Ethereum (ETH) Price May Skyrocket Soon; Here’s Why

Ethereum’s (ETH) daily burn rate is close to overtaking the pace at which new tokens are minted, recent data shows. The token could see a spike in prices as the supply of ETH tokens becomes limited.

The latest rise in ETH burning appears to be driven by increased NFT minting activities. The Ethereum blockchain is the biggest platform for NFTs, which are usually minted by burning a fractional amount of ETH tokens.

Despite recent losses, ETH is still up 20.6% over the past month. A bulk of these gains are attributed to increased interest ahead of a widely anticipated upgrade.

ETH deflation is price-positive

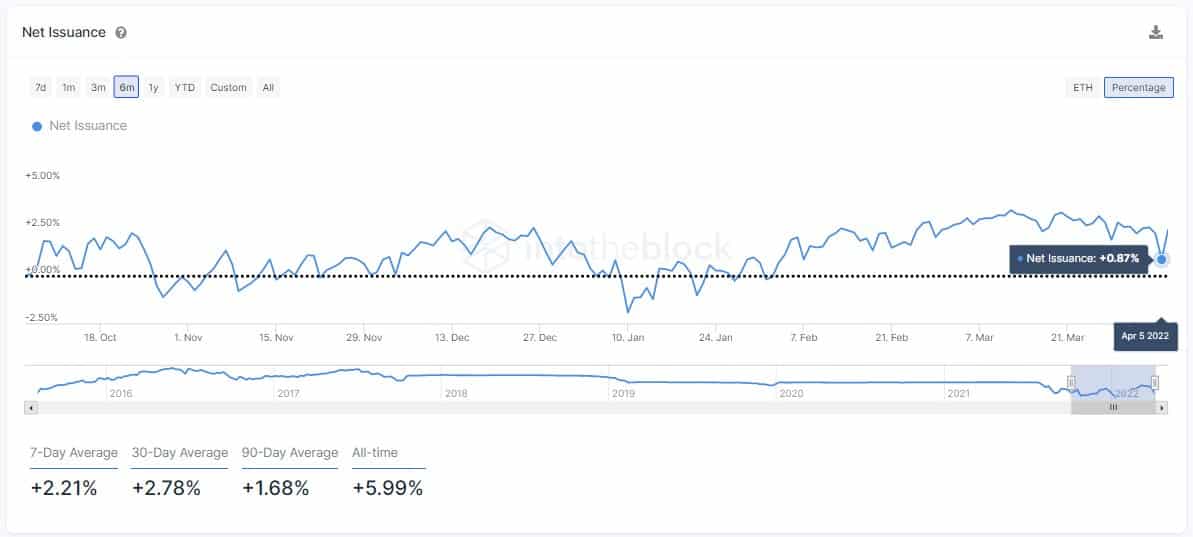

Data from crypto researcher IntoTheBlock shows that ETH’s net daily issuance- the ratio of minting to burning- recently hit a two-month low of 0.87%. The level dropping below 0 will put ETH in deflationary territory.

The last time the token had a consistent negative net issuance was for a week in January. During this period, the token’s price surged as much as 10%. While broader market weakness eventually bought down the token, it still saw a nearly week-long rally.

Recent data from Dune Analytics showed trading volumes on NFT marketplace OpenSea exceeded $100,000 for six days in a row. The indicates an elevated demand for ETH-based NFTs. The token’s daily burn rates were also steadily rising through late-March to early-April.

By comparison, ETH’s hash rate has remained steady for most of the year, around record highs.

Proof of Stake shift is closely watched

ETH is widely expected to shift to a PoS model this year. The move is set to bring down the token’s computing and energy requirements, making it more accessible to investors. This is widely expected to drive more capital flows into the token, especially from institutional investors.

Anticipation of the PoS shift already saw the token rally over 20% through March, while Wall Street majors such as Goldman Sachs were looking into offering derivatives linked to ETH.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs