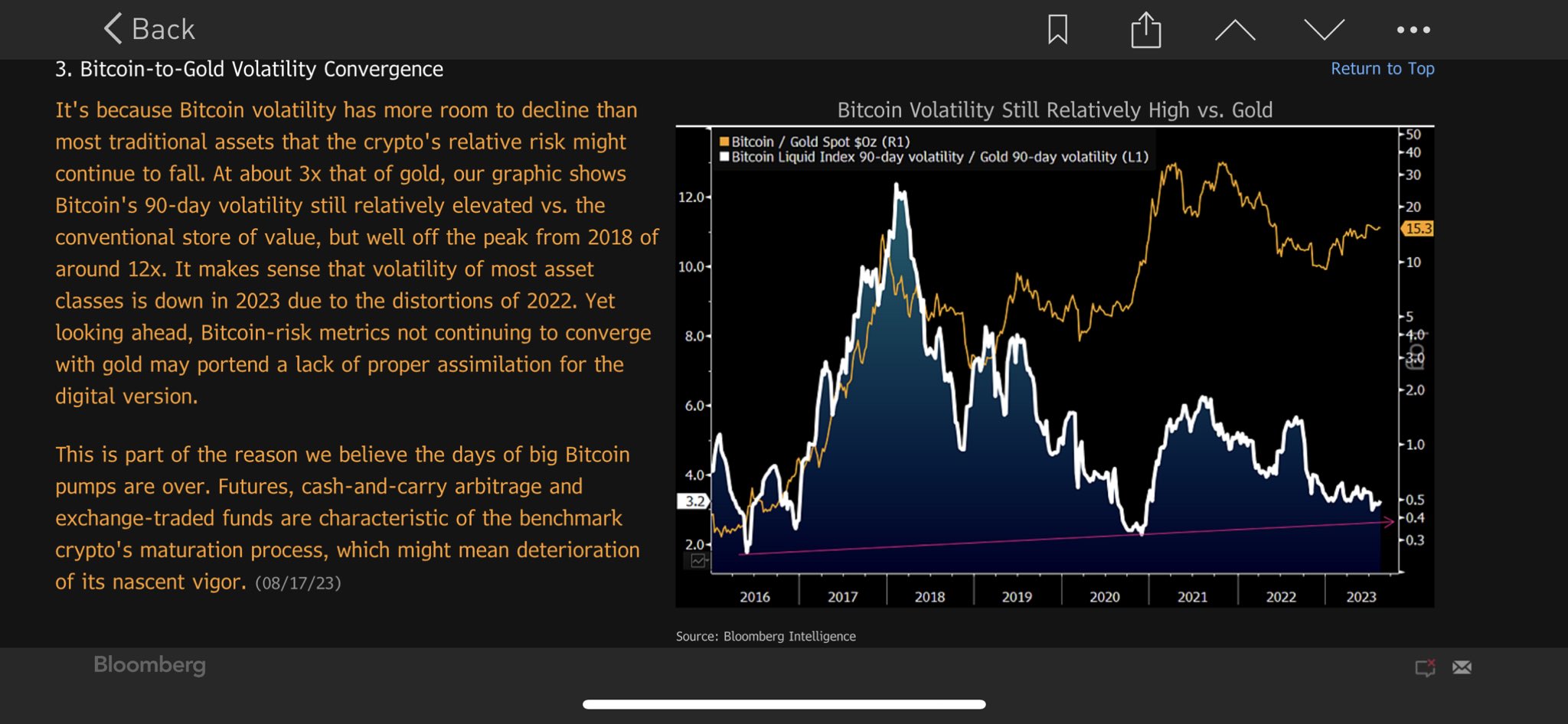

Mike McGlone, senior macro strategist at Bloomberg Intelligence, on August 21 shared data on Bitcoin-to-gold volatility convergence. According to McGlone, Bitcoin’s volatility continues to drop against that of gold and has more room to decline than most traditional assets. Bitcoin’s volatility drop is also causing crypto’s relative risk to decline, making it less risky.

“At about 3x that of gold, my graphic shows Bitcoin’s 90-day volatility still relatively elevated vs. the conventional store of value, but well off the peak from 2018 of around 12x.”

According to the report, the days of big moves in BTC price are over. Bitcoin may not see a sudden price jump or swift move to an all-time high due to a significant decline in volatility.

Bitcoin witnessing growing adoption in the traditional finance industry, especially after BlackRock spot Bitcoin ETF filing. Futures, cash-and-carry arbitrage, and exchange-traded funds are characteristic of the benchmark crypto’s maturation process.

Also Read: XRP Leads the Pack in Altcoin Space Recovery, Whales Buy the Dips

BTC Price to Witness Rebound?

The macro factors along with a weak technical chart structure are putting pressure on Bitcoin price. The Federal Reserve’s plan to continue rate hikes and the US dollar index (DXY) moved to 103.50 caused BTC price to tumble recently.

According to popular crypto analyst Ali Martinez, each time BTC had broken below the 200-day SMA over the last 10 years, it touched the Realized Price. Currently, the Realized Price is around $20,350.

BTC price jumped 0.5% in the past 24 hours, with the price currently trading at $26,090. The 24-hour low and high are $26004 and $26260, respectively. However, trading volume has decreased by 10% in the last 24 hours.

Also Read: BTC Price Falls Under This Crucial Support, Next Bitcoin Target $20,350

- XRP Ledger Validator Spotlights Upcoming Privacy Upgrade as Binance’s CZ Pushes for Crypto Privacy

- Harvard Management Co (HMC) Cuts BlackRock Bitcoin ETF Exposure by 21%, Rotates to Ethereum

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Trump’s WLFI Slides 8% as Senators Tell Bessent To Review World Liberty’s UAE Stake

- XRP Price Slides Under $1.5 Amid $50M Market Dump on Upbit

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)