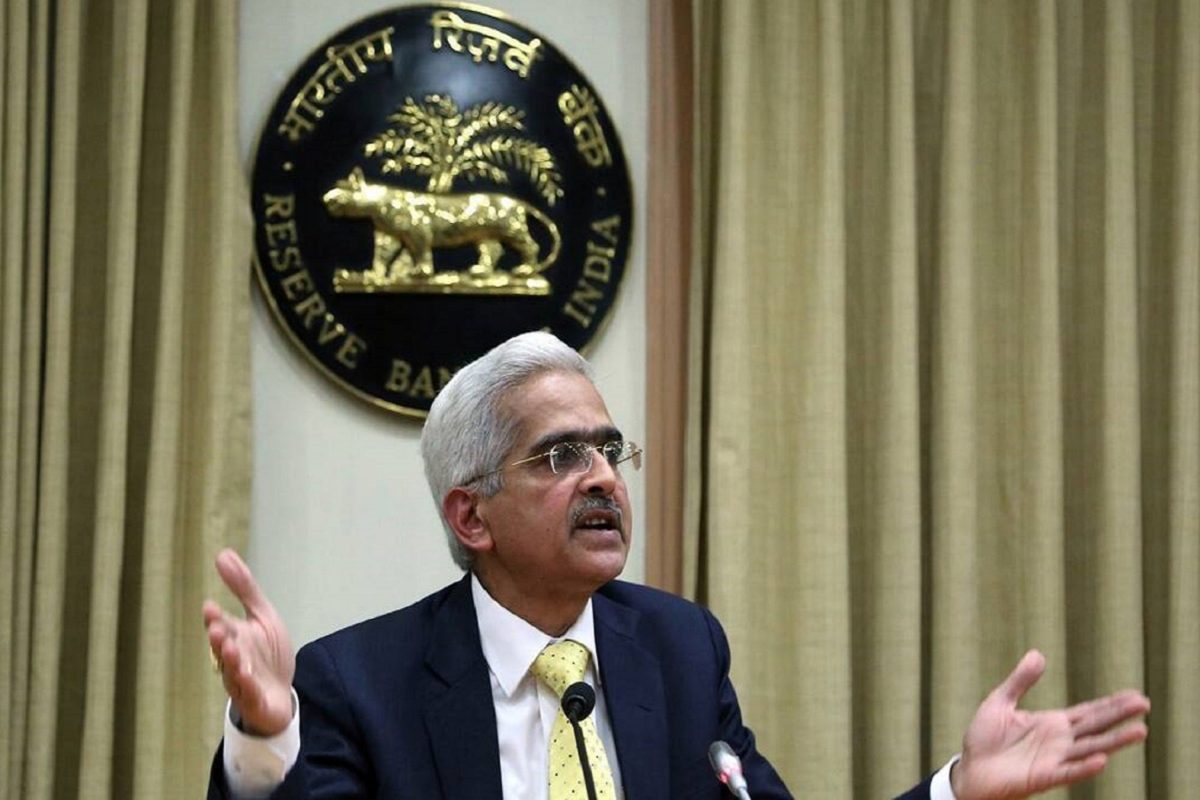

Digital Rupee Will Wipe Out All The Black Money, Claims RBI Official

Ajay Kumar Choudhary, executive director of the Reserve Bank of India, stated at an interactive session on “Digital Rupee: A Way Forward” that the introduction of digital currency would significantly increase system operational efficiency and promote financial inclusion.

Digital rupee would add resilience linked to innovation in the way payments are made, claims Choudhary. According to him, it will also foster innovation in the field of international payments. In the future, the marketplaces will produce more enormous cases in accordance with their own needs. CBDC will provide the public with the desired experience while upholding consumer protection and averting negative social and economic repercussions, he added.

Will it replace current payment system?

Digital currency, according to Choudhary, will cover the strategic need at this moment. According to him, digital currency is more likely to supplement existing systems of payment than to replace them. It would give users a different option as a means of payment.

Also read: Lower Crypto Tax In India Union Budget 2023?: What To Expect

In order to create a system that is inclusive, competitive, and responsive to innovation and technological changes, he said, the Reserve Bank of India will take steps to ensure that the issuance of CBDC follows a calculated and proper approach with adequate safeguards to tackle any potential difficulties and risks.

According to the central bank digital currency (CBDC) tracker, nearly 105 nations—representing 95% of global GDP—have taken steps to integrate digital currency into their economic systems, Choudhary said, adding that about 50 nations are in an advanced stage of exploring the possibility of doing so, while 10 nations have already done so fully.

Also read: RBI Chief Reaffirms Crypto Ban, Warns Of Upcoming Financial Crisis

Difference in UPI and digital currency

When comparing digital currency with UPI, Choudhary noted that while UPI is a payment method, digital money issued by the central bank is a liability for the RBI, similar to physical currency. He noted that the respective bank is responsible for any transaction made through UPI.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs