Ethereum Faces Supply Shock Amid Whale Accumulation, Is Altcoin Season Next?

Highlights

- Ethereum supply on exchanges has fallen to the lowest level in seven years signalling a posssibkle supply shock.

- The falling supply comes as demand surges with whales scooping 1.2 million ETH tokens in two weeks.

- Historical patterns suggest that Bitcoin nears the end of its bull run, and this may trigger the next altcoin season.

Ethereum is facing a supply shock as the token balance on exchanges plunges to multi-year lows. This falling supply coincides with rapid whale and institutional accumulation, signalling high demand. Meanwhile, a key on-chain metric suggests that an altcoin season, aka alt season, could be underway.

Ethereum (ETH) price faces low volatility today, June 2, as it oscillates between a daily high of $2,544 and a daily low of $2,483. Ethereum was the only top ten altcoin, besides BNB, to record the least losses last week amid surging inflows to spot ETH ETFs.

Ethereum Faces Supply Shock As Demand Soars

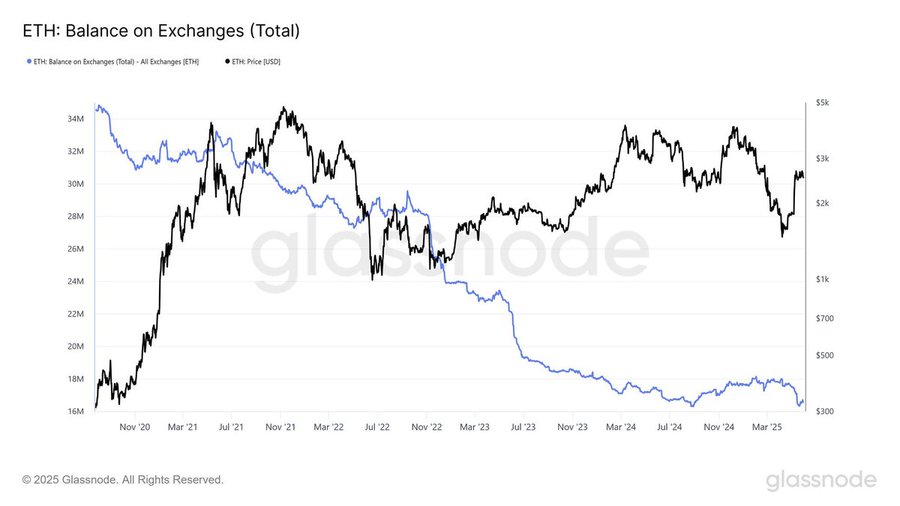

The supply of Ethereum available on exchanges has declined drastically, and this has created concerns about a possible supply shock. Data from Glassnode shows that the available ETH exchange balance has fallen to its lowest level in seven years.

Analyst CarlMoon opines that the falling supply is bullish for Ethereum price, and it could rally to a fresh all-time high before 2025 ends. He noted,

“Supply shock incoming for Ethereum. $ETH could easily hit $5,000 this year.”

