ETH Balance on Exchanges Touch 2 Year Low, What’s Next?

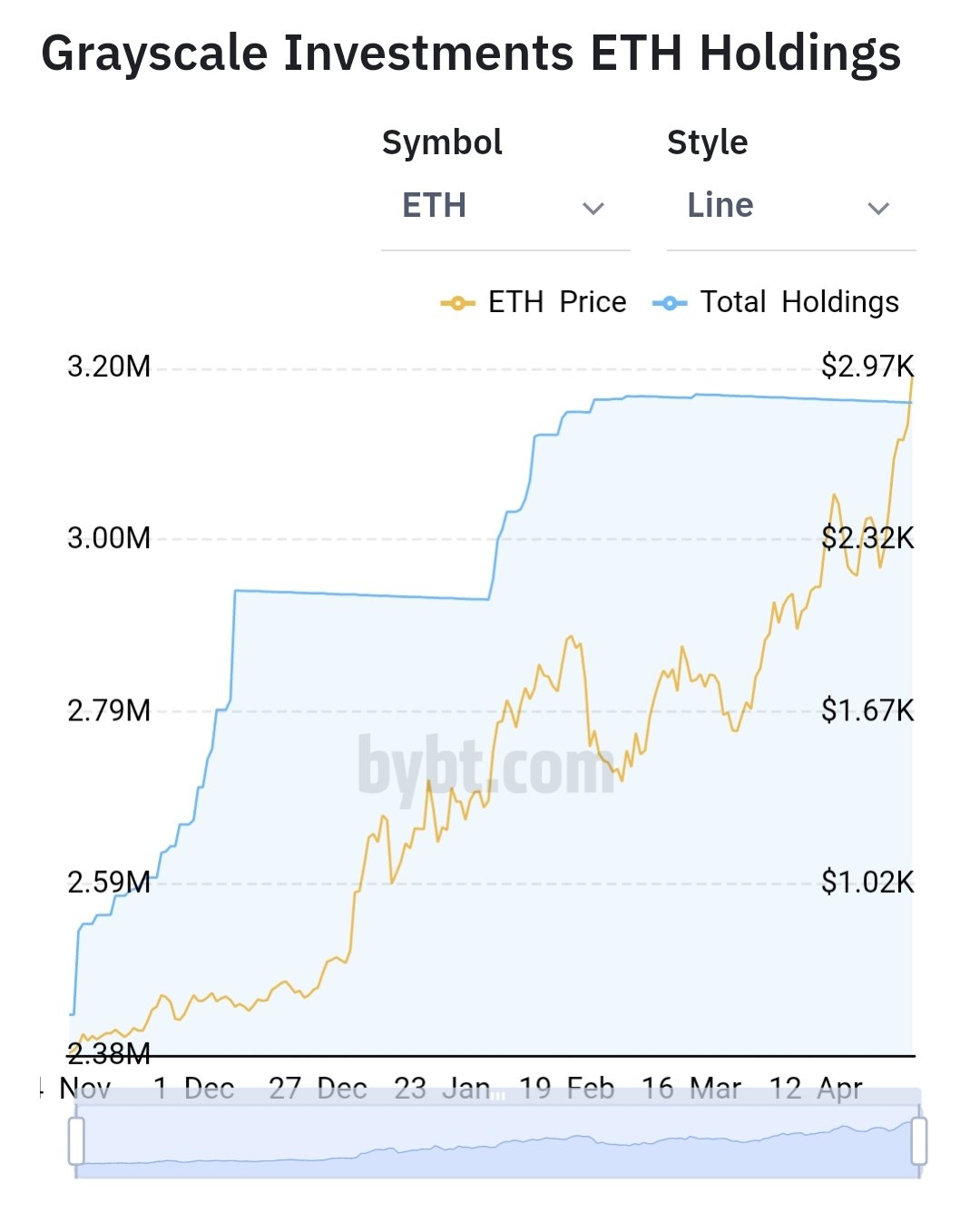

Ether ($ETH), the second-largest cryptocurrency by market cap has been on a phenomenal run over the past couple of weeks and reached a new ATH of $4,197 yesterday. Amid growing demand from institutions and record market dominance currently above 19%, the ETH balance on centralized exchanges dipped to a 2-year low. The continuous dip in the market supply of Ether amid growing demand is a key reason behind surging prices.

