Ethereum (ETH) Top Ten Largest Addresses Control 35% of the Supply, Is It Concerning?

The world’s second-largest cryptocurrency Ethereum (ETH) has been trading around the $1,650 levels, however, the network activity has been showing some interesting developments.

Ami the recent price crash, while the small traders have been trying to offload their supply, their big players have been accumulating. This has led to the ETH supply concentration with the ETH top 10 addresses now controlling 35% of the total supply. However, don’t think of it as the centralization of ETH here.

On-chain data provider Santiment explains: “The top 10 addresses within the Ethereum network now possess more than 35% of the total available supply. While this doesn’t indicate a sudden shift to centralization for the 2 cryptocurrency asset in the crypto space, it does highlight how smaller traders are succumbing to fear, uncertainty, and doubt (FUD) during this market dip”.

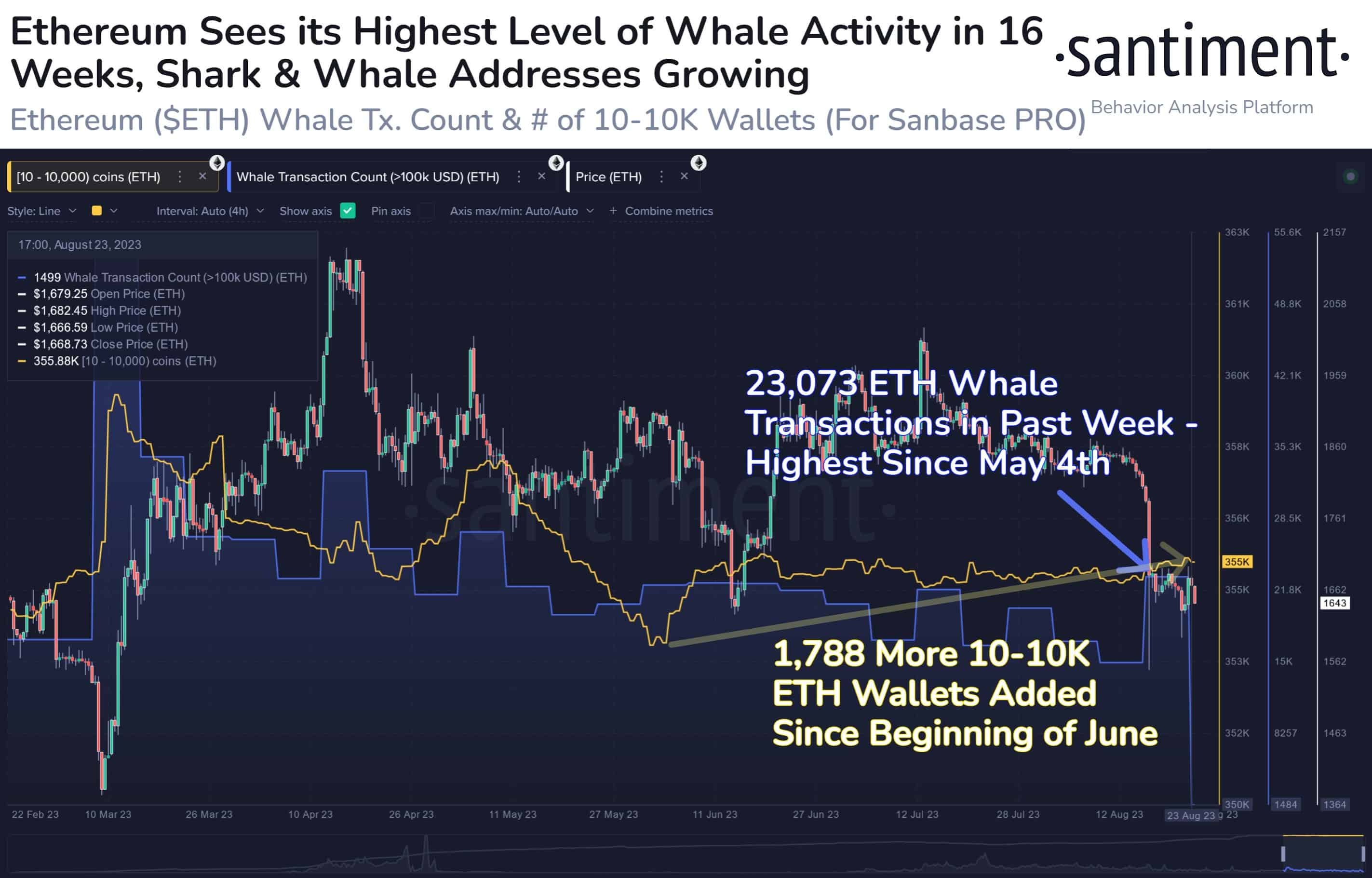

Amid the recent price volatility, the ETH whale transactions have also grown over the last three months. Since the beginning of June, more than 1788 10-10K ETH wallets have been added to their bags.

Santiment explains: “Amidst Ethereum’s decline below $1,650 and its notably volatile price environment, there has been a notable increase in significant address activity on its network. The number of wallets holding between 10 and 10,000 $ETH has rebounded to 355,000, while transactions of $100,000 or more have experienced a surge”.

Ethereum (ETH) Price Action Ahead

After a strong correction last week, the world’s second-largest crypto Ethereum (ETH) has managed to hold above the $1,650 levels.

Ether is currently below both the $1,680 mark and the 100-hourly Simple Moving Average. Furthermore, an important bearish trend line is taking shape with resistance around $1,665 on the hourly chart of ETH/USD.

Should Ethereum be unable to surpass the resistance at $1,665, it might initiate a new decline. The initial support to watch on the downside is around the $1,600 level. The first significant support lies near the $1,580 region.

If the price falls below $1,580, further losses might occur. The subsequent crucial support rests near the $1,550 level. Additional losses could potentially lead the price to approach the $1,520 level, or even decline to a fresh low below $1,500.

- Will Bitcoin Crash Again as ‘Trump Insider’ Whale Dumps 6,599 BTC

- XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral

- Crypto Markets Brace as Another Partial U.S. Government Shutdown Looms Next Week

- $40B Bitcoin Airdrop Error: Bithumb to Reimburse Customer Losses After BTC Crash To $55k

- ETH Price Fears Major Crash As Trend Research Deposits $1.8B Ethereum to Binance

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch