Ethereum Exit Queue Tops $4B as Staking Withdrawals Spike- ETF Approval Ahead?

Highlights

- Ethereum validator exits hints at profit-booking amid rising ETH price, as waiting time surges to 15 days.

- Analysts see it as a strategic exit before reallocating funds to the upcoming staked Ethereum ETFs, currently under SEC review.

- ETH price has corrected 15% from its recent high of $4,800, now holding around $4,200.

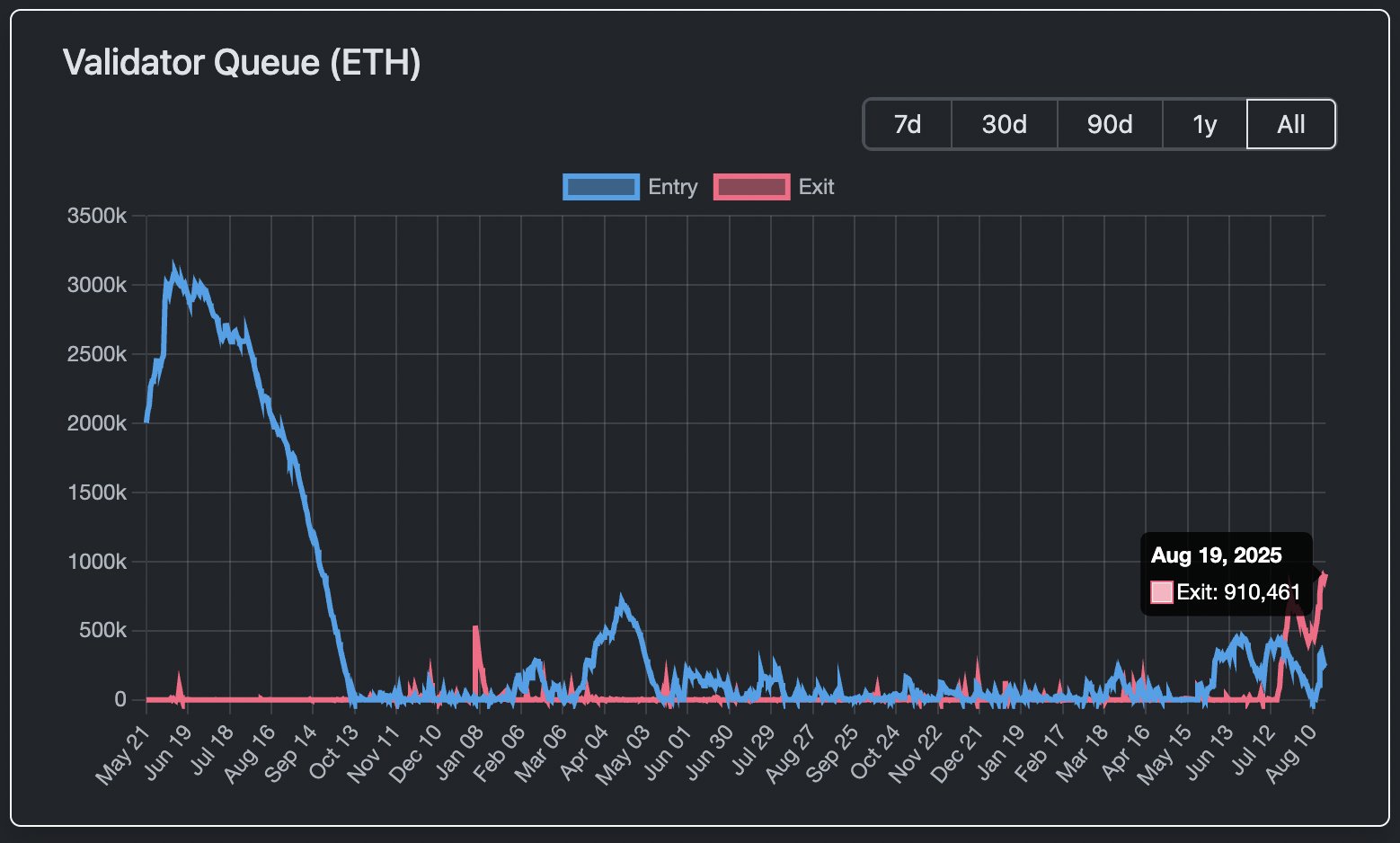

The Ethereum validator exit queue has reached closer to 1 million ETH, or $4.0 billion worth of ETH, with staking withdrawals on the rise amid the recent price rally. Over the past few weeks, the validator exits have been on the rise, largely driven by top three liquid staking platforms – Lido, EthFi, and Coinbase. As a result, the ETH price has seen over 10% pullback after facing rejection at $4,800 last week.

Ethereum Validator Exits On the Rise

Amid the rising Ethereum staking withdrawals and validator exits, investors have raised caution on the development. Over the past two weeks, the validator exit queue has grown from 640,000 ETH to more than 910,461, worth a massive $3.9 billion.

As per the data from Validator Queue, there’s a 15-day waiting period for the ETH exit, with a total number of active validators at 1.08 million. As of now, nearly 29.45% of the total ETH supply i.e. 35.3 million ETH is currently staked. On the other hand, the demand for new ETH staking is far below the exit demand. As of now, the ETH staking demand stands at 258,951 ETH, worth $1.09 billion.

The growing queue of unstaked ETH suggests significant profit-taking in progress. So far, strong inflows into spot Ethereum ETFs, and massive accumulation by the ETH treasury firms, have absorbed most of the selling pressure coming from validator exit.

All eyes on Staking for Ether ETFs

Crypto market analysts also believe that some investors might be unlocking liquidity now with the intention of re-entering via stake Ether ETFs. This could lead to effectively reallocating their positions without fully exiting the ETH market. Last month, asset manager BlackRock filed for a proposal to bring staking to iShares Ethereum Trust (ETHA).

Although the SEC’s final approval deadline is April 2026, Bloomberg ETF analyst Seyffart suggests the decision could arrive by October this year.

The net flows into Ethereum ETFs have also flipped negative over the past two trading sessions. On Monday, August 18, the net outflows stood at $196.6 million, with BlackRock’s ETHA contributing $87 million, and Fidelity FETH contributing $78 million, as per data from Farside investors.

ETH price has also come under selling pressure, correcting 15% from its weekly top. As of now, Ethereum is finding support at $4,200, with daily trading volume dropping to $45 billion.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale