Ethereum Buying Spree: BTCS Acquires 1,000 ETH, Now Holds 13,500 Coins

Highlights

- BTCS boosts Ethereum stash to 13,500 ETH, a 50% increase since Q1 2025.

- Grayscale, BlackRock, and Fidelity now hold over 3.3M ETH combined.

- Ethereum exchange supply hits 7-year low amid rising corporate accumulation.

BTCS Inc has increased its Ethereum (ETH) holdings to 13,500 coins. This follows the recent acquisition of 1,000 ETH for approximately $2.63 million. The purchase was made through the Crypto.com Exchange, using its institutional trading services. As of June 2, this move marks a nearly 50% rise in ETH holdings since the end of Q1 2025.

The company is focusing on ETH as part of its broader blockchain infrastructure strategy. As a result, its acquisition supports both its treasury model and infrastructure operations. BTCS aims to build scalable blockchain systems and sees ETH as central to these efforts.

BTCS Acquires 1,000 Ethereum, Total Hits 13,500

The firm BTCS continues to expand its blockchain operations and Ethereum reserves. With the addition of 1,000 ETH, the company now holds around 13,500 ETH. This increase reflects BTCS’s commitment to Ethereum-based technologies, including its NodeOps and Builder+ activities.

Charles Allen, CEO of BTCS, stated, “Ethereum remains at the core of our blockchain infrastructure strategy.” He added that ETH acquisition is a byproduct of their infrastructure development, not just a digital asset reserve. The company is working to scale revenue-generating blockchain services that operate on Ethereum’s network.

BTCS is not exploring Ethereum just because it could rise in value. Instead, the focus is on long-term development of resources and making services sustainable and now applying ETH to many areas of its business.

Crypto.com Role in the ETH Acquisition

The ETH was acquired through the Crypto.com Exchange, an institutional-grade trading platform. This exchange is designed for advanced and institutional users and provides deep liquidity and low latency. Crypto.com began offering U.S. services in 2024 and has become a major platform for institutional crypto trading.

According to BTCS, using Crypto.com helped optimize trade execution. The exchange reduced slippage and ensured cost-effective capital deployment.

“We have utilized Crypto.com’s institutional offering… reducing slippage and optimizing capital deployment,” said Allen.

Eric Anziani, President and COO of Crypto.com, commented on the partnership: “We are proud to partner with BTCS in its cryptocurrency acquisition strategy.” He said the platform is designed to provide institutions with advanced tools and liquidity for large-scale trades.

ETH Reserves Growing Among Public Companies

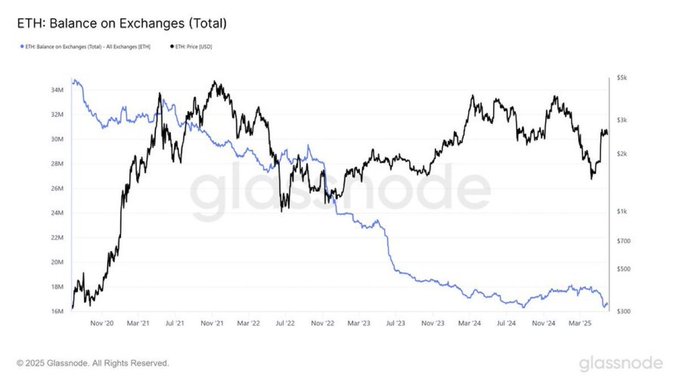

Subsequently, Ethereum exchange balances are now at their lowest point in seven years, according to on-chain data. More public companies are increasing their ETH holdings, and supply on exchanges continues to drop.

BTCS is among several firms increasing ETH reserves. Grayscale Investments holds about 1.85 million ETH, BlackRock holds about 1.05 million ETH, and Fidelity Investments holds around 460,900 ETH. In addition, Abraxas Capital and others have also made large ETH acquisitions.

Concurrently, SharpLink Gaming also recently closed a private placement deal to build its Ethereum treasury. The company revealed that it aims to raise between $750 million and $1 billion. It is aiming to surpass all others by holding the biggest reserves of ETH on the market.

Since corporate buying of ETH is increasing, it could soon become a key focus for many firms’ treasury and infrastructure plans, leading others to do the same.

- Bernstein Downplays Bitcoin Bear Market Jitters, Predicts Rally To $150k This Year

- Breaking: Tom Lee’s BitMine Adds 40,613 ETH, Now Owns 3.58% Of Ethereum Supply

- Bitget Partners With BlockSec to Introduce the ‘UEX Security Standard’ Amid Quantum Threats to Crypto

- Breaking: Michael Saylor’s Strategy Buys 1,142 BTC Amid $5B Unrealized Loss On Bitcoin Holdings

- MegaETH Mainnet Launch Today: What To Expect?

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry