Ethereum Breaks ATH After 3 Years On Several Exchanges, What’s Next?

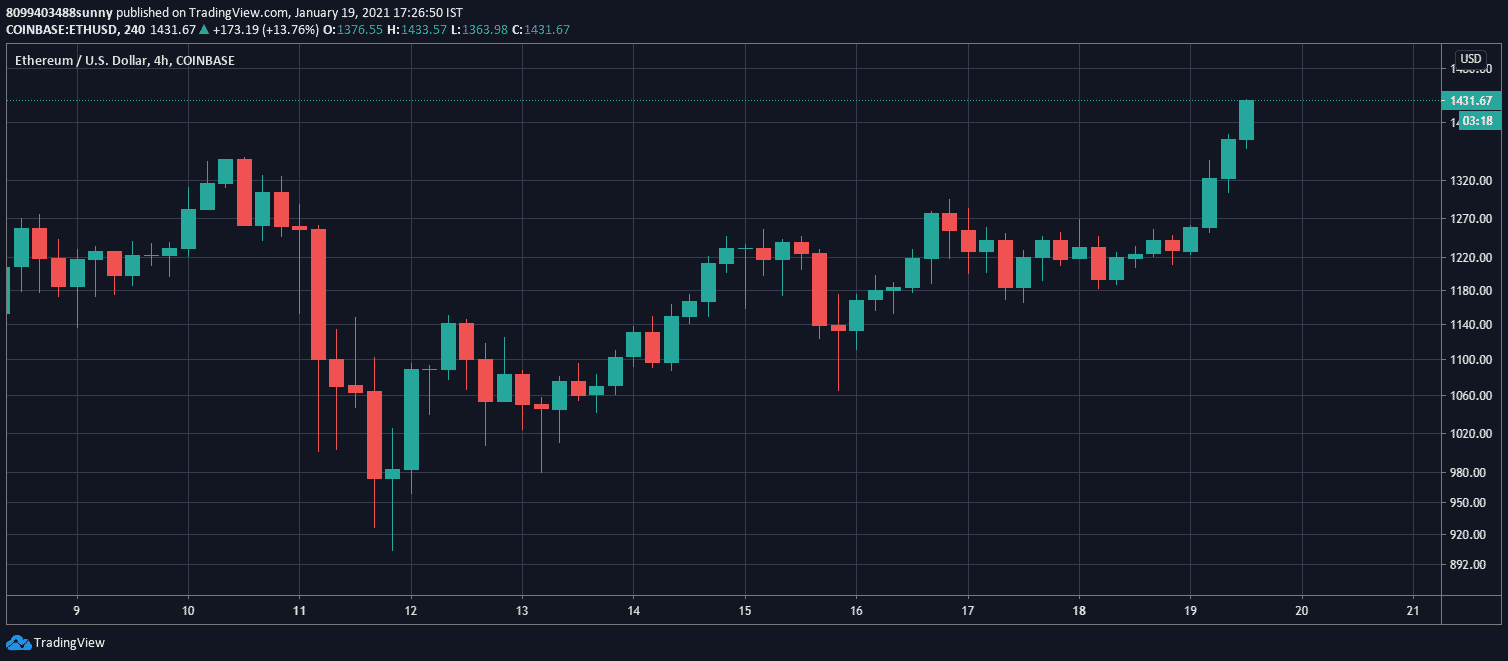

Ethereum finally broke its previous all-time high of $1432 to create a new ATH at the time of writing. The second-largest cryptocurrency by market cap has nearly doubled its price since the start of the new year and many trade pundits believe it could also see price actions quite similar to bitcoin especially when its CME debut is less than 15 days away.

All-time high of Ethereum on different exchanges:

• Kraken – $1,595

• Binance – $1,440

• Bitfinex – $1,424

• Poloniex – $1,424

• Bittrex – $1,423

• Huobi – $1,422

• Coinbase – $1,420

• Bitstamp – $1,420

• Gemini – $1,420I think $1,420 has a nice ring to it ????

— Larry Cermak (@lawmaster) January 10, 2021

ETH was also the best performing asset last year and had a better YTD return than Bitcoin which many mainstream headlines missed due to the hype around bitcoin. Just like Bitcoin’s current bull rally is fueled by institutions, ETH can very well be on the same course as ETH Futures debuts on CME next month. Another similarity with Bitcoin is its non-security status which makes it the choice of investment for institutions without any risk.

ETH outperforming bitcoin while all the institutions are buying bitcoin. What happens next ?

— KING CO฿IE ???? (@CryptoCobain) January 19, 2021

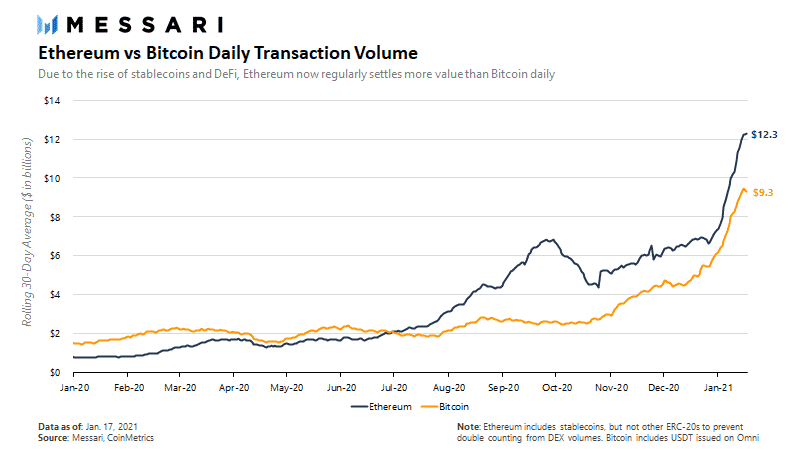

The second-largest cryptocurrency is on a parabolic move and daily on-chain transaction has already surpassed bitcoin daily transaction by nearly 3 billion.

What’s Next?

ETH could venture into new territories post breaching ATH on several exchanges and just like Bitcoin, it might very well see its price peak into uncharted territories especially when things are finally looking well in place for the second-largest cryptocurrency.

Governments around the globe are actively looking into forming user-friendly regulations, and with institutional influx eminent for ETH, it could well be the only asset after Bitcoin on various public companies’ portfolios.

With ETH 2.0 slated to take over within 2 years, Ethereum. the network could potentially become the crypto gateway for many mainstream fintech banks that can leverage Etheruem’s scalability and functionality to build the banks of futures.

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- BlackRock Signals $257M Bitcoin and Ethereum Sell-Off Ahead of Partial U.S. Government Shutdown

- XRP News: Jane Street Emerges Among Key Institutions Driving XRP ETF Inflows

- Bhutan Gov. Dumps More Bitcoin Amid $410M Institutional Sell-Off in BTC ETFs

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15