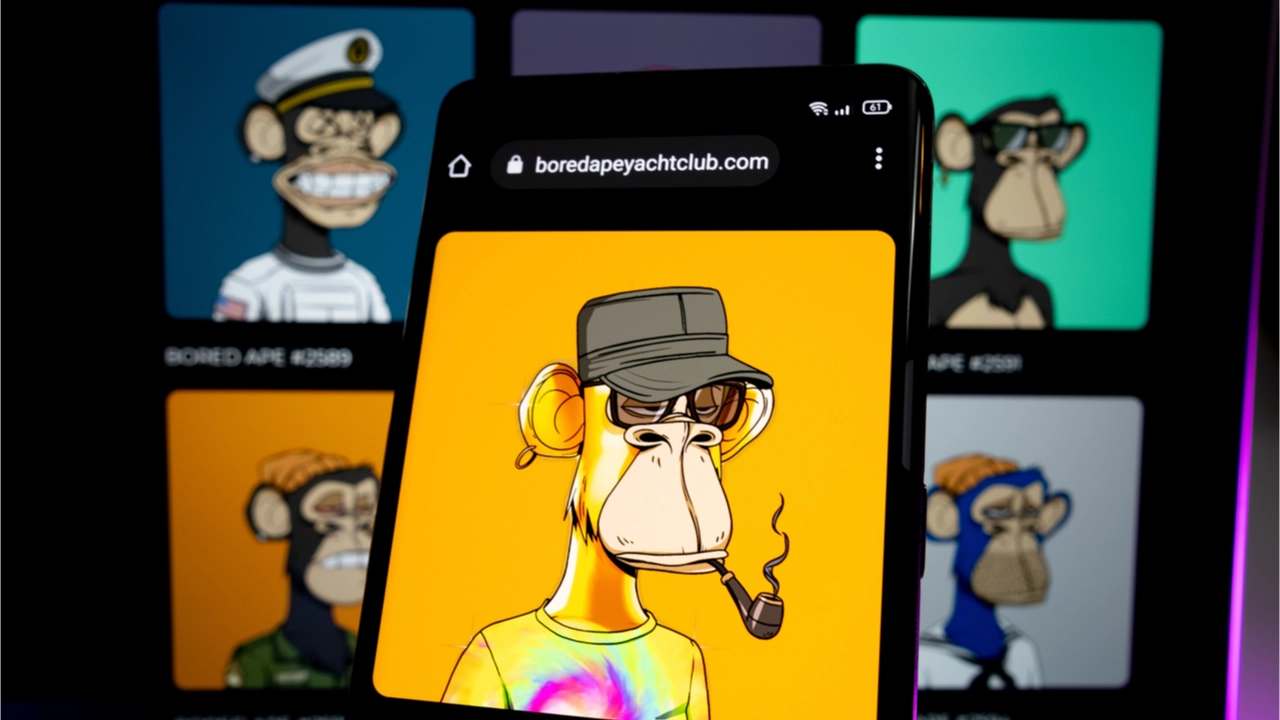

Demand For Bored Ape NFTs Skyrockets In 24 Hours, Here’s Why

Bored Ape Yacht Club (BAYC) NFTs saw demand skyrocket in the last 24 hours. The collection’s 24-hour trading volumes surged by 176%. The rise can largely be attributed to increased whale buying, as the floor price of the Bored Ape Yacht Club collection dropped below key levels.

BAYC is a unique collection of NFTs on the Ethereum blockchain, continuing to gain interest from celebrities, businesspeople, and crypto whales. Given that the apes are priced in ETH, their USD floor price has seen a sharp fall in recent weeks, tracking a decline in the world’s second-largest cryptocurrency.

Whales snap up Bored Ape NFTs Amid Price Drip

In the last 7 days, the floor price of BAYC today dropped to a minimum price of 100.85 ETH. The significant decrease in floor price in the last 24 hours attracted interest from whales.

According to data from NFTGo.io, whales acquired 5 out of 11 collections near the floor price of 109 ETH in the last 24 hours. The current price of the BAYC collection is 109.50 ETH. Moreover, the total market value is $996 million, and the number of addresses held is 6,419.

Crypto whale Jeffrey Huang bought the Bored Ape Yacht Club #7858 NFT at the highest price of 140 ETH, worth $423,433.41.

Furthermore, the BAYC and Mutant Ape Yacht Collection (MAYC) remained in the top 5 NFT collections in the last 24 hours as the collection continues to be in demand.

Meanwhile, the Bored Ape Yacht Club collection will be featured in the three-part film “The Degen Trilogy” by Coinbase next year, and the company is currently asking BAYC owners to submit Bored Ape characters and story ideas.

ApeCoin (APE) Price Awaits Uptrend

The ApeCoin (APE) price has rallied significantly higher in the last 7 days, making a high of $13.46. The news of BAYC and ApeCoin featuring in the Coinbase film trilogy and rumors of APE listing on Robinhood pushed APE price 20% high from April 12-14. Currently, the price is moving sideways in the $12-$12.50 range.

Nevertheless, the price BAYC linked APE will rise higher with rising in interest from whales and an improvement in market sentiments.

Recent Posts

- Crypto News

Breaking: U.S. Senate Delays CLARITY Act again, Crypto Market Structure Vote Slips to Early 2026

The CLARITY Act is no longer expected to pass the U.S. Senate this year. Lawmakers…

- Crypto News

Breaking: Bitwise Files S-1 For SUI ETF With U.S. SEC

Crypto ETF issuer Bitwise is looking to add a SUI ETF to its growing list…

- Crypto News

Crypto Hacks 2025: North Korean Hackers Steal over $2B in ETH and SOL This Year

In 2025, crypto hacks increased significantly. The cybercriminals associated with the North Korean government stole…

- Crypto News

Universal Exchange Bitget Removes Barriers to Traditional Markets, Offers Forex and Gold Trading to Crypto Users

The number one universal exchange Bitget is removing barriers between crypto and traditional finance. It…

- Crypto News

Breaking: U.S. CPI Inflation Falls To 2.7% YoY, Bitcoin Price Climbs

The U.S. CPI inflation came in well below expectations, providing a bullish outlook for Bitcoin…

- Crypto News

Crypto Market Brace for Volatility Ahead of Today’s U.S. CPI Data Release – What to Expect

The crypto market could see some price fluctuations ahead of the release of the major…