Ethereum Price Under Pressure As $400 Million Of Open Interest Wiped Out

Ethereum price surpassed $1900 for the first time after August, rising more than 16% in a month. This comes as Bitcoin takes a breather near $35K and altcoins take the lead. While the market sentiment remains positive, ETH price is under pressure as millions of open interest (OI) have been wiped out after a significant increase last week.

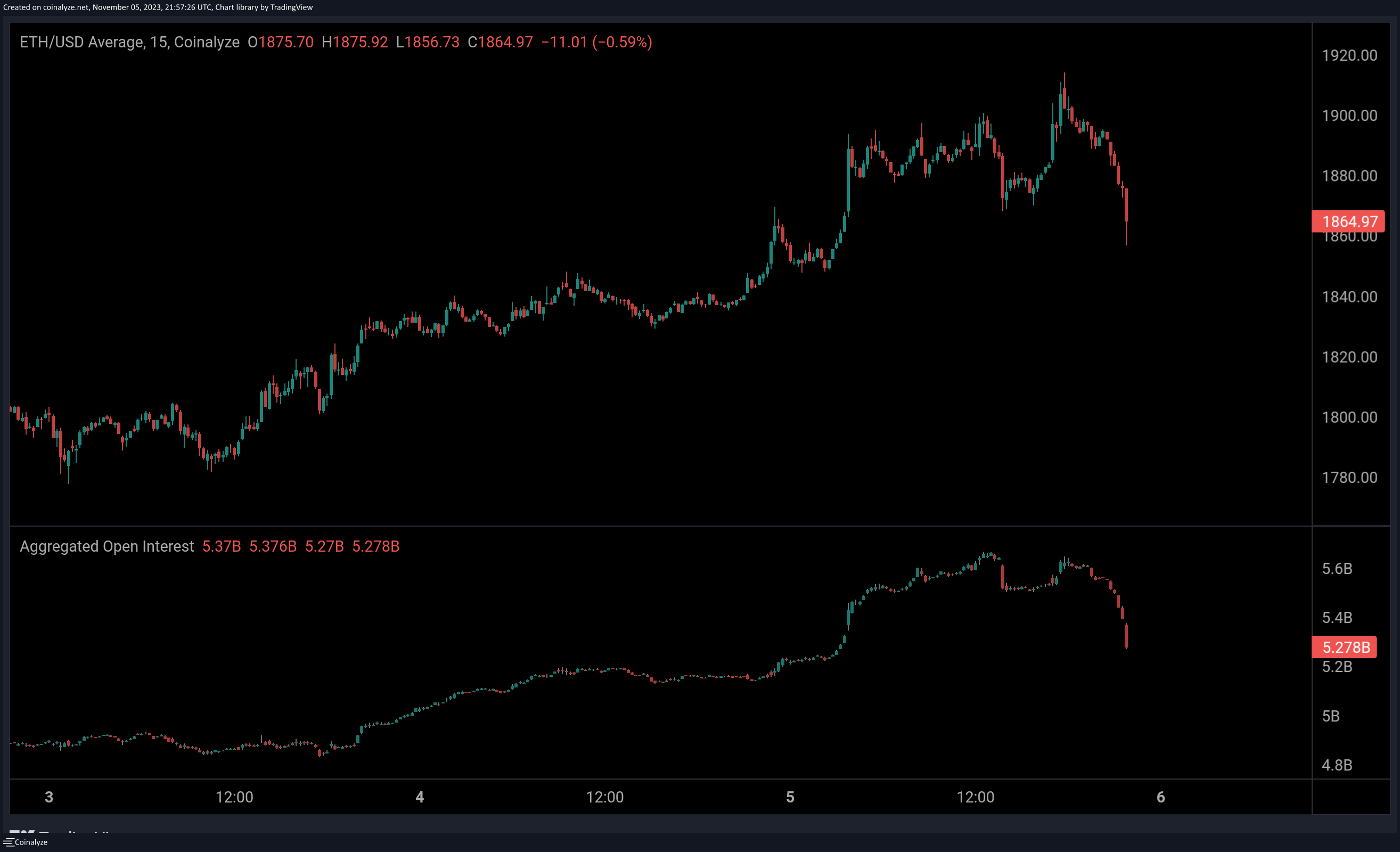

Ethereum $400 Million Of Open Interest Wiped Out

“Ethereum catches my eye on this Sunday. The Open Interest (OI) has increased by +$600m over the last days. This will be volatile very soon,” said on-chain crypto analyst Maartunn. Traders anticipate ETH to hit $2000 as Bitcoin price holds $35K strongly.

Maartunn on November 6 noted that $400 million of OI wiped out in a day, giving up mostly all gains in OI in the last few days. As a result, the ETH price is under pressure, probably for a pullback or a correction. With the market sentiment positive, a correction is unlikely. However, a retracement is most likely.

In addition, there are many ETH moves to crypto exchanges by whales amid altcoins’ recovery. A selloff by whales is typically considered a bullish move, but keep an eye on trading volume for an invalidation of a correction.

CoinGape Markets reported that a bearish breakdown channel pattern would set the price for a 16% drop. Ethereum has experienced heightened volatility near the $1830 level, proving to be a formidable resistance.

Popular crypto analyst Credible Crypto said the chart is clean at the moment and the $1400-$1500 zone was his HTF buy zone and the bottom. He believes ETH price will not go below $1500 again. In addition, he predicts ETH will hit $1700 first before moving to $2000.

ETH price fell 1% in the last 24 hours, with the price currently trading at $1,877. The 24-hour low and high are $1,863 and $1,911, respectively. Furthermore, trading volume has increased by 42% in the past 24 hours.

Also Read: Bitcoin Price Chart Indicates Major Incoming Move, Will ETH, XRP, ADA, SOL Follow?

- TRX Price Rebounds as Tron’s Treasury Push Gains Backing from Justin Sun

- 3 Reasons Why Bitcoin and Gold Prices Are Going Up

- Why is Crypto Market Up Today (Feb 9)

- Will Bitcoin Crash Again as ‘Trump Insider’ Whale Dumps 6,599 BTC

- XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch