ETH Price Upholds Consolidation Above $1,600, Are Large Holders Buying?

ETH price, although rangebound between support at $1,600 and resistance at $1,700, shows signs of an upcoming trend reversal. An earlier attempt to steady the bullish outlook came to a sudden halt, with Ethereum retracing to confirm short-term support at $1,600.

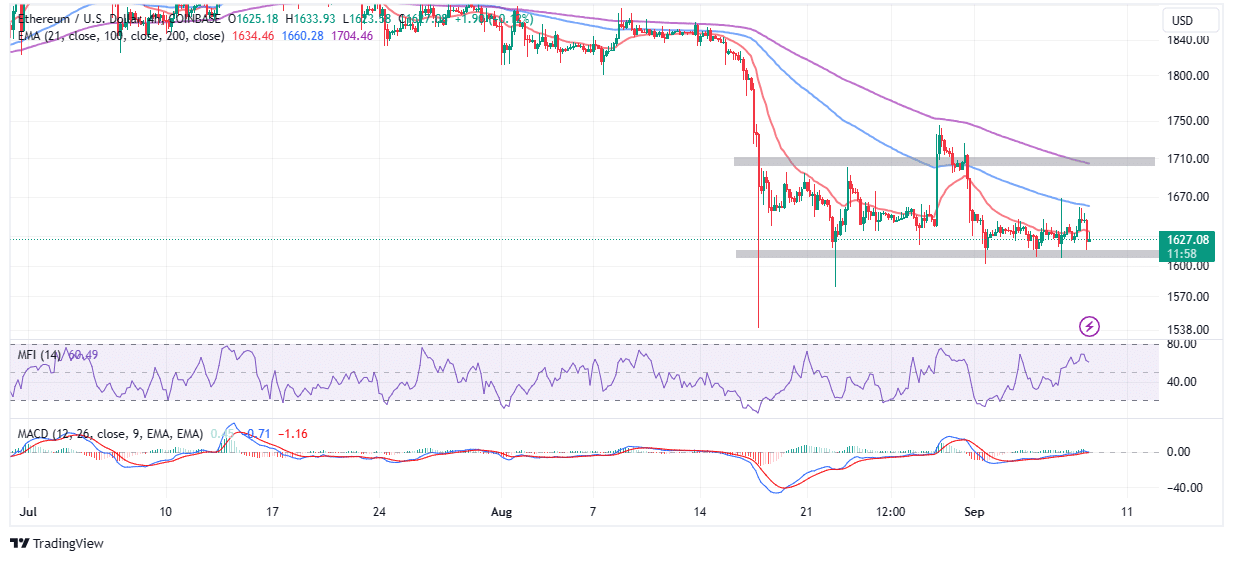

This uptrend coincided with a general bullish wave across the market that saw Bitcoin climb to $26,400 late Thursday. ETH price ascended to $1,660 in a candle wick, unable to push past the 100-day Exponential Moving Average (EMA) (blue).

Up barely 0.1% on the day, Ethereum live price has rebounded to $1,630 in a bullish four-hour candle. If this rebound continues as expected, ETH will likely close the day above the 21-day EMA (red) short-term resistance – a move likely to serve as confirmation for a rally above the upper range limit at $1,700.

Large Holders Buying ETH Is a Bullish Signal

Large holders are helping to keep Ethereum in the range channel while keeping bears in check. According to the latest insights from the on-chain analytics platform IntoTheBlock whales “are causing price consolidation in a tight range due to significant acquisitions both in the low and high 1600 ranges.”

The chart below shows significant support forming around the lower range limit at $1,600, as ETH price trades sideways. However, the expected recovery might take longer to play out considering the higher supply of 6.53 million ETH purchased at an average price of $1,670 compared to 5.11 million ETH with an average price of $1,623.

Evaluating ETH Price Bullish Outlook

ETH price recovery depends on support at $1,600 holding amid this bearish season to prevent potential dips that may cause more damage to investor holdings due to panic selling.

A short-term buy signal from the Moving Average Convergence Divergence (MACD) indicators reveals that bulls have the upper hand but are lacking momentum. As long as the blue MACD line holds above the red signal line, ETH price will keep the trend reversal intact for gains beyond $1,700.

Short-term traders with long positions may want to consider booking profits at $1,670 – the resistance coinciding with the 6.5 million ETH supply. If ETH price sails through this hurdle, bulls will have a clear path to $1,700 – the range limit in confluence with the 200-day EMA (purple).

The Money Flow Index (MFI), an indicator that compares the inflow and outflow volume shows that investors are starting to pump money into Ethereum and this is how the second-largest crypto might break out of the range and make its way to $2,000.

The Ethereum community is also looking forward to the possibility of the SEC approving the first futures-based ETH ETF. Experts believe it is time for the green light, considering futures-based BTC ETFs have been in existence since 2021.

With the ETF approval almost a guarantee, ETH price is expected to outperform most cryptos in September and October, including Bitcoin. BTC price rallied by more than 60% following the approval of the futures ETF in 2021, hence the improving sentiment around Ethereum.

Related Articles

- SHIB Price Prediction: Shiba Inu Shows Signs Of New Lifeline, But There’s A Catch

- Ripple Reopens Registration For Victory Party, Fans Predicts Possible Happenings

- Binance Ends NFT Staking Program And Polygon (MATIC) Network Support

Recent Posts

- Crypto News

Breaking: Rep. Max Miller Unveils Crypto Tax Bill, Includes De Minimis Rules for Stablecoins

Rep. Max Miller is circulating a 14-page draft of a proposed crypto tax bill in…

- Crypto News

XRP Holders Eye ‘Institutional Grade Yield’ as Ripple Engineer Details Upcoming XRPL Lending Protocol

Ripple engineer Edward Hennis has provided key details about the upcoming XRP Ledger (XRPL) lending…

- Crypto News

Michael Saylor Sparks Debate Over Bitcoin’s Quantum Risk as Bitcoiners Dismiss It as ‘FUD’

Strategy co-founder Michael Saylor earlier this week commented on the risk of quantum computing to…

- Crypto News

Ethereum Faces Selling Pressure as BitMEX Co-Founder Rotates $2M Into DeFi Tokens

Ethereum is under new sell pressure after a high-profile crypto trader sold his ETH assets…

- Gambling

Best Crypto Casinos in Germany 2025

If you’re a German gambler tired of strict limits and slow payouts at locally licensed…

- Crypto News

Tom Lee’s Fundstrat Warns Clients Bitcoin Could Fall to $60,000 Despite His ATH Public Forecast

Top asset manager Fundstrat has advised its private clients to expect a pullback in Bitcoin…