Ethereum Faces Selloff Risks As Whales’ Unrealized Profit Hits 2021 Highs

Highlights

- Ethereum risks falling as historical data signal whales could start profit booking soon.

- It coincides with spot Ethereum ETFs outflows and bearish forecast by Citigroup.

- Analysts predicts ETH price risks correction to $4,000.

Ethereum could face a choppy path ahead as whales continue to book profits when ETH price moves higher. While the Federal Reserve resumes its interest rate cuts, the latest selloff by whales, Citigroup’s bearish outlook, and outflows from spot Ethereum ETFs signal significant headwinds towards $5,000.

Ethereum Whales On-chain Data Sparks Concerns

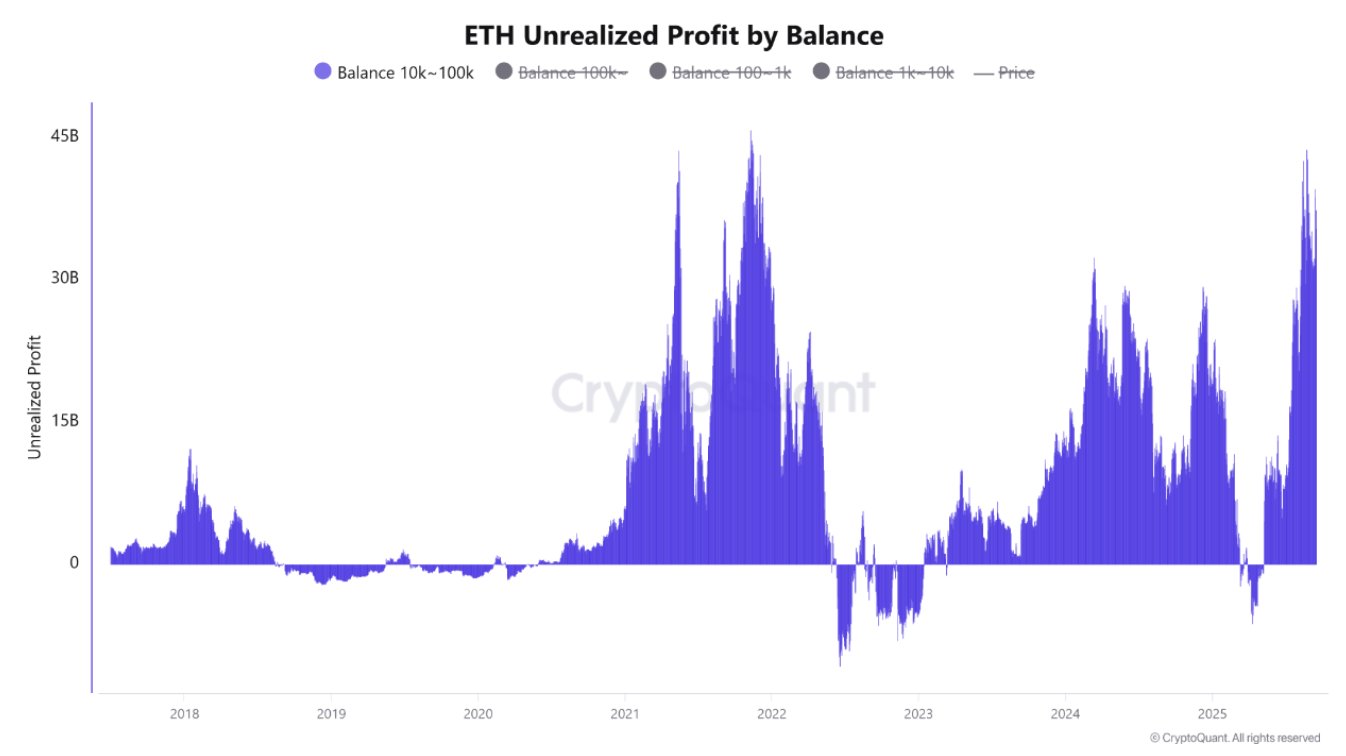

CryptoQuant on September 18 highlighted that unrealized profit of Ethereum whales holding 10K–100K ETH climbed to levels witnessed during the previous cycle’s peak in 2021. The level is often considered a benchmark by whales to book some profits.

Historically, such higher unrealized profits of whales could trigger profit-taking activity or increased selling pressure in the crypto market. Notably, long-term holders have continued to cut their holdings in the last few months.

