DeFi update: Total locked value (USD) on DeFi platforms surges to all-time highs

The decentralized finance field is rapidly growing with the total USD value soaring past the $700 million USD mark for the first time ever. According to data collected from DeFi Pulse, a data analytics company, Maker remains the largest DeFi product with 47.86% dominance. The surge in value of DeFi products signals a possible cross above $1 billion dollars in the coming weeks or months.

Total USD value locked in DeFi crossed $700m today for the first time?@defipulse

Let's make a betting market for when it reaches $1b 🙂 pic.twitter.com/OjMnI5HzHk

— Camila Russo (@CamiRusso) November 29, 2019

Having set a new ATH earlier this month, the current surge sets a bullish sign in Ethereum based products as the decentralized finance apps adoption continues to rise.

DeFi products cross the billion dollar mark

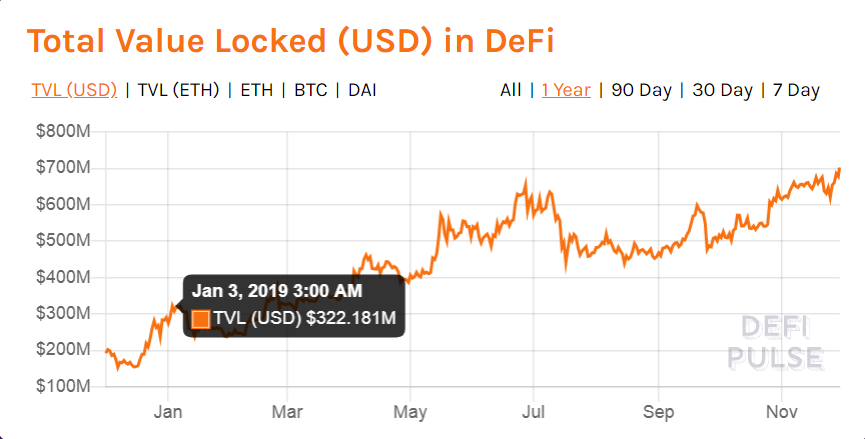

A close look at the DeFi value charts shows an explosive growth in the USD, Ethereum (ETH) and Dai (DAI) value stored in decentralized finance applications. Starting the year off at $275 million dollars on January 1st, the value stored across DeFi products has seen tremendous growth as products increase in the field.

Over the course of the year, the value locked in DeFi has grown over 155% to $702 million as of November 29th, representing the all-time high value.

In ETH terms, the value is still at its ATH locking over 4.5 million ETH tokens in financial products on a decentralized network.

Maker leads the DeFi apps in value

Maker, a platform that lends Dai stable token in collateralized loans, leads the decentralized finance world with close to half of all the value. The Ethereum based lending app currently has 2.1 million ETH locked, equivalent to $331.6 million USD, representing a 3% increase in the past 24 hours.

Synthetix ranks as the largest derivatives dapp with a total of $183 million USD locked. Uniswap is the largest decentralized exchange, and the fifth largest DeFi product with a total of $26.5 million locked in USD value, a 3.4% increase in the past 24 hours.

- Is Bitcoin Bottom Still Far Away as Matrixport Says More Bear Market Signals Are Emerging?

- Dalio’s Warning on World Order Sparks Fresh Bullish Outlook for Crypto Market

- 8 Best Multisig Crypto Wallets in 2026 – Top List Reviewed

- Michael Saylor Says Strategy Can Cover Debt Even If Bitcoin Crashes to $8,000

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs