Ethereum (ETH) Locked By DeFi dApps Moves Past $1 B Mark

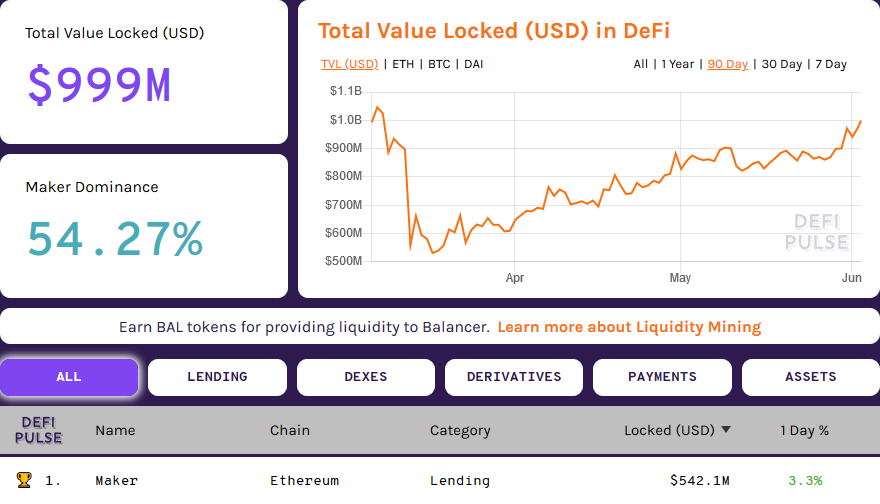

The amount of ETH locked by open finance, DeFi, dApps now exceeds the $1 billion mark according to streams from DeFi Pulse, a site that tracks the performance of financial dApps. A milestone for the emerging trustless finance sub-sector and most importantly Ethereum, from where most DeFi dapps are launched from.

DeFi and ETH Price: The Relationship

Lending rates in DeFi dapps remain high. Part of this is because ETH, which is the collateral required for borrowing loans, is an asset whose prices fluctuate.

When prices rise, instead of simply holding, investors can use the asset to earn above market rates. This could explain the swelling of the total amount of ETH locked in DeFi.

We will never see USD locked in DeFi below $1 billion again ?? pic.twitter.com/nJD77XvGQg

— Anthony Sassano | sassal.eth (@sassal0x) June 2, 2020

Interestingly, the spot price of ETH is positively correlated and syncs with the amount of coins locked by these apps.

It peaked in February 2020 when the price of ETH rose to over $280 (and amount locked in DeFi soaring to $1.2 billion) before dropping and halving to around $550 million in March 2020.

At this time, ETH prices were changing hands below the $120 mark triggering a wave of forced liquidations at MakerDAO.

Not only did borrowers lose their collateral but a resulting network congestion led to an $8 million loss because of a collateral auction hitch.

ETH 2.0 is Vital For Ethereum

Predictably, as ETH prices appreciate ahead of ETH 2.0 Beacon Chain mainnet, it is highly likely that the amount of ETH locked by DeFi dApps will continue to swell and even print new highs.

While everyone wasn't looking, the initial deployment of ethereum's layer 2 scaling strategy has *basically* succeeded. What's left is refinement and deployment. A thread: https://t.co/30Dfr9XmFs

— vitalik.eth (@VitalikButerin) June 1, 2020

The success of the Beacon Chain mainnet, the foundation of ETH 2.0, is vital for the network and ETH prices since most apps prefer the network despite its scalability challenges.

Is Defi Disrupting Traditional Finance?

DeFi apps seek to disrupt the traditional finance system punctuated by centralized entities known for reaping big profits by charging exorbitant rates for borrowers.

As the tables turn and blockchain becomes mainstream, holders of digital assets like ETH or Tron, for instance, would lend their assets and even borrow funds for stablecoins pegged to the USD or any other reserve currency without the participation of the middleman.

The absence of the middleman gives DeFi dApps an edge and an advantage over traditional setups. Notably, that smart contracts drive processes and eliminate errors could be one factor that contribute to the expansion of the interesting financial application.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Is World War III Near? Bitcoin Price Drops As UK, France, Germany Consider Iran Action

- Is Bitcoin Dead? Here’s What the Data Really Says

- US-Iran War: Meme Coin Market Plunges After Iranian Drone Hits US Embassy in Kuwait

- Arthur Hayes Sees 5x HYPE Token Rally as Oil Perps Pump on Hyperliquid Amid U.S.–Iran War

- How BTC, ETH and XRP Prices React as Crude Oil and Safe Havens Surge After Khamenei’s Death

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs