Ethereum Leads With $219B Capital Inflow, Surpassing Solana and Tron

Highlights

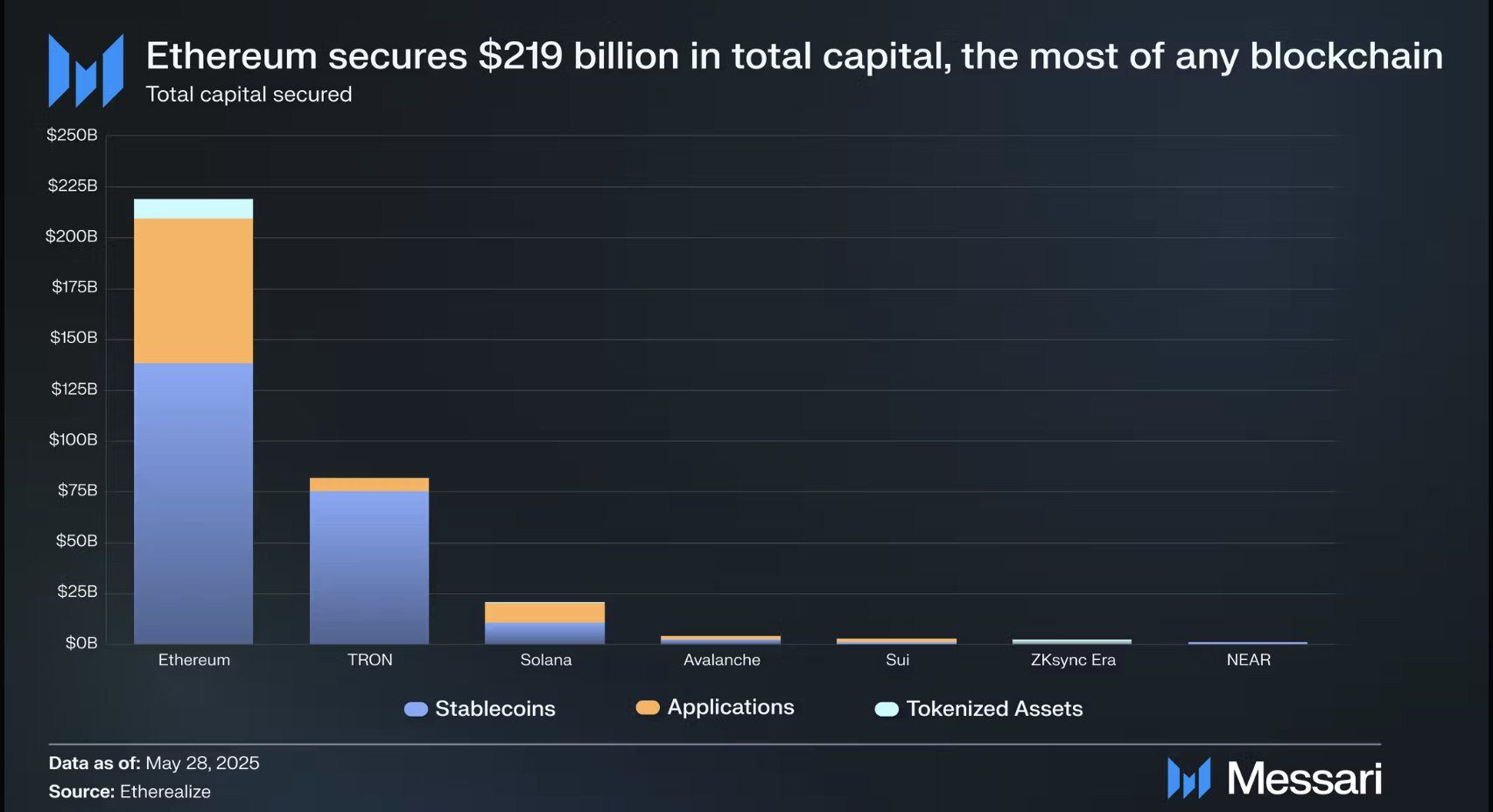

- Ethereum has secured $219 billion in total capital surpassing Tron and Solana.

- Stablecoins, tokenized assets, and DApps are contributing a significant chunk to Ethereum's value.

- Several large entities are scooping up ETH, stoking speculation for a price rally.

Ethereum has amassed $219 billion in total capital, bolstered by stablecoins, decentralized applications, and tokenized assets. Despite a surge in on-chain transactions, Tron, Solana, and Avalanche continue to trail Ethereum in terms of total capital secured.

Ethereum Rakes In $219B in Assets, Dwarfing Other Blockchains

According to a post on X by analytics platform Messari, Ethereum currently holds $219 billion in value. Messari’s data reveals that Ethereum’s figures outperform those of Solana, Avalanche, and Tron.

The data accounts for total on-chain value hosted on the blockchain, including stablecoins, tokenized assets, and other applications. A closer look at Messari’s chart indicates that stablecoins represent the most significant portion of Ethereum’s $219 billion in secured capital.

Specifically, stablecoins account for over $135 billion of Ethereum’s total capital, compared to just around $75 billion for Tron.

Notably, Tether (USDT), Circle’s USDC, and WLFI’s USD1 are issuing substantial amounts of their stablecoins on the Ethereum blockchain.

While Tron ranks a distant second in total capital secured, its growth is primarily driven by the USDT stablecoin.

Other chains, such as Solana, reported much lower stablecoin volumes, totaling just around $12 billion.

Meanwhile, the Ethereum network maintains a clear lead over its peers in the application segment, driven by non-fungible tokens (NFTs), decentralized finance (DeFi), and staking. Data from DeFiLlama places Ethereum’s total value locked (TVL) at $61.10 billion, underscoring its dominance across all categories.

Additionally, data from Artemis Analytics shows that Ethereum leads all other blockchains in net flows across DeFi bridges.

However, Solana is gaining ground in the application segment, having secured approximately $25 billion in capital, outperforming Avalanche, SUI, and NEAR.

Despite Ethereum’s dominance, calls to scale the network have reached a deafening pitch in recent months. Recently, Vitalik Buterin unveiled a plan to scale Ethereum L1 by 10X in a little over a year to improve network capabilities.

Institutional Buyers Flock To ETH

Investors are bracing for an Ethereum supply shock as new data shows that ETH balances on exchanges are at their lowest levels in seven years. According to the data, ETH holders are withdrawing their balances from exchanges, signaling long-term bullish sentiment.

🚨ETH SUPPLY SHOCK Incoming!🚨

Exchange balances of Ethereum are collapsing—now at their lowest levels in 7 years. pic.twitter.com/5hx61lEiJ1

— Coin Bureau (@coinbureau) June 2, 2025

At the moment, ETH is trading at $2,545, rising by nearly 1% over the last day. Several institutions are scooping up ETH en masse in recent days, with BTCS acquiring 1,000 ETH to increase its holding.

Additionally, Sharplink Gaming is moving forward with plans to establish an Ethereum Reserve Treasury, raising $425 million through a private placement deal.

The combination of institutional ETH accumulation and the upcoming network upgrade fuels optimism for a rally to $3,000. Analysts suggest that a decline in Solana could trigger capital rotation into Ethereum, driving ETH back toward previous highs.

- CLARITY Act Odds Spike to 90% as Coinbase CEO Confirms “Great Progress” On Crypto Bill

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand