Ethereum (ETH) On-Chain Data Suggests EIP 1559 Upgrade is in Play

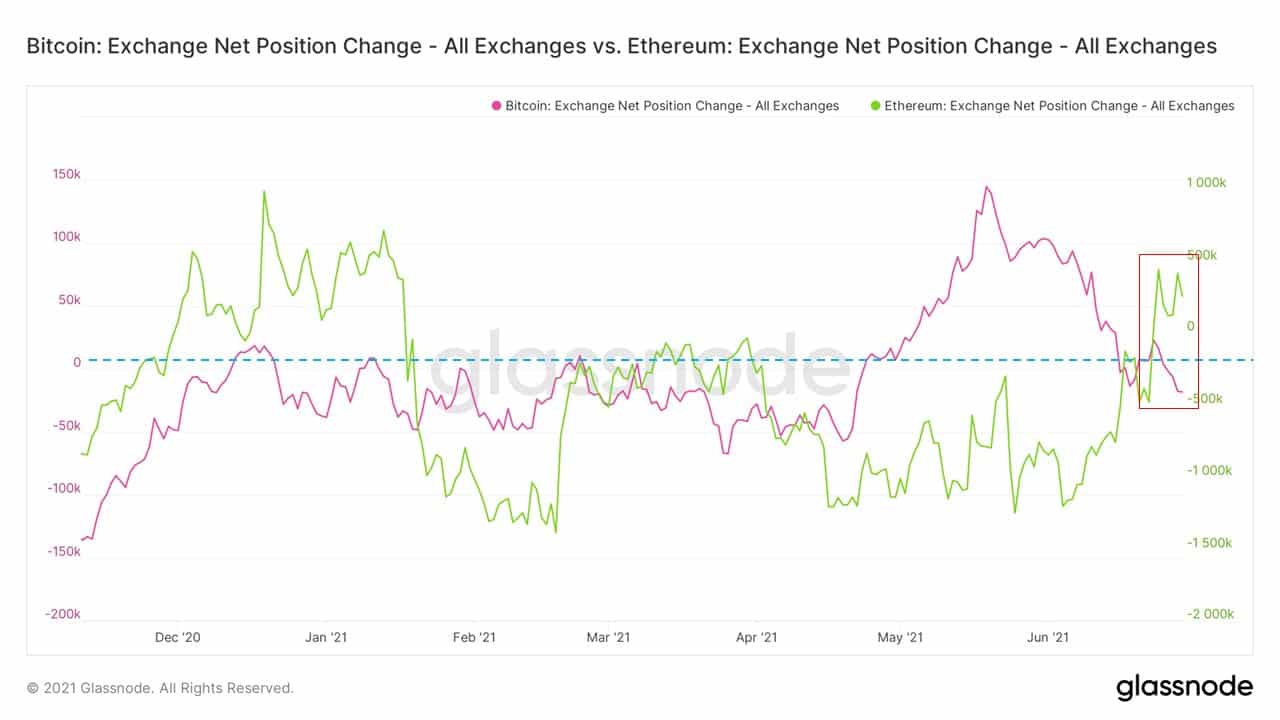

Ether(ETH), the second-largest cryptocurrency by market cap has seen a key on-chain trend reversal as ETH saw a net inflow of funds for the first time since April. On the other hand for Bitcoin, the tide has reversed and the top cryptocurrency registered a net outflow of funds. The trend reversal for ETH is being attributed to the upcoming EIP-1559 upgrade scheduled to be updated in the upcoming London hardfork.

The net inflow of funds in Ethereum suggests more traders are buying ETH at the moment. Analysts also beleive EIP-1559 could be driving the current sentiment.

The upgrade promises to resolve the gas fee crisis on Ethereum that has plagued the network at the peak of the bull run. The upgrade would make the transaction cost more stable and burn gas fees with each transaction. If successful, the upgrade could make ETH a deflationary asset where supply decreases over time.

The London hard fork’s first testnet Ropsten went live last week while the second testnet Goerli will go live today followed by Rinkeby testnet on July 7. The net inflow of funds for Ether could be because of the same.

ETH Rises Over 20% to Regain $2,000

Ether price has shown great recovery over the past three days this week, rising over 20% to regain the $2,000 price range. ETH is currently trading at $2,154. Like most of the altcoins, ETH had lost more than half of its valuation over the past couple of months, falling from an all-time high of $4,362 recorded in May. However, the on-chain metrics remain as strong as ever.

Ether recorded a new high after its number of active addresses surpassed that of Bitcoin for the first time since the beginning.

- Fed’s Chris Waller Says Support For March Rate Cut Will Depend On Jobs Report

- Breaking: Tom Lee’s BitMine Adds 51,162 ETH Amid Vitalik Buterin’s Ethereum Sales

- Breaking: Michael Saylor’s Strategy Makes 100th Bitcoin Purchase, Buys 592 BTC as Market Struggles

- Satoshi-Era Whale Dumps $750M BTC as Hedge Funds Pull Out Billions in Bitcoin

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?