Deutsche Bank Predicts Central Banks Could Adopt Bitcoin Alongside Gold by 2030

Highlights

- Deutsche Bank believes that pro-crypto regulations could contribute to Central Banks adopting Bitcoin.

- They also predict that a national Bitcoin reserve could help give BTC more legitimacy.

- The bank believes BTC is following a similar trajectory as gold.

Deutsche Bank has made a bold prediction regarding Bitcoin’s trajectory and how central banks could eventually adopt the flagship cryptocurrency along with gold on their balance sheets. The financial giant also highlighted factors that could contribute to this major adoption of BTC.

Deutsche Bank Makes Bullish Prediction For Bitcoin

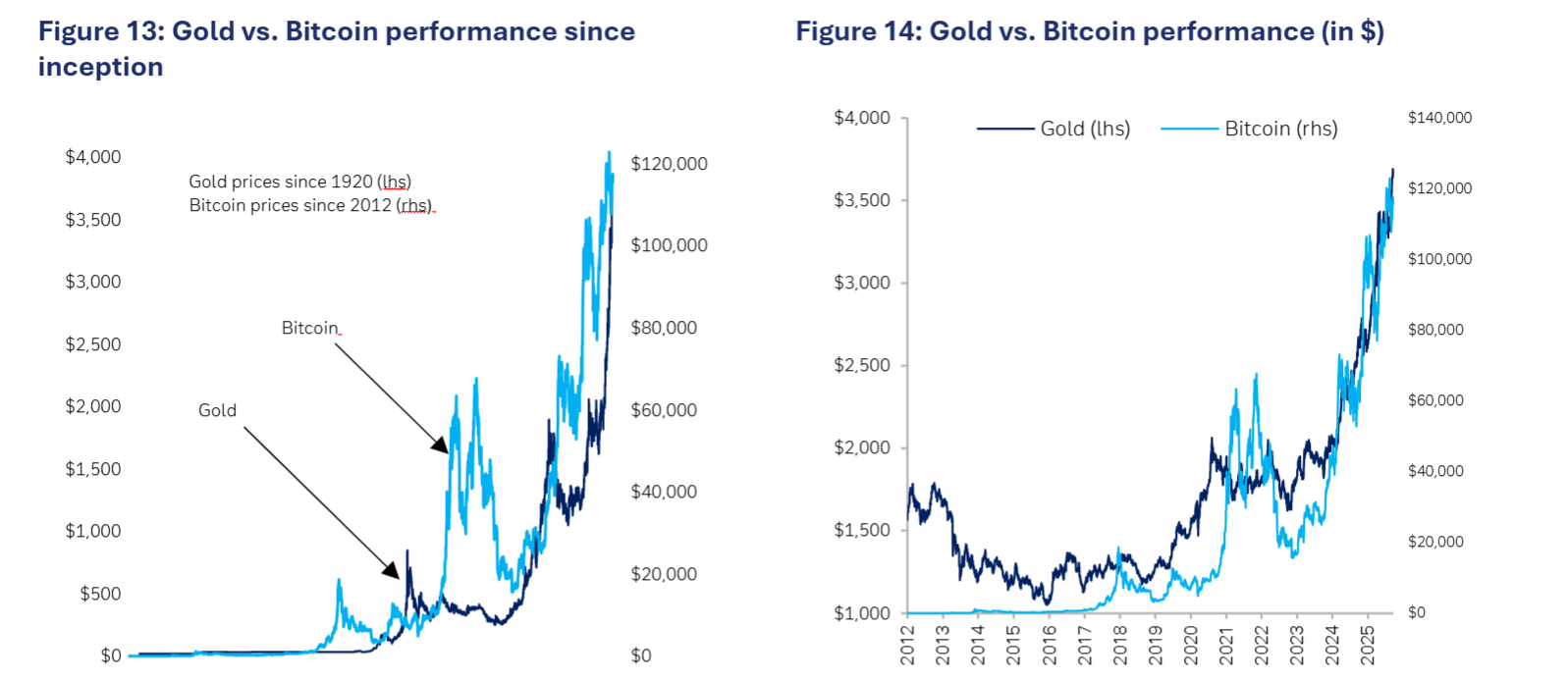

In a research report, Deutsche Bank stated that there is room for both gold and Bitcoin to coexist on central bank balance sheets by 2030. They reached this conclusion based on an evaluation of both assets across key criteria, including volatility, liquidity, strategic value, and trust.

The banking giant noted how gold’s demand has remained strong, with its price reaching all-time highs (ATHs) this month. Meanwhile, Deutsche Bank also stated that the BTC price has demonstrated “remarkable resilience,” as it trades close to its ATH of $124,000, which it reached last month.

The report noted that Bitcoin’s price strength highlights its growing institutional adoption and its emerging status as a potential macro hedge. Deutsche Bank further alluded to how BTC, which is already commonly referred to as “Digital Gold,” is already the reserve asset for major companies, such as Michael Saylor’s MicroStrategy, Tesla, and less conventional consumer companies like Metaplanet.

Strategic Reserve Plans Strengthen The Case For BTC

The banking giant believes that while gold has long been the standard alternative, Trump’s decision to establish a U.S. Strategic BTC reserve has reignited the argument for central banks to hold the crypto as a reserve asset.

The research report noted that plans for a Bitcoin Reserve have been in the works since last summer. As CoinGape reported, industry leaders, including Saylor, recently met and discussed how to push for the BTC Reserve bill, the BITCOIN ACT.

Deutsche Bank also highlighted how high inflation, geopolitical instability, and dollar independence, combined with pro-crypto regulations, have made authorities increasingly re-evaluate their reserve compositions.

As such, they believe that a national Bitcoin reserve could be the final push for central banks to adopt the flagship cryptocurrency, as it could signal confidence in crypto’s future and set international financial standards, much like the U.S. gold reserves today.

What The Future Holds For Both Assets

Deutsche Bank declared that Bitcoin and gold will ultimately continue to coexist in the medium term, with the latter maintaining its lead in official reserves while the former expands in private and alternative reserves.

The banking giant reiterated that both assets are complementary alternatives to traditional safe-haven assets due to their low correlation with other asset classes, relatively scarce supply, and their use as a hedge against inflation and geopolitical volatility.

The report noted that BTC still lacks trust and transparency, which are two key components of a reserve asset, but that should change with more regulations on the horizon.

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Analysts Warn BTC Price Crash to $10K as Glassnode Flags Structural Weakness

- $1B Binance SAFU Fund Enters Top 10 Bitcoin Treasuries, Overtakes Coinbase

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown