Ethereum Bulls Incoming? Total Value Locked by DeFi Apps Up 28% in 3 Days

The total value of ETH locked by DeFi dapps in USD terms is up 28% in the last three days, a boon for traders who witnessed one of the largest single day fall of Ethereum on Mar 12, 2020.

Ethereum is the leading platform for decentralized finance or open finance applications.

Its decentralized nature and smart contracting capacity means that the network is perfect for coin holders to earn interest or borrow loans from their digital asset stash.

The Age of DeFi

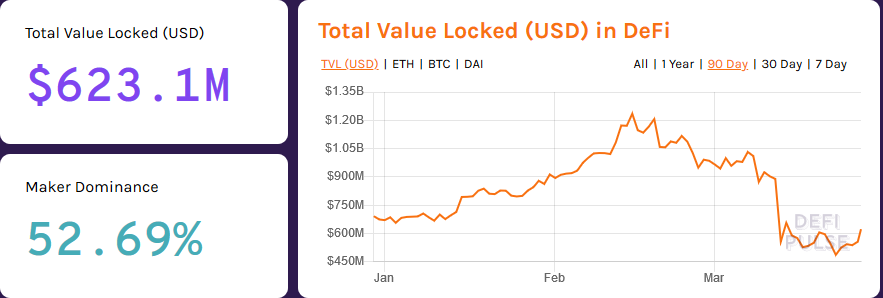

There are several DeFi applications, and after the fall of mid-March, the amount of ETH locked is now up to $623 million up from $487 million of Mar 23.

ETH is the collateral for all the CDPs released by Ethereum-based DeFi lending and loaning apps.

Because of the volatile nature of ETH, a digital asset open to market forces and autonomous like Bitcoin, creators prefer their loans in DAI to be over-collaterized. The current ratio is 150%.

The rise in the total value of ETH held by DeFi dapps is a mark of confidence and a leading indicator of a correction. As observed, there seems to be a positive correlation between the locked value and the price of ETH.

ETH Primed for Higher Prices as TVL Rise 28%

The Total Value Locked (TVL) peaked on Feb 15 when $1.23 billion in ETH were cumulatively held by DeFi apps.

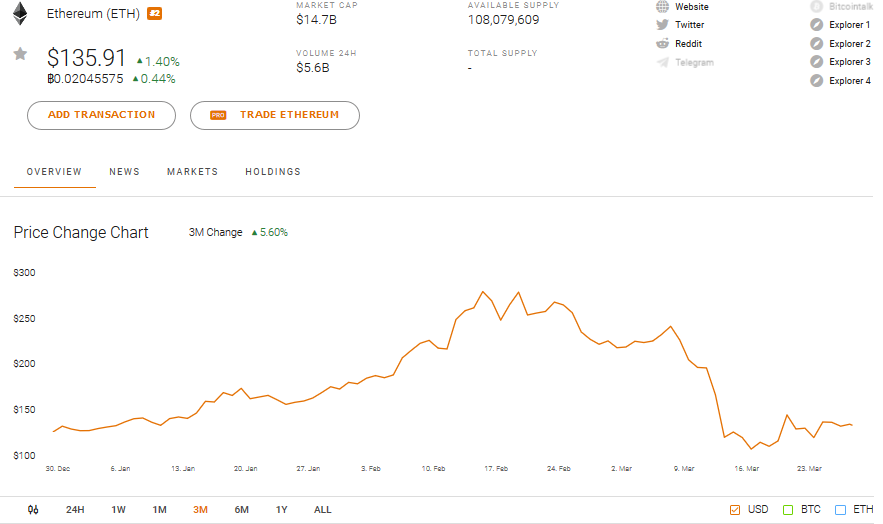

Coincidentally, this the time when ETH peaked. On Feb 15, ETH prices reached $277 before falling in subsequent sessions.

However, the TVL of DeFi apps fell immediately and by Feb 19 when ETH retested $277, the amount locked stood at $1.20.

At the moment, ETH is consolidating at $135, $15 shy off the main resistance at $150. Meanwhile, TVL is bottoming up, up 28% in three days.

If history guides and price action are anything to go by, ETH will likely edge higher.

MakerDAO Troubles

Meanwhile, MakerDAO remains the most dominant application despite heavy losses on Mar 12-13 when Ethereum was temporarily clogged.

The slow network means that the collateral auction couldn’t function as coded and there are individuals who placed zero bids.

This was recouped when the foundation minted extra MKR tokens to compensate victims.

- Fed’s Goolsbee Cites Inflation Worries in Case Against Further Rate Cuts

- David Schwartz To Step Down as Ripple CTO, Delivers Heartfelt Message to XRP Community

- Michael Saylor Reveals Strategy’s Endgame To Accumulate $1 Trillion Bitcoin For Its Treasury

- CZ Hints at ‘Uptober’ Bitcoin Rally Following Green September

- BlackRock Now Holds 3.8% of Bitcoin Supply; Bloomberg Analyst Explains Why It’s ‘Extraordinary’

- SUI Price Eyes $4.5 as Coinbase Futures Listing Sparks Market Optimism

- Chainlink Price Holds $20 Support Amid Tokenization With DTA Standard Progress – Is $47 Next?

- Analyst Predicts Dogecoin Price Surge as DOGE ETF AUM Hits $20M

- Ethereum Price Eyes $8,600 As Institutions And Whales Double Down

- Dogecoin Price Prediction – Chart Set-Up Highlights Perfect Buying Opportunity With Outflows Backing $0.45

- Bitcoin Price Set to Rebound Ahead of US Government Shutdown, NFP Data