Ethereum Price Doldrums: How to Survive Second Stage Capitulation

Ethereum price is struggling to keep support at $1,830 intact, while the entire crypto market continues with its longstanding lull. Since the rejection from $2,000 around mid-July, recovery attempts have been minimal, with the least resistance path mainly downward.

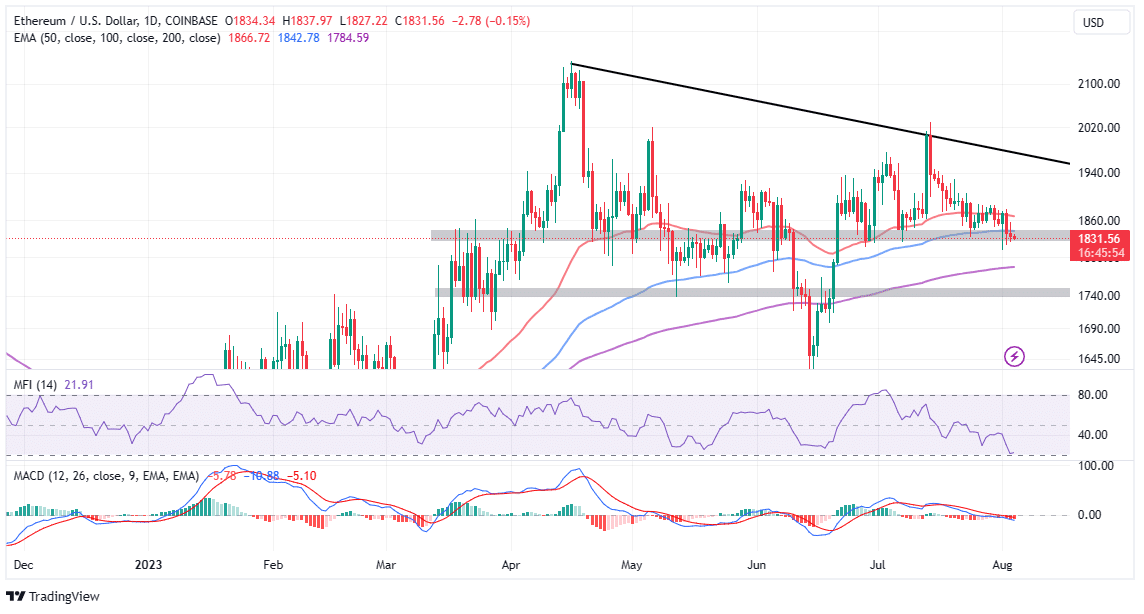

Based on the prevailing technical picture, bears have the upper hand, especially with Ethereum price below all the major moving averages such as the 50-day EMA (red), the 100-day EMA (blue), and the 200-day EMA (purple).

Support at $1,830 is critical for the resumption of the uptrend, but if declines intensify, the buyer congestion at $1,800 will come in handy.

Ethereum Price Final Capitulation

The crypto winter has lasted well over two years with attribute to many attacks on the blockchain ecosystem, including the Terra crash “through which governments are stepping in with a regulatory framework… to protect investors,” Michaël van de Poppe, a popular analyst told investors on Friday.

This push to regulate the market, although understandable, is exerting a lot of pressure to the extent of risking the survival of the crypto ecosystem.

In addition to the recently resolved matter between Ripple and the SEC, the regulator is suing Coinbase and Binance, and the DoJ has been investigating the latter exchange platform. In all this, proposals for Ethereum and Bitcoin exchange-traded funds (ETFs) have surged in the past couple of months, bringing institutions like Blackrock and Valkyrie into the industry.

Ethereum and most other altcoins, according to Poppe, “have been trending downwards for 18-24 months straight.

However, one notable fundamental factor is that the supply on exchange continues to shrink to the lowest levels while staking both on the Ethereum protocol and liquid staking platforms like Lido soar to the highest levels since the implementation of the Shanghai upgrade.

The mundane market structure represents “the second stage of capitulation, which is time.” Investors will continue to feel like markets are unresponsive, with some shunning crypto for other industry sectors.

As for investors, perhaps excluding traders, it is wise to keep calm and be patient with the market. Accumulation, according to Poppe the best strategy at the moment, with institutions like Blackrock jumping in.

What’s Next for Ethereum Price in The Short Term?

The bearish outlook in both the Moving Average Convergence Divergence (MACD) and the Money Flow Index (MFI) hints at declines continuing to $1,800 in the short term. In addition to the sell signal, the MACD holds below the mean line (0.00), further reinforcing the bearish grip.

If bulls manage the arrest the bearish situation at $1,830 traders can prepare to seek fresh exposure to ETH longs after the price steps above the 100-day EMA. The subsequent break above the 50-day EMA at $1,866 would serve as confirmation for a stronger uptrend to be validated by recovery past the descending trendline for gains above $2,000.

Related Articles

- Bitcoin Price Calm Before The Storm: Selling Now to Buy Later?

- Crypto News: Coinbase ($COIN) Posts Better-Than-Expected Q2 Results

- Strong Boost In Bitcoin Address Activity Hints At Short-Term BTC Price Jump

Recent Posts

- Crypto News

Tom Lee’s Fundstrat Warns Clients Bitcoin Could Fall to $60,000 Despite His ATH Public Forecast

Top asset manager Fundstrat has advised its private clients to expect a pullback in Bitcoin…

- Crypto News

125 Crypto Firms Mount Unified Defense as Banks Push to Block Stablecoin Rewards

Over 125 cryptocurrency companies have joined forces to defend stablecoin rewards programs against banking industry…

- Crypto News

BlackRock Bitcoin ETF Ranks Among Top ETFs In 2025 Despite Crypto Downturn

The BlackRock Bitcoin ETF (IBIT) has emerged as one of the top exchange-traded funds (ETF)…

- Crypto News

Stablecoin Adoption Deepens as Klarna Turns to Coinbase for Institutional Liquidity

Klarna has taken a major step into crypto finance by partnering with Coinbase to accept…

- Crypto News

Ripple, Circle Could Gain Fed Access as Board Seeks Feedback on ‘Skinny Master Account’

The Federal Reserve of the United States has given an opportunity to the public to…

- Crypto News

Fed’s Williams Says No Urgency to Cut Rates Further as Crypto Traders Bet Against January Cut

New York Federal Reserve President John Williams has signaled his support for holding rates steady…