Ethereum (ETH) Exchange Outflow Suggests The ETH Rally Is Not Stopping Anytime Soon

This week Ethereum (ETH) rallied all the way above $3500 levels hitting its new all-time high and pushing its crypto market dominance to 17%. In its journey upwards, Ethereum has toppled many big financial giants like Mastercard (NYSE: MA), PayPal (NASDAQ: PYPL), and Bank of America (NYSE: BAC).

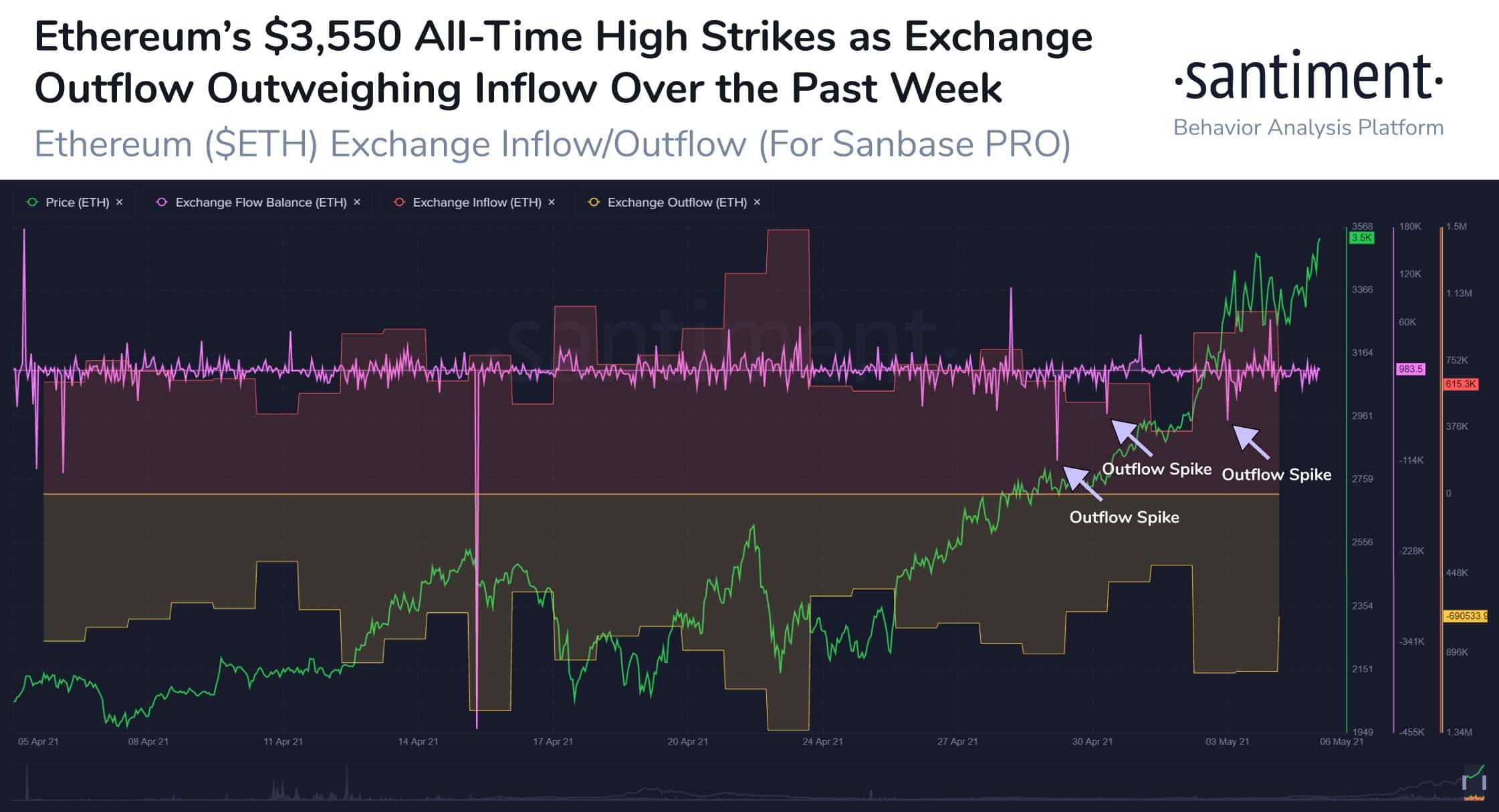

However, despite a massive 4x run-up this year in 2021, it seems Ethereum (ETH) isn’t stopping anytime soon. The Ethereum (ETH) exchange supply has been dropping at a faster rate than the exchange inflows. This clearly implies further continued growth and less risk or any other major sell-offs.

