Ethereum Records Massive Growth As New ETH Addresses Skyrocket Since May

Highlights

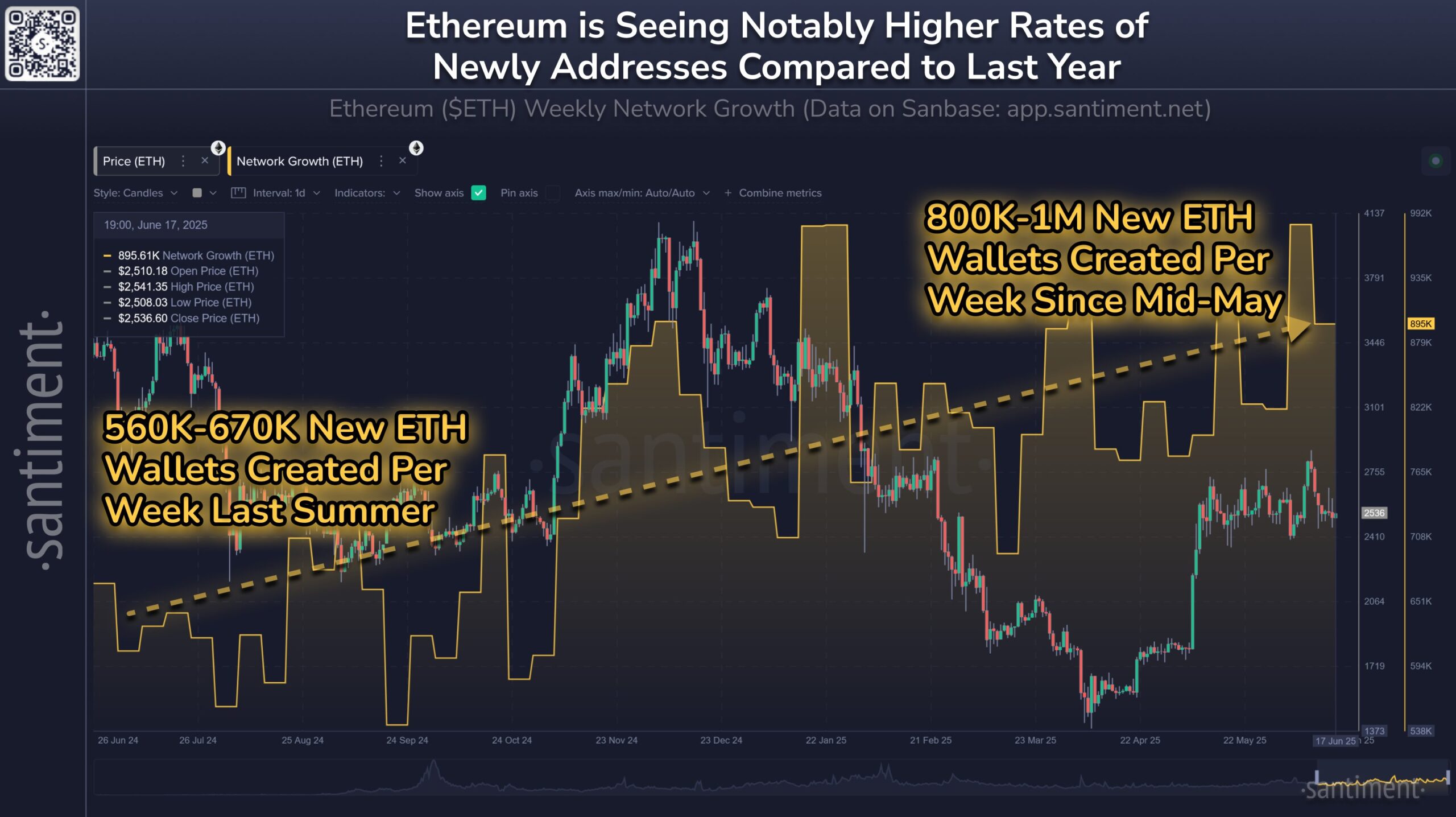

- Ethereum wallet creation jumps 33%, nearing 1 million new addresses weekly.

- Surge in ETH wallets shows rising user confidence and growing network activity.

- Ethereum's stable price hints at increased adoption, Layer 2, and DApp interest.

Ethereum’s network is showing a sharp rise in new wallet activity, based on fresh data from Santiment. The number of new Ethereum addresses created each week is now between 800,000 and 1 million. That’s a significant jump from last summer when the network added only 560,000 to 670,000 wallets per week.

Ethereum Wallet Creation Surges 33% Year-Over-Year

The pace of new wallet creation has picked up sharply since mid-May. At the same time, Ethereum is trading near $2,500. This price level has remained stable over the past week.

Santiment notes that this growth in wallets highlights Ethereum’s improving network utility. The network is gaining more users, even during times of sideways price action. New wallets often reflect more interest from both traders and developers.

This wallet growth is not just a small increase. Compared to the same time last year, the current weekly rate is up by around one-third. The recent trend suggests growing confidence in Ethereum’s long-term role in the crypto space. Activity like this often builds during quiet periods, ahead of larger market shifts.

Santiment’s chart also shows a gradual upward trend in wallet creation over several months. There were weekly drops along the way, but the broader trend remains clearly positive. The latest weekly data shows nearly 896,000 new ETH addresses, just below the 1 million mark.

Ethereum wallet growth. Source: X (@santimentfeed)

Wallet Growth Signals Rising Network Strength

More wallets can mean more participants entering the ecosystem. These may be individual investors, institutions, or developers testing apps. Whatever the case, it reflects a busy and growing network. Ethereum is still the largest smart contract platform by usage and that status remains strong in 2025.

One reason behind this rise may be upcoming developments in the Ethereum ecosystem. Layer 2 networks and staking protocols continue to draw new attention. Also, growing interest in decentralized applications may be prompting more users to interact with Ethereum directly.

The $2,500 level could act as a psychological support. Price stability during this wallet surge is notable. Investors tend to view increased network activity as a positive signal. It may not lead to instant price gains, but it adds to long-term strength.

Ethereum price is down 0.17% in the last hour and trades at $2,495.

- $3.5T Banking Giant Goldman Sachs Discloses $2.3B Bitcoin, Ethereum, XRP, and Solana Exposure

- Why is XRP Price Dropping Today?

- Breaking: FTX’s Sam Bankman-Fried (SBF) Seeks New Trial Amid Push For Trump’s Pardon

- Fed’s Hammack Says Rate Cuts May Stay on Hold Ahead of Jobs, CPI Data Release

- $800B Interactive Brokers Launches Bitcoin, Ethereum Futures via Coinbase Derivatives

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?