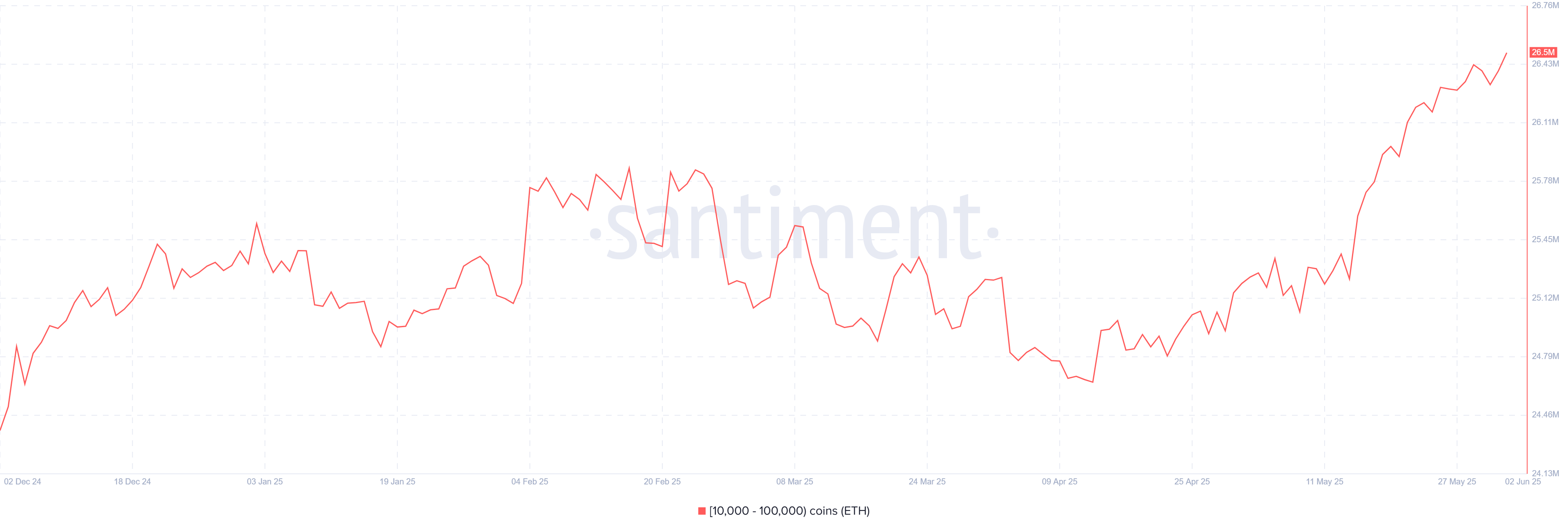

The declining supply coincides with rapid accumulation by Ethereum whales holding between 10,000 and 100,000 ETH tokens. On-chain analytics platform Santiment shows that these addresses have increased their holdings from 25.23 million to 26.5 million within a two-week period.

This accumulation history shows that these whales have purchased 1.27 million ETH tokens since May 14. These addresses now hold the largest amount of ETH since late January 2024.

During the two weeks that these whales bought 1.27 million ETH tokens, spot Ethereum ETFs surpassed $500 million in inflows per SoSoValue data. Hence, as demand from whales and institutions surges on the back of weakening demand, the result is a supply shock that could affect Ethereum’s price performance.

Meanwhile, Ethereum co-founder Vitalik Buterin is planning to scale ETH 10x in one year, a move that could further impact the supply if it boosts the network’s usage.

Altcoin Season Looms

The Bitcoin Realized Cap hints at an upcoming altcoin season even as most altcoins, including Ethereum, struggle against BTC’s growing dominance. Per CryptoQuant’s Realized Cap metric. Bitcoin’s Realized Cap is falling in a pattern that suggests the end of the current bull cycle.

As Bitcoin’s bull cycle nears the end, CryptoQuant analyst Crypto Dan noted that capital may start flowing back to altcoins, and once this happens, Ethereum could record an upward move.

Nevertheless, the altcoin season index from Blockchain Center has a value of 16, indicating that it is currently Bitcoin season and the demand for altcoins remains particularly low. This metric is currently sitting at range lows despite the Ethereum price showing strength during the recent downward trend.

In summary, Ethereum is facing a supply shock as the available amount of ETH tokens on exchanges plunges to the lowest level in seven years. Meanwhile, whales are rapidly accumulating ETH tokens, with addresses holding at least 10,000 ETH purchasing more than one million tokens.

For a detailed forecast on Ethereum price and how it will perform between 2025 and 2030 as supply falls against strong demand – Read This.

- Breaking: Bitcoin Bounces as U.S. House Passes Bill To End Government Shutdown

- Why Is The BTC Price Down Today?

- XRP’s DeFi Utility Expands as Flare Introduces Modular Lending for XRP

- Why Michael Saylor Still Says Buy Bitcoin and Hold?

- Crypto ETF News: BNB Gets Institutional Boost as Binance Coin Replaces Cardano In Grayscale’s GDLC Fund

- Ondo Price Prediction as MetaMask Integrates 200+ Tokenized U.S. Stocks

- XRP Price Risks Slide to $1 Amid Slumping XRPL Metrics and Burn Rate

- Gold and Silver Prices Turn Parabolic in One Day: Will Bitcoin Mirror the Move?

- Cardano Price Prediction as the Planned CME’s ADA Futures Launch Nears

- HYPE Price Outlook After Hyperliquid’s HIP-4 Rollout Sparks Prediction-Style Trading Boom

- Top 3 Meme coin Price Prediction: Dogecoin, Shiba Inu And MemeCore Ahead of Market Recovery