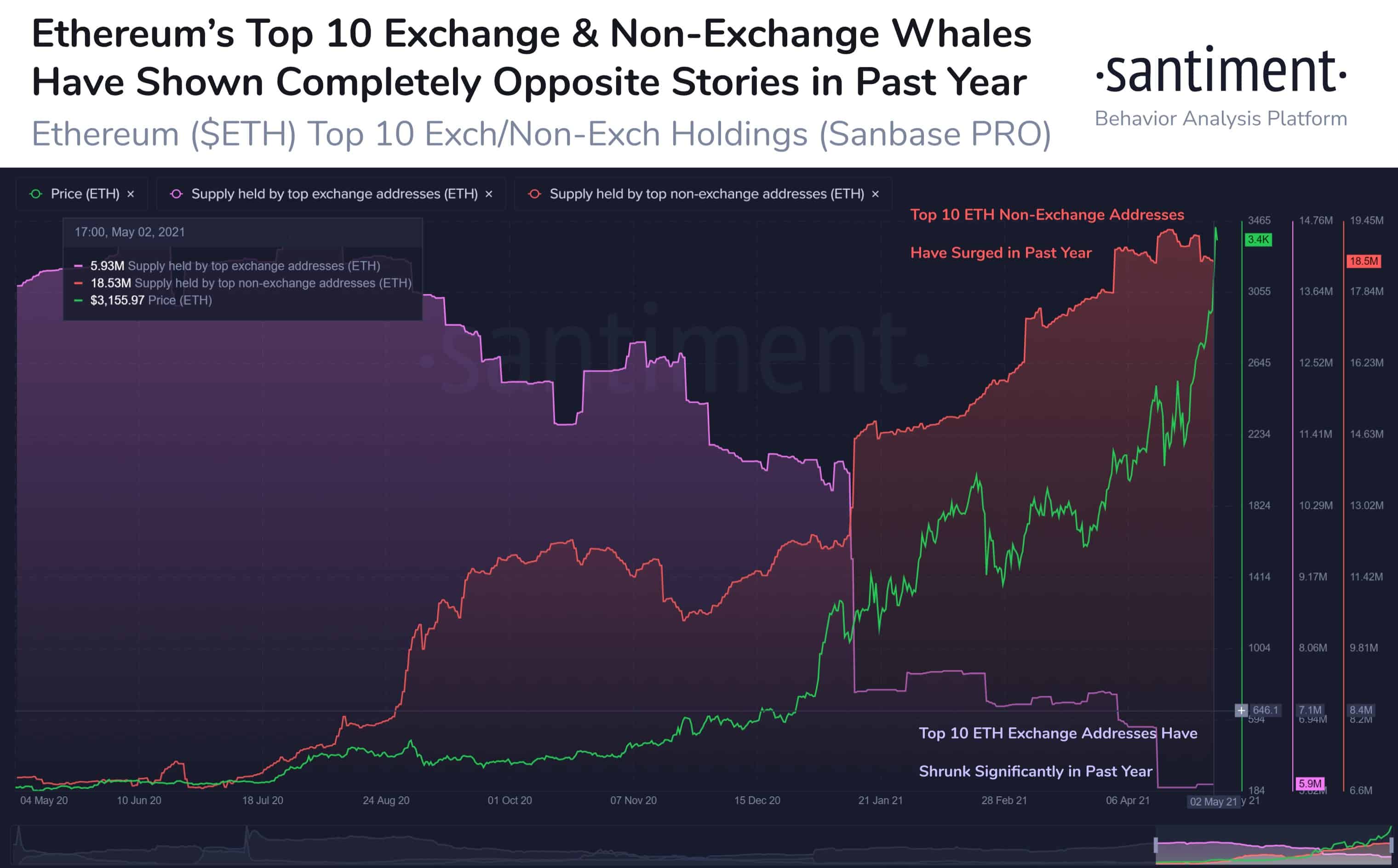

However, the behavior of the Ethereum whale address has been interesting to watch for. While the non-exchange ETH whales have doubled in numbers over the last eight months, the exchange ETH whales have dropped in half. Below is the graph from Santiment that shows a completely opposite behavior of the exchange and the non-exchange whales.

Ethereum Coins Moving to DeFi and ETH 2.0 Deposit Contracts

As ETH supply moves off-exchanges, a massive number of ETH coins at the same time has been moving to Ethereum-based decentralized finance (DeFi) protocols. As per Santiment, the total value of ETH coins locked in DeFi has doubled over the last three months.

Similarly, deposits in the Ethereum smart contracts have also reached an all-time high as of now. The value of ETH coins staked in these deposit contracts has reached close to $13 billion.

📈 #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 4,276,578 ETH

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/5mv0OLa6rx

— glassnode alerts (@glassnodealerts) May 6, 2021

Also, there is enough evidence of the fact that U.S. institutional investors have been buying Ethereum recently. The ETH premium on Coinbase has significantly surged since the beginning of 2021.

Another evidence that US (institutional) investors are buying $ETH at @Coinbase.$ETH Coinbase premium has been significantly increased since early 2021.

New money is flowing into the crypto market. https://t.co/4PRRP3kEzJ pic.twitter.com/JcFQiJK9qY

— Ki Young Ju 주기영 (@ki_young_ju) May 5, 2021

One of the major issues with high Ethereum on-chain activity has been its gas fee. However, it seems that the gas fee has significantly dropped over the last two weeks thereby alleviating investors’ pain and boosting more network activity. The daily active addresses on Ethereum are also on the rise at this point.

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?