Ethereum Fees at ATH as Miner Revenue Surges to $800,000 Per Hour

Another day has brought another all-time high for average transaction fees on the Ethereum network, but it is only the miners that have anything good to say about it.

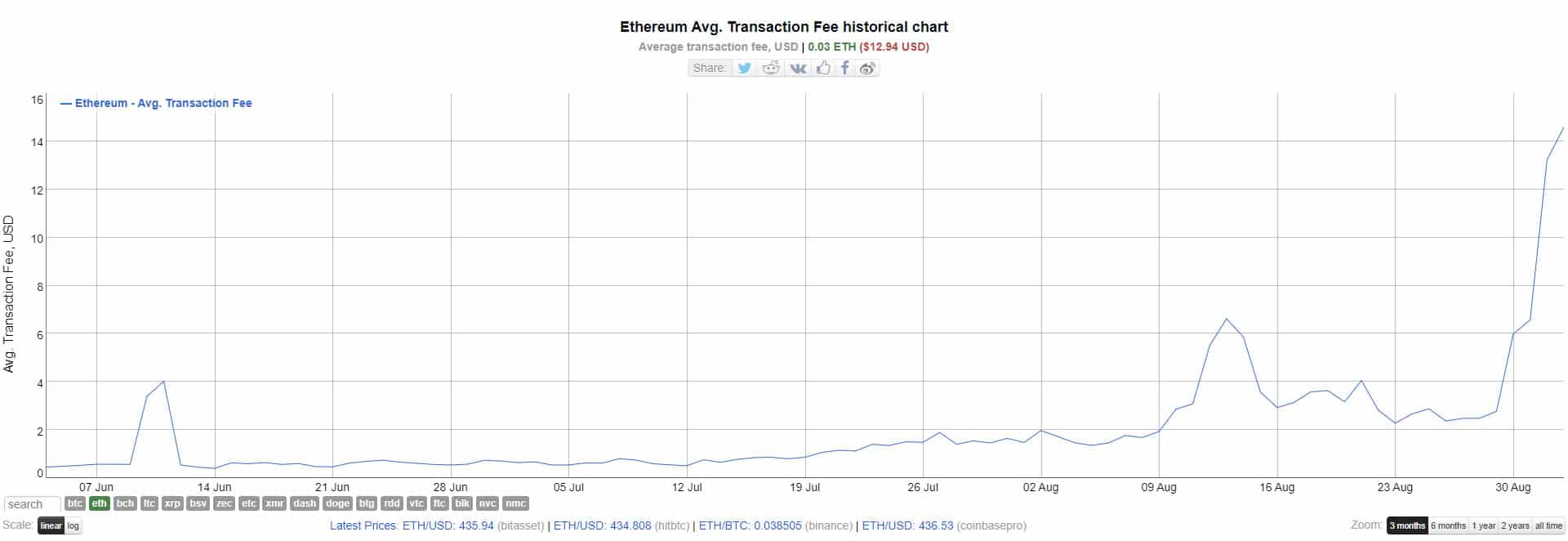

Driven by an explosion in cloned food-themed DeFi farming protocols, average Ethereum transaction fees have surged to their highest ever levels at almost $15, or 0.03 ETH. In less than a week, average gas prices have skyrocketed almost 500% according to bitinfocharts.com.

It can now cost as much as a hundred dollars to carry out a blockchain transaction on the Ethereum network depending on the amount transferred, the token type, and its destination.

The previous high in average fees was in mid-August when a Yam farming frenzy pushed them above $6.50. Before then it was during the crypto bubble in early January when Ethereum prices hit their peak at $1,400.

ETH fees are totally out of control pic.twitter.com/uTccZsFMQX

— Nico (@CryptoNTez) September 3, 2020

The spike in gas prices has been caused by waves of newly cloned DeFi platforms that promise unsustainable yields, the latest being Sushi, Kimchi, and Hotdog (which has already been liquidated).

Liquidity providers have flocked to Uniswap to acquire these food flavored tokens using ETH as liquidity. ETH Gas Station reports that Uniswap alone has generated $12.7 million in fees over the past 30 days.

ETH Miners Making it Big

Ethereum users, unless they are whales, are having a tough time at the moment but the same cannot be said for its miners. On-chain analytics platform Glassnode recently reported that 24 hours after hitting a record half a million dollars per hour in a new record has been set for miner revenue. That new record now stands at $800,000 per hour.

Average #Ethereum miner revenue from fees has surged to $800,000 per hour (!) in the past 24 hours.

Chart: https://t.co/BwMlpYKcb1 https://t.co/jnFCJ7Ti2w pic.twitter.com/uLxRgR7vVp

— glassnode (@glassnode) September 2, 2020

Ethereum is now being used to gain exposure to other assets in the DeFi sector and all of those transactions take its toll on the network.

Ethereum Price Outlook

In terms of price, Ethereum is currently mirroring Bitcoin’s movements as it pulls back from a 2020 high of $480 on Wednesday. Since that two year peak, ETH prices have retreated almost ten percent to today’s levels at around $435. Industry analysts have noted that traders are taking profits while predicting that the dip will not last.

“Exchange traders tanking prices while ETH users continue to leverage at levels not seen before.”

Another $ETH dip that won't last.

Exchange traders tanking prices while ETH users continue to leverage at levels not seen before. pic.twitter.com/7vhHn8KP6r

— 0xNick (@0xEther) September 2, 2020

All the while DeFi continues to gain momentum, Ethereum will be in demand which is bullish overall for prices despite the current gas fee woes.

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- XRP Ledger Validator Spotlights Upcoming Privacy Upgrade as Binance’s CZ Pushes for Crypto Privacy

- Harvard Management Co (HMC) Cuts BlackRock Bitcoin ETF Exposure by 21%, Rotates to Ethereum

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)