Ethereum Price Risks Falling 17% Amid Strong Investor Pessimism, Implied Volatility ATL

Binance CEO Changpeng “CZ” Zhao on Thursday shared his bullishness on Ethereum price as ETH locked on the Beacon Chain reached an all-time high. Typically, token unlocks cause crypto prices to fall, while locking or staking increases crypto prices.

However, ETH price is currently trading below $1,850 while implied volatility also dropped to a new all-time low. Ethereum risks falling to $1500 if it breaks the crucial support level.

Binance CEO “CZ” Shares Bullish Outlook on Ethereum

Binance CEO took to Twitter to share that locked ETH hit an ATH, mentioning “locked” ETH instead of “staked” ETH to give more focus on the price. It means he is bullish on Ethereum price as locked ETH and ETH staking continue to rise.

Typically, an increase in the amount of ETH locked up may lead to a decrease in the overall supply of Ethereum tokens available in the market. The decrease in ETH will cause prices to rally higher.

ETH locked means all ETH that is out of circulation, it includes ETH staked on the Beacon chain, ETH deposited to the Beacon contract but not validating yet, and rewards on the Beacon chain.

Locked ETH at ATH. You know what follows? https://t.co/3xS8OoCfT9

— CZ 🔶 Binance (@cz_binance) May 11, 2023

According to Etherscan data, 21.10 million ETH worth over $38 billion have been deposited into Ethereum’s Beacon Deposit Contract. The Ethereum Staking deposits outpaced withdrawals amid the memecoin frenzy, especially PEPE, that caused gas fees on Ethereum to rise to a 12-month high.

Data from Nansen indicates the number of unique staking depositors stands at roughly 112,000, which has increased significantly after the Shanghai upgrade. Moreover, data sourced from BeaconScan shows that the number of active validators have increased to 566k, with nearly 40k pending validators.

Also Read: Terra Classic Project DFLunc Burns Billions Of LUNC, More Than Binance

Will ETH Price Rally?

Binance announced a reduction in the processing time for ETH staking withdrawal requests to just five days from 15 days, starting from May 18, which is almost 3x times faster than earlier. This will put selling pressure on the ETH price.

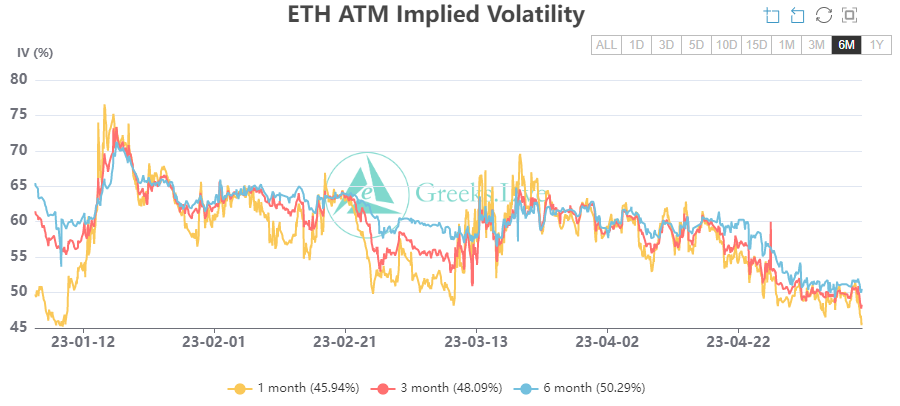

Meanwhile, the implied volatility (IV) for ETH has hit lower today, especially ETH short-term IV falling all-time low across all terms. Generally, IV dips in a bullish market as volatility falls, but the overall volatility market remains lower as macro data failed to move ETH price significantly.

ETH price is currently trading at $1,816, down 3% in the last 24 hours. The market continues to witness liquidation amid uncertainty. CoinGape Media reported that ETH price breakdown below crucial support could cause a 17% fall to $1,500.

Also Read: Binance Opens Conflux Network (CFX) Mainnet Deposits and Withdrawals

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act