Over the past 24-hours, the net outflow of Ether from exchanges is more than Bitcoin at $3.1 billion against the $1.9 billion inflow. Ether has more than tripled its 2017 ATH price of $1,260 and its year on return is currently much higher than Bitcoin.

📊 Daily On-Chain Exchange Flow#Bitcoin $BTC

➡️ $3.1B in

⬅️ $3.0B out

📈 Net flow: +$183.4M#Ethereum $ETH

➡️ $1.9B in

⬅️ $3.1B out

📉 Net flow: -$1.2B#Tether (ERC20) $USDT

➡️ $2.4B in

⬅️ $1.9B out

📈 Net flow: +$565.2Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) May 11, 2021

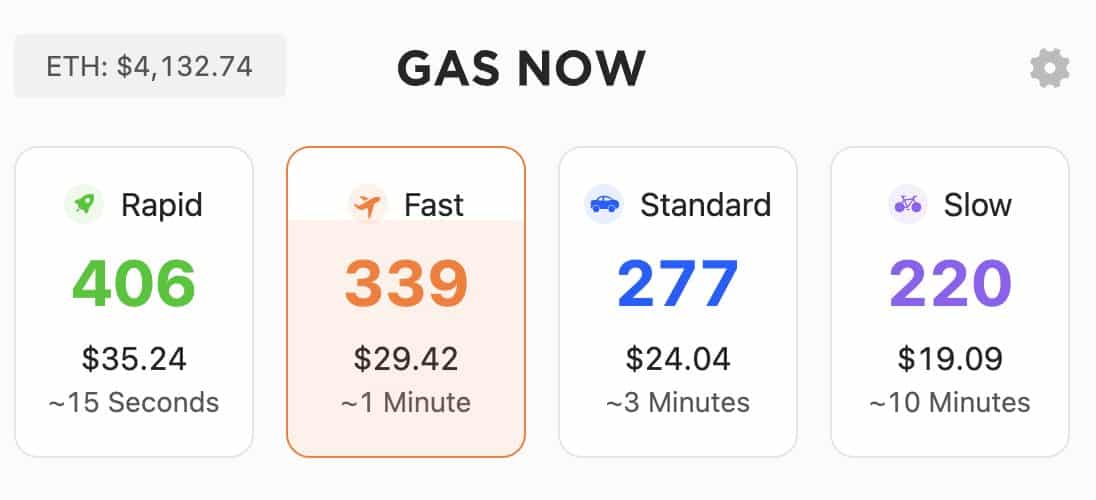

The Ghost of Gas Fee Returns, Would it Come Back to Haunt ETH?

The ETH bulls still look set to continue their surge as on-chain activity and ETH wallets have continued to rise along with spot price, however, the ghost of the rising gas fee has returned to haunt the second largest digital asset again. Towards the end of February and the first half of March, the high gas fee on the Ethereum network not only brought down the spot volume but also made many Defi protocols barely usable. At the same time, many Ethereum rivals also gained a lot of traction during the same time frame especially Binance Smart Chain (BSC), so much so that it was recoding nearly 4X the volume of the Ethereum network at its peak.

The Gas fee is rising again and many believe it is because of the recent trend of meme coins such as SHIB getting listed by many exchanges which in turn has skyrocketed the gas fee to new highs.

Many believed that the rising gas fee could possibly halt the price surge, but after a brief consolidation phase ETH bounced back stronger. While a significant transaction fee of $252 for a simple swap on Uniswap for sure doesn’t look practical given digital assets are promoted to be something that cost barely negligible when compared to centralized banks, but it might not bring a downfall in ETH spot surge.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs