DeFi: Crypto Lending Firm Compound Raises $25 Million From Andreessen Horowitz

Compound, the crypto lending money market platform based on the Ethereum platform, has received $25 million to expand its activities in a Serie A funding led by Andreessen Horowitz, an investment giant and one of the most visible investors of Coinbase amongst other flagship cryptocurrency and blockchain projects like Ripple.

Their lending is automated and its protocol allows users to earn compound interest on their staked ETHs. Its protocol comprises of open-source smart contracts that adjust interest rates in real-time largely depending on borrowing demand.

Crypto Lending Firm Valued at $90 Million

Rates on staked assets, denominated as tokens, fluctuate depending on supply and demand but are compounded. Conversely, borrowers can receive assets, up to 75% of the stake asset whose value depends on quality, against collateral. If debts are undercollateralized, then a liquidator, who receives 5 percent for action, can liquidate the asset.

With the $25 million, Compound was valued at over $90 million, in a funding round where Bain Capital Ventures, Polychain Capital and Paradigm chipped in. In 2018, Compound raised $8.2 million in a seed round also led by Andreessen Horowitz.

Chris Dixon, the general partner of the investment firm, said:

“Compound is a lending protocol that is open to anyone in the world, that dis-intermediates banks and allows anyone to earn interest on their money. We’ve worked with Robert and his team for over two years and think they are world class technologists and entrepreneurs.”

Dominance in Ethereum’s Crypto Lending Scene

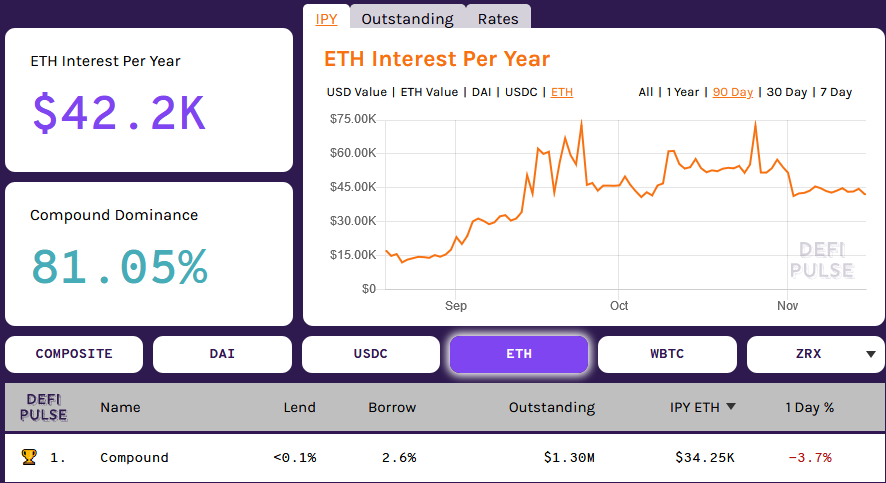

Compound dominance in crypto lending in Ethereum stands at 81%. At the time of writing, users have earned $42k worth of ETHs as interest in the last year. Furthermore, there is $101 million worth of ETH locked up in the crypto lending DeFi service.

According to Robert Leshner, the founder of Compound and a trained Economist, a large percentage of borrowers are cryptocurrency companies who are staking their assets and borrowing stablecoins to cater for salaries and other operational costs. There are also crypto traders and sophisticated hedge funds leveraging their ETH holdings for short-term gains.

Understandably, the low and even negative interest rates in traditional markets are pushing investors away to alternatives. DeFi presents an opportunity. Fashioned on the auspices of decentralization and reverting control back to the user, DeFi products and services as crypto lending are executed without intermediation.

This chart illustrates the steady adoption of #DeFi's most popular sector lending, despite the bear market.

Can't wait to see what this chart looks like in a bull market. ?

source: https://t.co/9xfFsxp1bo pic.twitter.com/m7dDK780UB

— DeFi Pulse ? (@defipulse) November 9, 2019

By rolling out dapps that use smart contracts that democratize the space allowing everyone to borrow funds without passing through a central authority, it is no surprise that the sector has grown by leaps and bounds.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

Buy $GGs

Buy $GGs