December Rate Cut Odds Fall As Fed Officials Remain Cautious Over Rising Inflation

Highlights

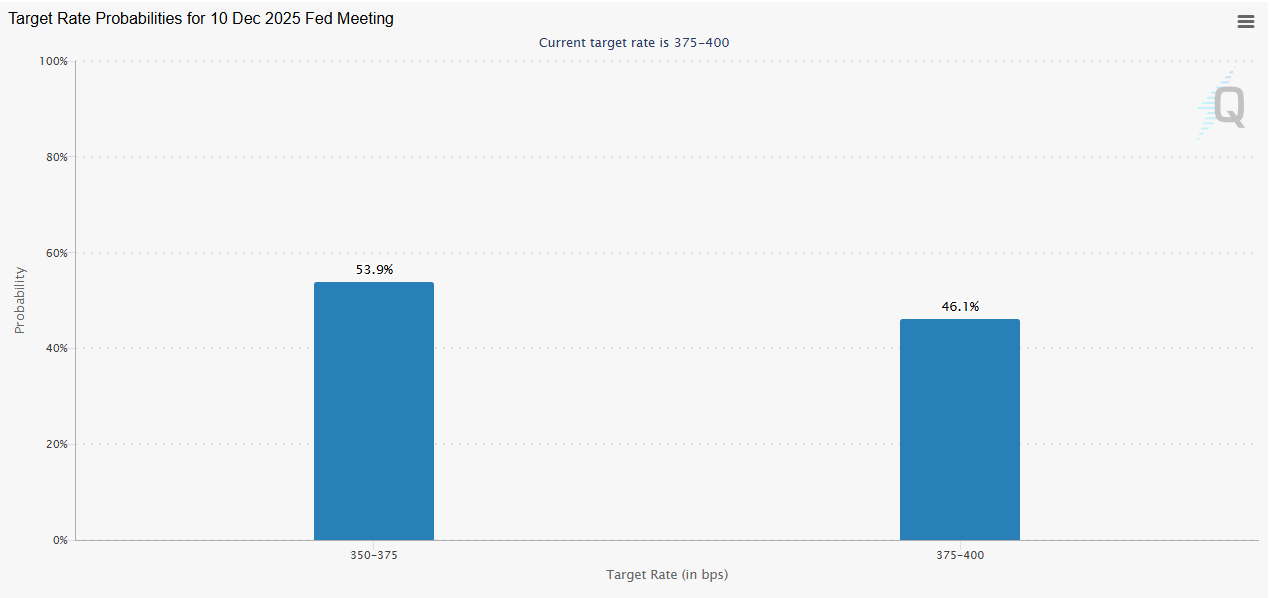

- There is currently a 53% chance of a December rate cut, dropping from as high as 70%.

- Fed officials such as Fed President Raphael Bostic have warned about the inflation risk.

- Bitcoin has continued to trade sideways amid this uncertainty.

A December Fed rate cut is looking more uncertain as traders begin to reduce their bets on the FOMC lowering rates by another 25 basis points (bps) next month. Bitcoin and the broader crypto market have continued to trade sideways amid uncertainty about the FOMC’s next move.

December Rate Cut Odds Fall To New Low

CME FedWatch data shows that the odds of a 25 bps rate cut next month have dropped to 53%, marking a new low, having reached as high as 70% just before the Fed made another 25 bps cut last month. As a result, there is now a 46% chance that interest rates will remain unchanged following the December FOMC meeting.

