Ethereum Price Make Or Break Moment Is Here With $2,055-Bound Breakout in the Offing

Ethereum price is wobbling slightly in the red on Tuesday as bulls and bears way their options out of a three-week-long consolidation. Despite the general sluggishness of the crypto market, ETH is up 0.9% to $1,877 with $41 billion in trading volume.

Bitcoin, on the other hand, is up 1.1% to $30,500. As reported, investors are looking forward to the release of the US CPI data – which analysts believe may shape the market for the next few weeks.

Ethereum Price Awaits Rectangle Pattern Breakout

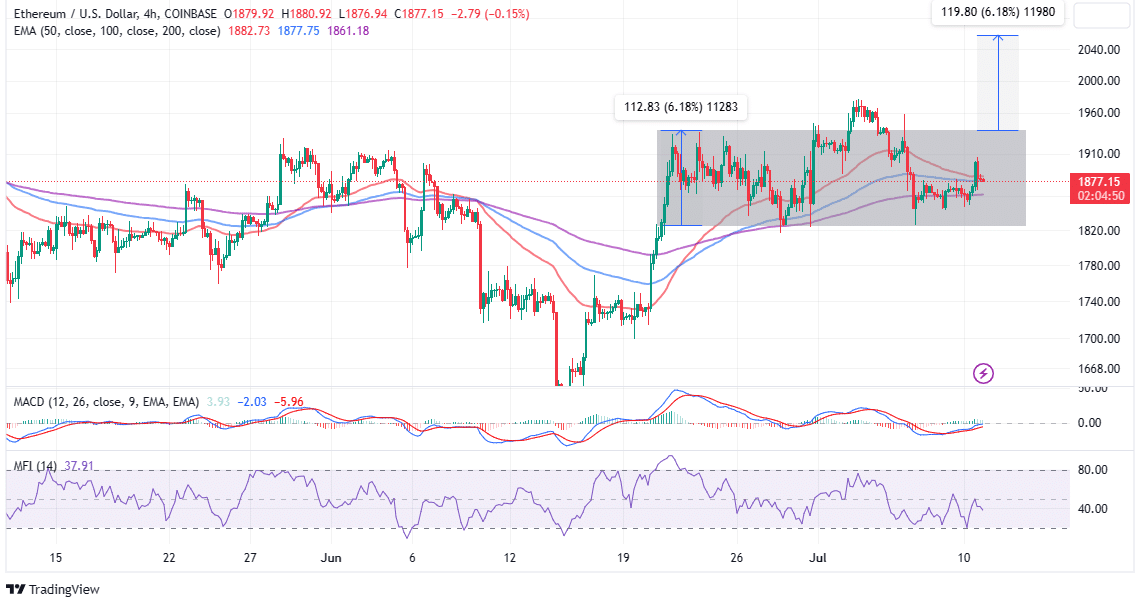

Ethereum has, since June 20, stayed within the confines of a rectangle pattern, which, if validated, may culminate in a breakout to $2,055.

The bullish rectangle pattern, as shown on the four-hour chart, reveals a pause in an uptrend before Ethereum price resumes its upward movement. This crucial pattern occurs when the price of an asset like ETH moves sideways between two parallel horizontal lines, forming a rectangle shape.

Traders look out for the pattern’s confirmation after the price breaks above the upper resistance line, signaling that the buyers have regained control and the uptrend is likely to continue.

The bullish rectangle pattern to helps to identify potential entry points for their long positions or exit points for their short positions.

It is advisable to incorporate indicators such as volume, moving averages, or oscillators to confirm the pattern and gauge the strength of the anticipated Ethereum price breakout.

Meanwhile, the breakout target equals the width of the rectangle extrapolated above resistance at $1,938 to $2,055.

The Moving Average Convergence Divergence (MACD) shows that bulls have the upper hand, and if investors take the call to buy Ether seriously, momentum will build up, thus increasing the chances of the rectangle breakout.

For now, bulls must battle to keep the support provided by the 100-day Exponential Moving Average (EMA) (line in blue) at $1,877 intact. This will allow them ample time to consolidate their efforts to deal with the immediate 50-day EMA (in red) resistance at $1,882.

The 100-day EMA and the 200-day EMA (in purple) support areas are critical for the resumption of the uptrend, especially with the Money Flow Index (MFI) pointing downwards from the midline (50).

If declines surpass the 200-day EMA at $1,861, all eyes will shift to the next buyer congestion at $1,800, but support at $1,830 will have a chance to absorb the selling pressure. A sustained breakout below the rectangle support could mean declines to $1,700.

Ethereum Staking Surges 18% Since The Shapella Upgrade

The Shapella upgrade allowed investors to withdraw staked Ether on the Beacon chain for the first time since the transition to a proof-of-stake (PoS) consensus mechanism.

While at first analysts feared that withdrawals would put a lot of strain on Ethereum price, as investors accessed their locked ETH, it has had the opposite effect, with staking jumping by 18% since the upgrade.

According to on-chain data from Glassnode, as the amount of staked Ether rises, the platform’s circulating supply is shrinking. The ability to stake and unstake Ether as investors wish has increased investor confidence, especially among those who prefer to grow their wallets while waiting for the bull market.

Currently, staked Ether accounts for almost 21% of Ethereum’s circulating supply. If this trend continues, the selling pressure is bound to decrease significantly, creating a suitable environment for a rally.

Related Articles

- Veteran Investor Raoul Pal Predicts A 20x Rally in Solana (SOL) Price

- NFT Scam: Moroccon Man Stealing Bored Ape NFTs on Fake OpenSea Marketplace

- Ripple Bags Rare Award for its Role in CBDC Innovation

Recent Posts

- Crypto News

Crypto Gains New Use Case as Iran Turns to Digital Assets for Weapon Sales

Iran has affirmed its readiness to take overseas weapons sales using digital money. The introduction…

- Crypto News

Bitcoin Could Rally to $170,000 in 2026 If This Happens: CryptoQuant

A CryptoQuant analysis has explained what needs to happen for Bitcoin to rally to as…

- Crypto News

Lighter Team Under Fire After Alleged $7.18M LIT Token Dump Post-Airdrop

New data indicates that wallets associated with Lighter might have traded millions of dollars in…

- Crypto News

Binance Market Maker Hack: Trader Rakes in $1M via Failed BROCCOLI Price Manipulation

A covert New Year crypto hack on Binance has made headlines, with a trader raking…

- Crypto News

Breaking: UK Begins New Initiative to Crack Down on Crypto Tax Evasion

The UK has now implemented measures to control the undeclared income from crypto assets. The…

- Crypto News

Mark Cuban and Dallas Mavericks Clear Hurdle as Judge Dismisses Crypto Lawsuit

Adding to the growing list of high-profile crypto lawsuits settled in the US in 2025,…