Eric Trump Predicts Imminent Gold Outflow Into Bitcoin Despite Crash Below $100k

Highlights

- Eric Trump says a major rotation of capital would happen from gold into Bitcoin.

- He argues Bitcoin low transfer cost give it an edge over gold.

- Bitcoin still outperforms gold long-term, gaining 135% in 2024 versus gold’s 35%.

Eric Trump has predicted that Bitcoin is set to attract capital from gold. This comes even as BTC’s price struggles below $100,000 due to the recent market crash.

Eric Trump Sees Bitcoin Flipping Gold in Global Reserve Debate

In a recent interview, Eric Trump made the case that the balance between the two assets was shifting more towards Bitcoin. He said that as the world gets increasingly connected, assets such as Bitcoin start to have the advantage over physical commodities like gold.

Eric Trump shared that gold requires physical storage. Bitcoin however offers fast solutions for international investors.

Eric’s comments follow other calls suggesting Bitcoin could one day surpass gold in market value. In October, Binance founder Changpeng “CZ” Zhao predicted Bitcoin would one day flip gold’s approximate $30 trillion valuation. “It might take some time, but it will happen,” CZ said.

Strategy co-founder Michael Saylor also chimed in. He said Bitcoin will surpass gold’s market cap by 2035. He said this will happen precisely when 99% of the digital currency’s supply will already have been mined. Saylor added BTC was the “centerpiece of the digital gold rush.”

Bitcoin has recently dropped in price. However, JPMorgan says this is a normal market correction with possible further decline. The bank still expects the coin to reach about $170,000 in the next 6 to 12 months.

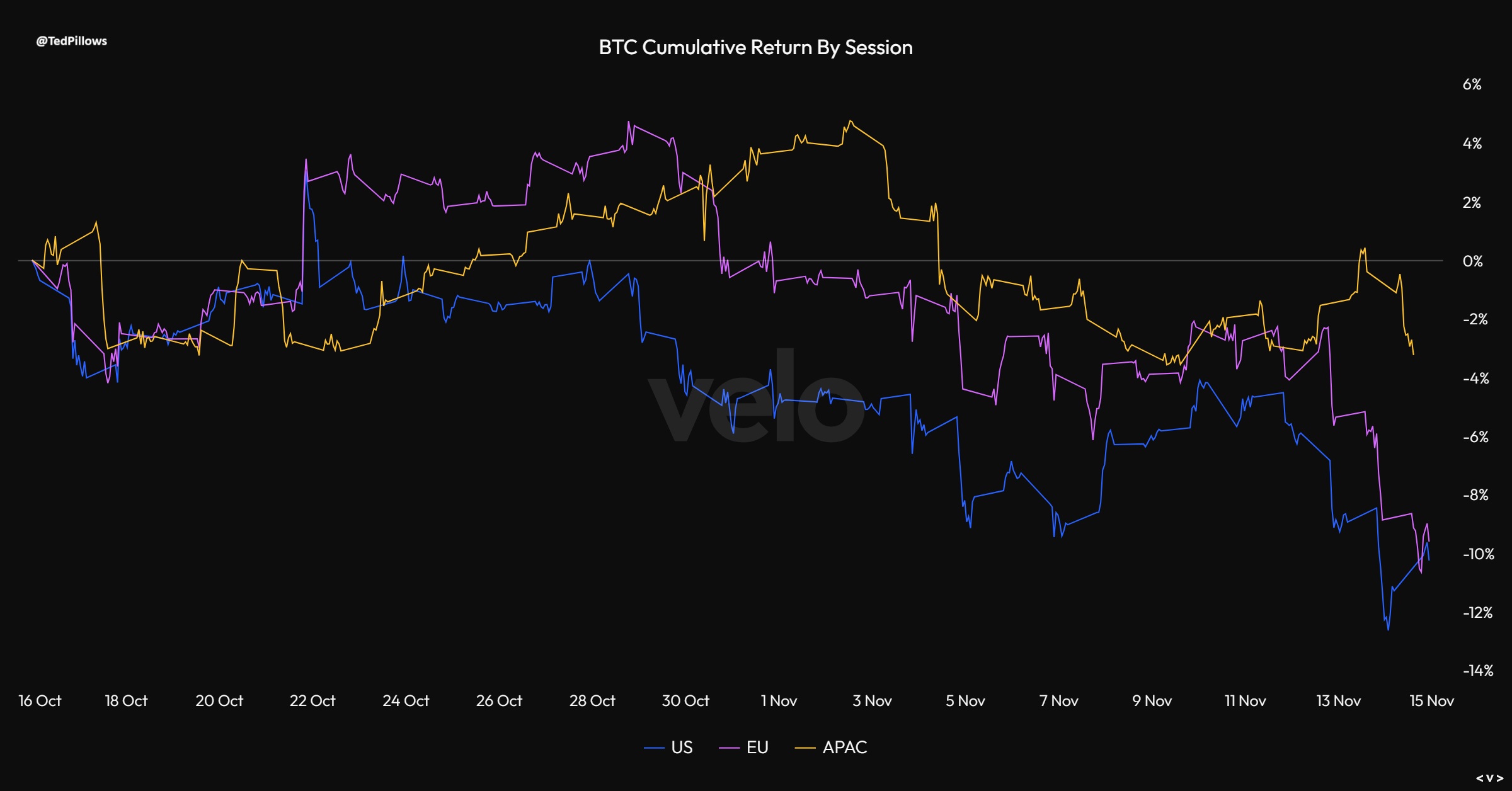

Ted Pillows also noted that Bitcoin’s initial drop was mainly caused by sales from Asian investors. However, the fall below $100,000 happened mostly because U.S. investors were selling their positions. As per current trading data, the U.S. is now the largest seller of the coin during the decline.

Market Dip Highlights Divide Between Bitcoin and Gold

Though both are now deemed safe-haven assets, bitcoin and gold continue to behave quite differently in the markets. Gold currently holds a market cap between $20.8 and $28 trillion. Bitcoin, on the other hand, has over $2 trillion. This is about 8-10% of gold’s value.

Also, Gold has just seen its largest daily drop since 2013. This might be the beginning of a rotation of capital from gold into Bitcoin, according to one analyst at Bitwise.

Meanwhile, Peter Schiff is not convinced about Bitcoin’s chances to flip gold. He argued that Bitcoin is starting to lose its appeal as a store of value. Schiff pointed out that Bitcoin has also fallen over 30% against gold since August.

- $3.5T Banking Giant Goldman Sachs Discloses $2.3B Bitcoin, Ethereum, XRP, and Solana Exposure

- Why is XRP Price Dropping Today?

- Breaking: FTX’s Sam Bankman-Fried (SBF) Seeks New Trial Amid Push For Trump’s Pardon

- Fed’s Hammack Says Rate Cuts May Stay on Hold Ahead of Jobs, CPI Data Release

- $800B Interactive Brokers Launches Bitcoin, Ethereum Futures via Coinbase Derivatives

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?