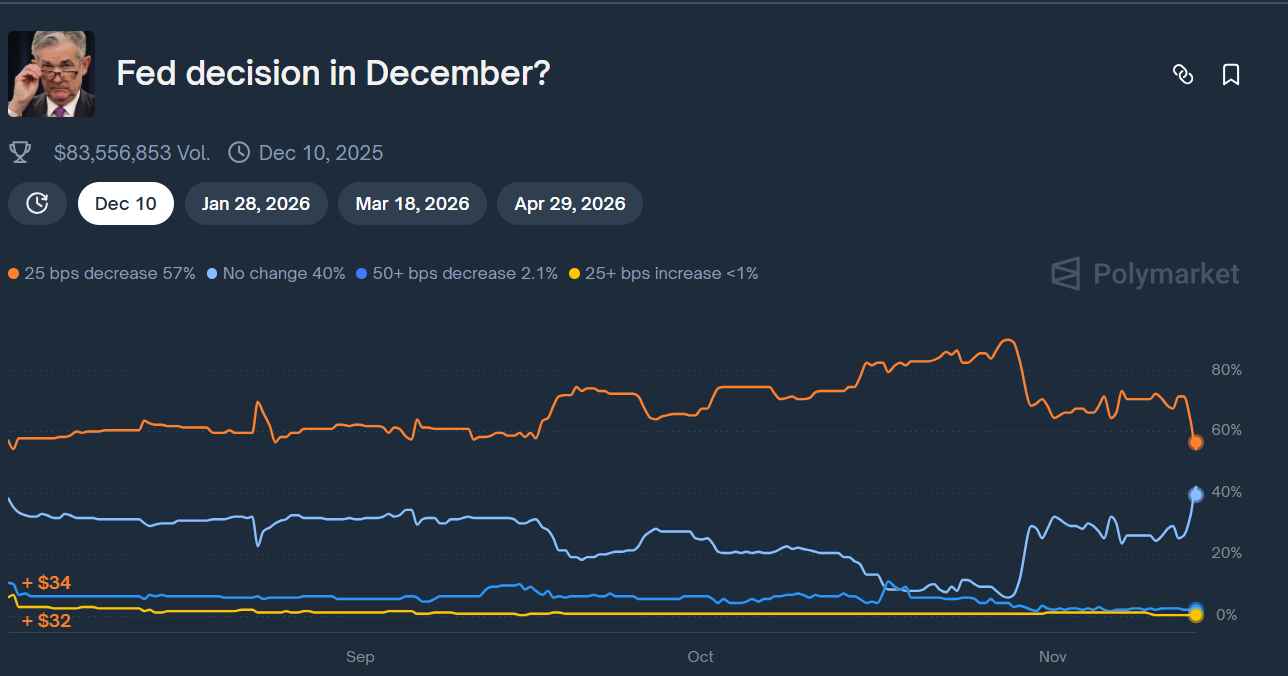

Polymarket data also shows a drop in the odds of a 25 bps Fed rate cut next month to 57%, while there is a 40% chance that interest rates will remain unchanged after the December FOMC meeting. This means that the crypto market could end up seeing only two cuts this year after the Fed lowered interest rates in September and October.

This development has contributed to the tepid Bitcoin price action in recent times. The flagship crypto had rallied to new all-time highs (ATHs) before the September and October rate cuts, given the bullish macro backdrop.

However, with so much uncertainty about whether the Fed will cut rates again, BTC is trading within a tight range and has even failed to sustain a rally despite the end of the U.S. government shutdown. It is worth noting that Fed officials have contributed to the uncertainty around a December Fed rate cut as they continue to raise concerns about rising inflation.

Inflation Concerns Persist

According to a Bloomberg report, Atlanta Fed President Raphael Bostic stated that inflation remains the greater risk compared to the softening labor market. As such, he favors holding rates steady until they get on track to reach their 2% target. He also warned about further rate cuts as they could reignite inflation.

Other Fed officials, such as Fed Presidents John Williams, Austan Goolsbee, and Alberto Musalem, have also recently raised concerns about inflation, further suggesting that a December Fed rate cut is far from certain. Williams stated that inflation is high and that it isn’t showing signs of coming down. He admitted that the labor market is cooling but that it is not shifting “more dramatically.”

On the other hand, Fed Governor Stephen Miran has continued to advocate for more rate cuts, stating that a 50 bps cut in December was appropriate but that they should make a 25 bps cut at a minimum. Miran remarked that they shouldn’t focus on the current data but make policy based on where they think the economy will be a year and a half from now.

Despite the end of the government shutdown, the Fed might not have adequate data heading into the December FOMC meeting. White House press secretary Karoline Leavitt said that the October CPI and jobs data may never be released due to the shutdown at the time.

- Taiwan Eyes Plan To Establish Bitcoin Reserve By Year-End With Seized BTC

- Breaking: Crypto ETF Asset Manager Grayscale Files for U.S. IPO with the SEC

- Breaking: Czech Central Bank Buys Bitcoin as BTC Gains Ground as a Reserve Asset

- Toncoin (TON), Plasma (XPL) Rebound as Coinbase Announces Listing

- Hyperliquid Pool Sees $4.9M Loss Amid POPCAT Whale Market Exploit

- Is Dogecoin Price Set for a Rally After 4.72 B $DOGE Whale Accumulation?

- XRP Price Shows Early Signs of Recovery Ahead of the First U.S. XRP ETF Debut—Rally Ahead?

- Will XRP, DOGE And ADA Surge After U.S. Government Shutdown Resolution?

- FUNToken is Trending Sideways Ahead of the $5M Giveaway: Is It Accumulating?

- Death Cross Triggers Sell Signals for Cardano Price— Will ADA Retest $0.50?

- Sui Price Set for a $5 After Launch of USDsui Native Stablecoin