Institutions and Whales Keep Selling Ethereum

Spot Ethereum ETFs recorded a net outflow of $1.89 million on Wednesday, indicating selling by institutional investors despite a 25 bps Fed rate cut. Fidelity’s FETH saw an outflow of $29.19 million and Bitwise’s ETHW saw $9.7 million in outflow, as per Farside Investors data.

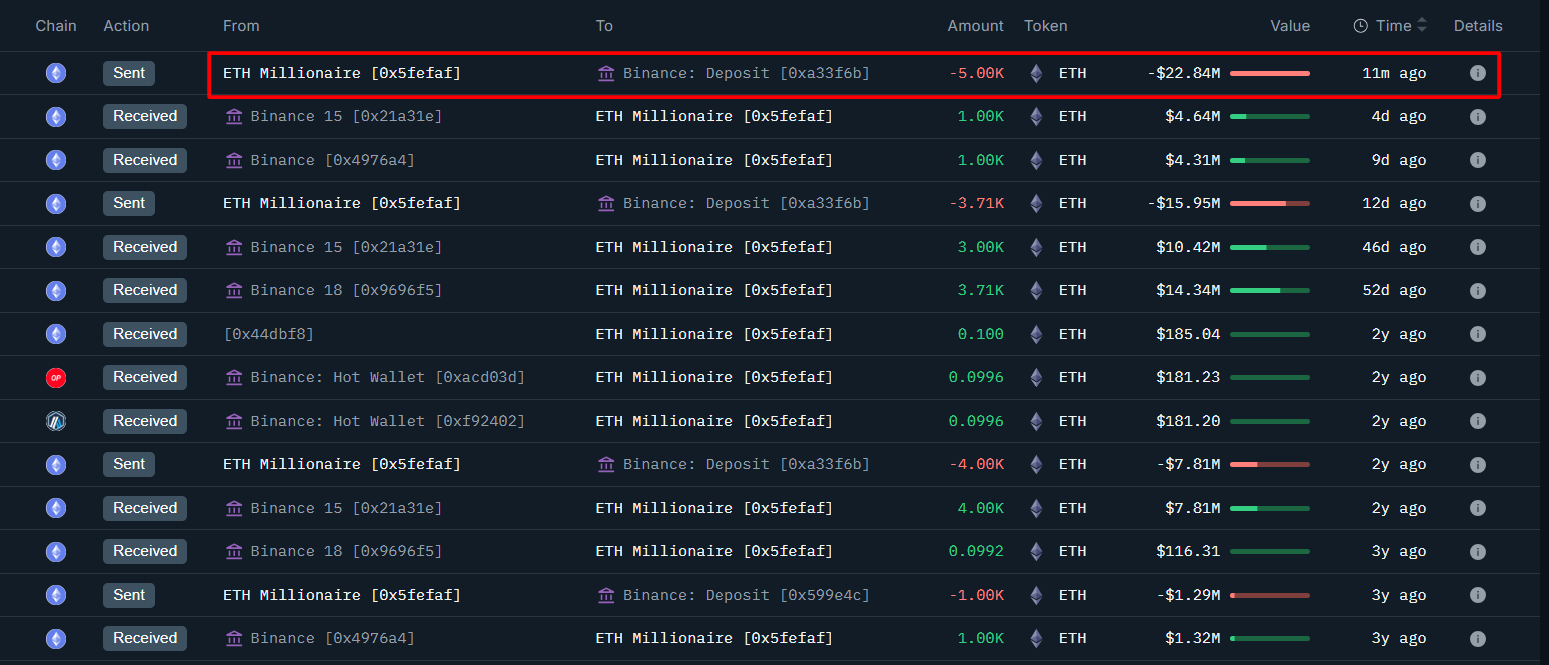

Moreover, Onchain Lens highlighted a whale moving its entire 5,000 ETH holdings worth $22.84 million to crypto exchange Binance. The whale made an overall profit of $5.08 million.

As CoinGape reported earlier, Wall Street giant Citigroup remains bearish on Ethereum. The bank predicted ETH price to end this year at $4,300, while also sharing a bearish case target of $2,200. It added that macroeconomic factors have contributed moderately to the ETH price rally above $4,500.

