Dogecoin Whales’ 1.3 Billion Dump Fuels Concern, DOGE Price Slips

Highlights

- Dogecoin whales dumped 1.3 billion tokens recently, dampening market sentiment.

- DOGE price slumped over 4% today, reflecting the fading investors' confidence.

- A top analyst highlighted key support levels to watch ahead for the meme coin.

Dogecoin whales have sparked market concerns amid the ongoing topsy-turvy scenario recorded in the broader crypto market. The recent heavy dump by the large investors or whales has also weighed on the DOGE price, as evidenced by the recent plunge of around 4%. Besides, it also reflects the waning risk-bet appetite of the investors, which might further drag the meme coin’s price lower in the coming days.

Dogecoin Whales Offload 1 Bln Tokens

A massive sell-off by Dogecoin whales has sent shockwaves through the crypto market, sparking concerns about the future trajectory of DOGE price. According to data from Santiment, a prominent market analytics platform, large investors have dumped 1.32 billion Dogecoin in the last 48 hours.

Market analyst Ali Martinez highlighted this alarming trend, citing Santiment data, and warned that waning risk appetite among investors could further drag prices lower in the coming days. The sell-off by the Dogecoin whales is seen as a reflection of the broader market’s volatile scenario, with investors seemingly losing confidence in the cryptocurrency’s growth prospects.

This significant dump has weighed heavily on the price of DOGE, which plummeted by approximately 4% in recent trading sessions. However, a recent DOGE price prediction showed that the crypto is currently at a neutral position and might hover around its current level through this month.

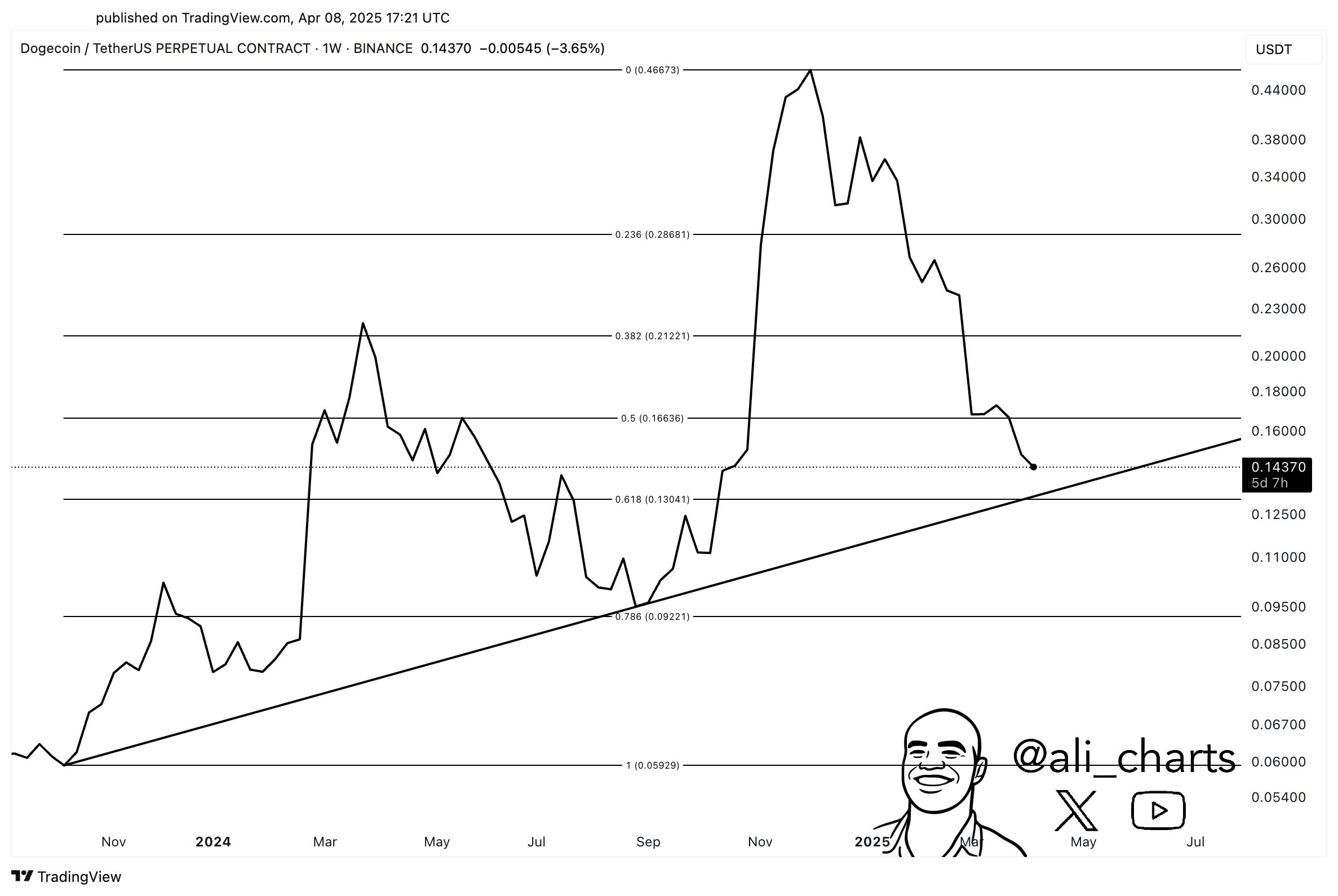

Meanwhile, Ali Martinez has also identified a crucial support level for the DOGE price that investors should keep a close eye on. According to Martinez, the leading meme coin has consistently respected a rising trendline since October 2023, which now converges with the 61.8% Fibonacci retracement at $0.13. This convergence of technical indicators makes $0.13 a key price level to watch, as it could potentially determine the short-term trajectory of DOGE.

Martinez’s observation highlights the significance of this support level, which could act as a strong support for future price movements. A breach of this level could signal a further decline while maintaining above it could trigger renewed confidence in the traders.

DOGE Price Slips: More Dip Incoming?

Dogecoin price today was down more than 4% and exchanged hands at $0.1467 amid the Dogecoin whales dump. Its one-day volume fell 26% to $1.99 billion. Notably, the crypto has briefly maintained the $0.13 support over the last 24 hours, while touching a low of $0.1367 and a high of $0.1567.

Besides, the derivatives data by CoinGlass showed that Dogecoin Futures Open Interest also fell 1.12%, reflecting the gloomy sentiment hovering in the market. Simultaneously, Ali Martinez also predicted that the DOGE price may crash 59% to $0.06 level ahead if the bears continue to dominate.

- XRP News: Ripple Expands Custody Services to Ethereum and Solana Staking

- Bernstein Downplays Bitcoin Bear Market Jitters, Predicts Rally To $150k This Year

- Breaking: Tom Lee’s BitMine Adds 40,613 ETH, Now Owns 3.58% Of Ethereum Supply

- Bitget Partners With BlockSec to Introduce the ‘UEX Security Standard’ Amid Quantum Threats to Crypto

- Breaking: Michael Saylor’s Strategy Buys 1,142 BTC Amid $5B Unrealized Loss On Bitcoin Holdings

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th