Ethena Labs Exits Hyperliquid USDH Bid as Polymarket Traders Back Native Markets

Highlights

- Ethena Labs has withdrawn its proposal to issue Hyperliquid’s USDH stablecoin after community concerns

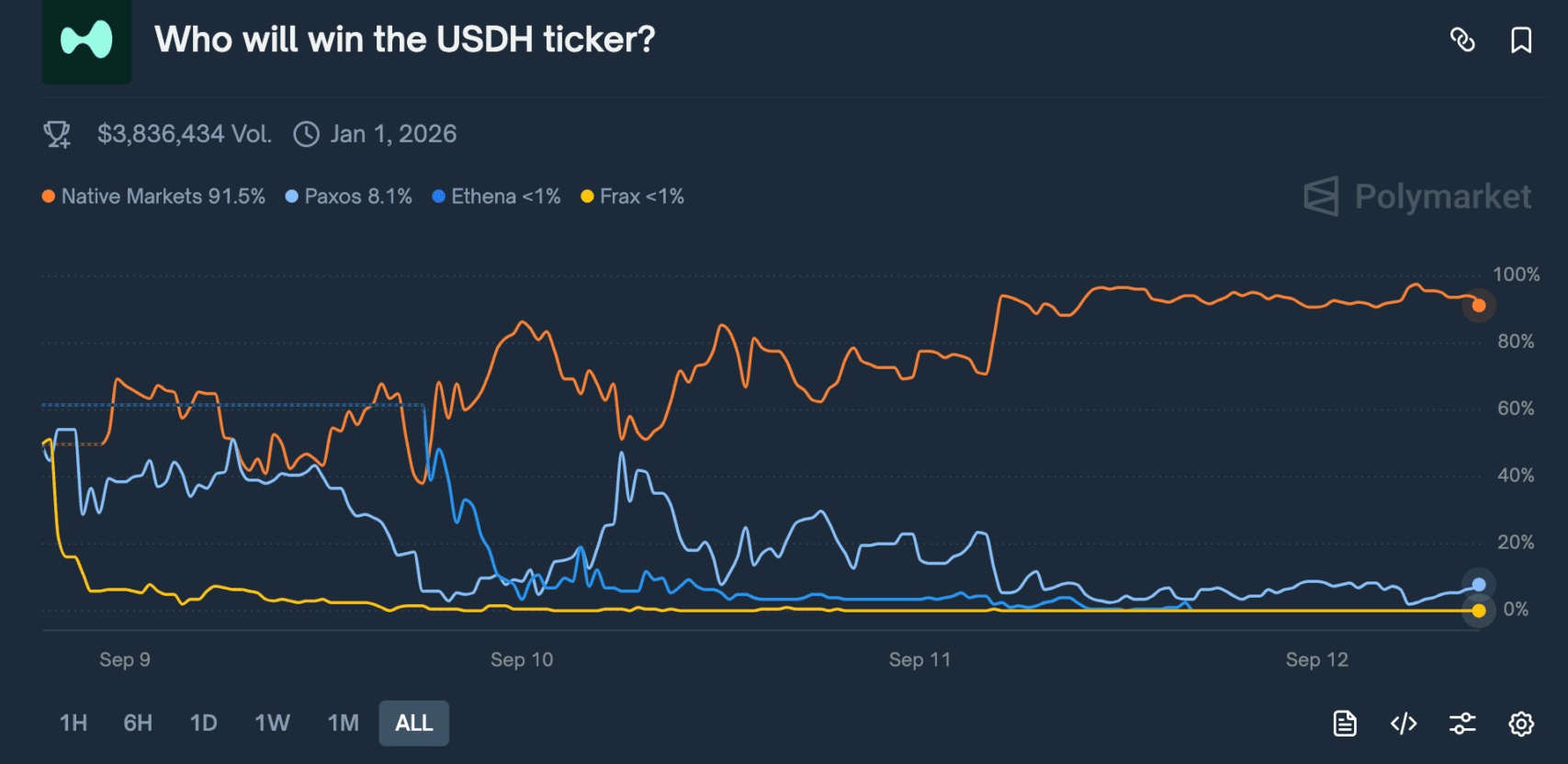

- Polymarket traders give Native Markets a 91% chance of winning the validator vote.

- Winner of the vote will manage a $5.9 billion stablecoin reserve.

Ethena Labs has formally pulled its bid to issue Hyperliquid’s USDH stablecoin. This comes as Polymarket traders increasingly back Native Markets to secure the mandate.

Ethena Labs Steps Back On USDH Issuer Bid

In a recent X post, Ethena Labs’ founder confirmed that the team would no longer be seeking validator support for Hyperliquid’s USDH stablecoin. The decision, he said, followed direct feedback from both community members and validators. They raised concerns that Ethena was not a native Hyperliquid project and that its broader product ambitions extended well beyond USDH.

Hyperliquid had announced plans to launch its native USDH stablecoin through a validator vote. As it stands, Native Markets seems to be the leading candidate.

The founder further praised the community-led process, congratulating Native Markets on its momentum. “No one cares how big you are, your pedigree, or resources,” the founder remarked. He called the validator vote a “level playing field” where new entrants can earn credibility purely through grassroots support.

Although Ethena Labs exited the USDH race, the team emphasized that its long-term vision remains intact. The company is doubling down on new product development within the Hyperliquid ecosystem.

Planned innovations include synthetic dollar instruments such as hUSDe, USDe-linked savings, and card spending solutions. This would hedge flows on Hyperliquid and HIP-3 market designs. This includes reward-bearing collateral and modular prime broking.

Traders on Polymarket Bet Big on Native Markets Winning

According to Polymarket, traders are giving Native Markets 91% odds of winning the validator vote. The team has been gathering visible community support. This comes particularly after the protocol’s foundation announced it would abstain from directly influencing the outcome.

The Hyperliquid Foundation clarified that it will align its validator vote with whichever team gains the most non-foundation support. This would ensure a transparent and community-led selection process.

The eventual winner of the vote will oversee a $5.9 billion stablecoin reserve, currently dominated by Circle’s USDC pairs.

Following the vote, Kraken intends to list USDH alongside HYPE, continuing its bullish momentum. The action could hasten adoption by increasing the new token’s institutional visibility.

The USDH vote, scheduled for September 14, saw interest from other heavyweight firms. Paxos, Frax, and Agora were also in contention. Notably, Arthur Hayes bought additional ENA tokens, betting on the outcome of its stablecoin launch. With Native Markets now holding the lead, the outcome could redefine which teams set the tone for Hyperliquid’s next growth phase.

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?