Analysts Predict ETH Price Could Fall to $4,000

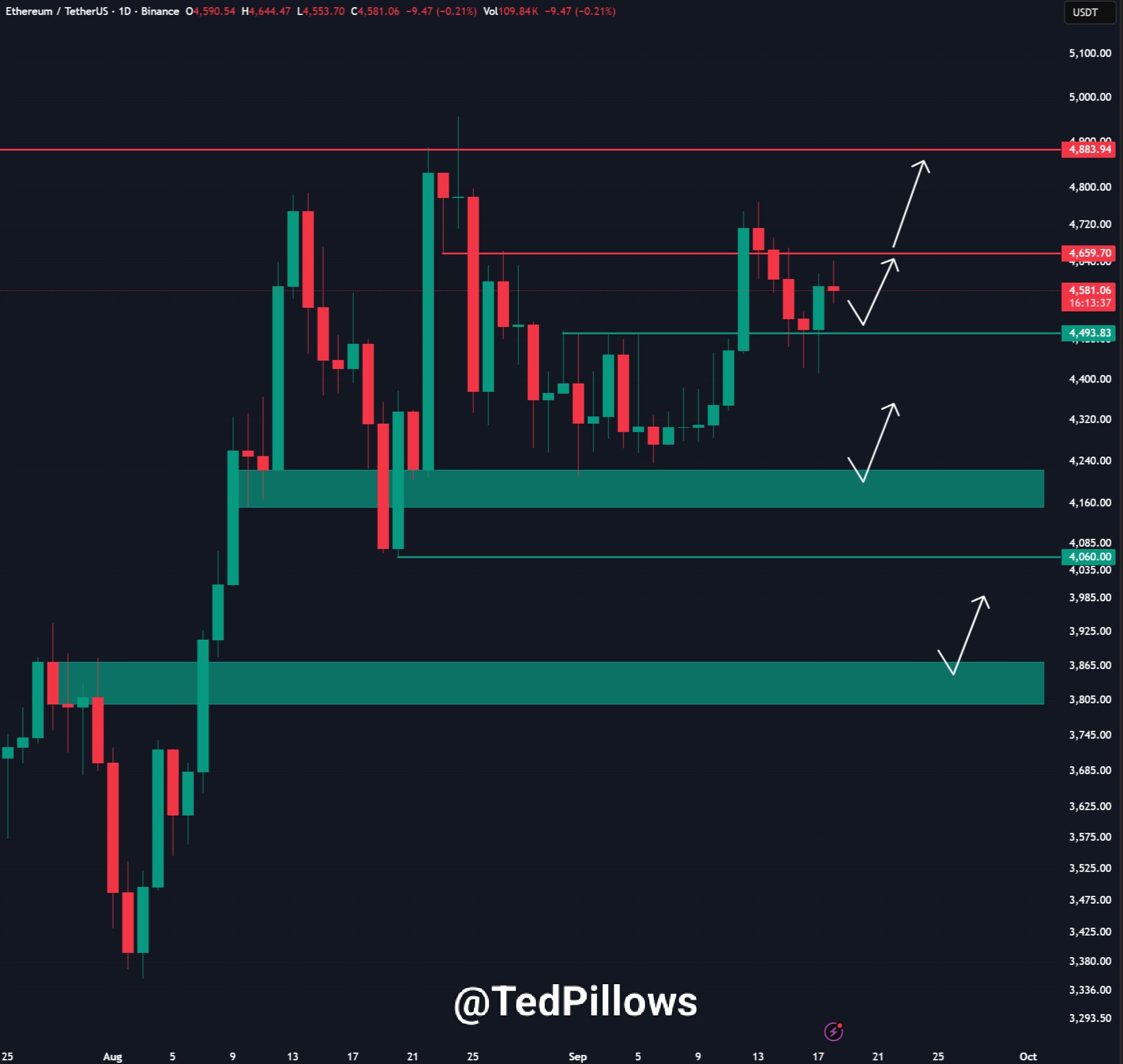

Analyst Ted Pillows pointed out that ETH price is still consolidating below its $4,700 resistance. Ethereum needs to rebound above the level to avert a correction towards $4,000.

Moreover, analyst Ali Martinez pointed out that the TD Sequential indicator has flashed a sell signal on Ethereum. He predicted ETH price to drop to $4,570 again. This indicates multiple headwinds, along with technical indicators, signal a potential drop in Ethereum.

ETH price soared 2% in the past 24 hours, with the price currently trading near $4,600. The 24-hour low and high are $4,429 and $4,643, respectively. Trading volume has increased by 28% in the last 24 hours.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs