Ethereum Sees $634M Inflow Sparking Optimism, What’s Next For ETH?

Highlights

- Ethereum achieves a record $2.2 billion in year-to-date inflows.

- ETH-focused ETFs drive investor interest despite comprising just 5% of total ETF assets.

- Bitcoin faces $457M outflows, while XRP sees $95M inflows amid US ETF speculation.

Ethereum witnessed $634 million inflows last week, pushing its year-to-date inflows to a record-breaking $2.2 billion. The surge signals rising institutional confidence in ETH, reflecting a dramatic turnaround in sentiment.

Experts point to favorable demand-supply dynamics, bolstered by these inflows and Ethereum’s adoption across blockchains, as key factors driving the renewed optimism around ETH.

Ethereum Inflows Indicate Growing Institutional Confidence

Ethereum has witnessed a significant surge in institutional interest, as evidenced by the recent $634 million inflows into Ethereum investment products. According to CoinShares blog, ETH year-to-date inflows have now reached an impressive $2.2 billion. This dramatic turnaround signals renewed optimism in its long-term growth prospects, fueled by growing adoption and strong demand from institutional investors.

The rising institutional interest is closely tied to the performance of ETH ETFs. In recent weeks, Ethereum-based exchange-traded funds have gained traction, with strong inflows contributing to the demand-supply dynamics that continue to favor ETH. These ETFs have become a key instrument in driving ETH’s institutional adoption, with investors increasingly turning to Ethereum as a part of their digital asset strategy.

This uptick in ETF inflows is part of a broader trend in the digital asset market. Digital asset investment products saw a total of $270 million in inflows last week, while Ethereum’s continued growth indicates that its adoption is outpacing other assets. As institutional investors flock to ETH, the asset continues to solidify its position as a leading digital asset, driven by its role in blockchain technology and Layer 2 scaling solutions.

Global ETF Inflows and Their Broader Impacts

The cryptocurrency market saw $270 million in digital asset inflows last week. Ethereum dominated with $634 million, while Bitcoin recorded outflows of $457 million, marking its first significant outflow since September. Analysts attribute Bitcoin’s decline to profit-taking following its recent rally past the psychological $100,000 level.

Ethereum shines, seeing US$634m inflows last week, in stark contrast to bitcoin which saw US$457m outflows due to profit taking.https://t.co/TlJtOZYhVt

— James Butterfill (@jbutterfill) December 2, 2024

XRP also saw notable inflows of $95 million, driven by excitement around a potential U.S. ETF. Recently, WisdomTree has filed an S-1 form for the XRP ETF fund with the US SEC.

On the other hand, the total crypto ETF inflows reached a record $37.3 billion this year worldwide, underscoring growing investor interest. However, crypto ETFs remain a small fraction, only around 5%, of total ETF assets, as noted by Eric Balchunas.

A Closer Look Into ETH Market

At the time of writing, Ethereum (ETH) price trades at $3,615, down 3% in the past 24 hours. Its 24-hour low and high stand at $3,570 and $3,761, respectively. Its market cap is $435 billion, with a 24-hour trading volume of $40 million.

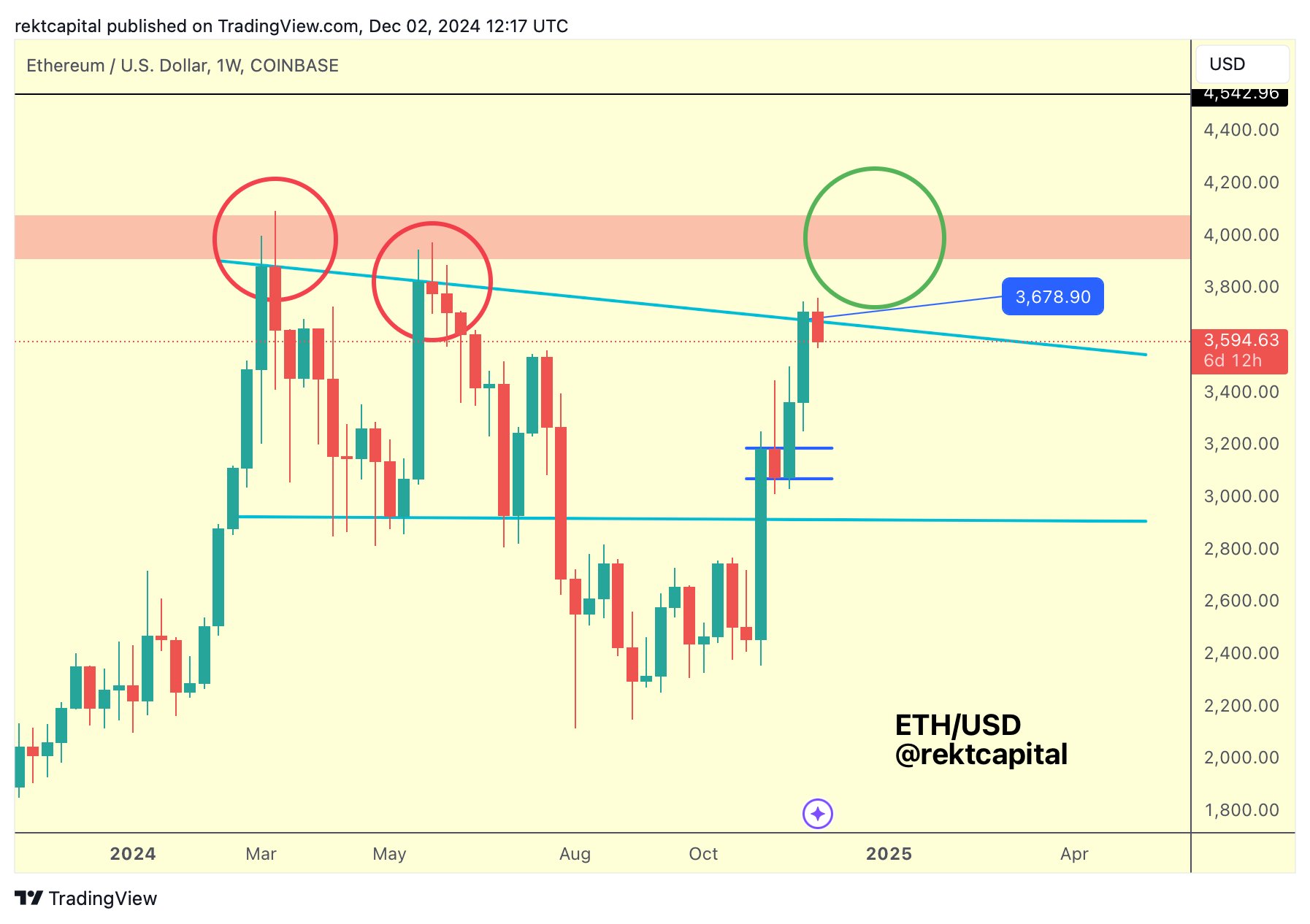

Although Ethereum has underperformed Bitcoin year-to-date, with a 59% gain compared to Bitcoin’s 124%, its fundamentals remain strong. Analysts, including Rekt Capital, believe that if the price can reclaim key levels like $3,650, it could signal a breakout.

Additionally, the Ethereum whale activity is also increasing, as highlighted by the prominent crypto market expert Ali Martinez. Recently, Martinez said that with over 280,000 ETH, worth $1 billion, being purchased within just 96 hours.

Ethereum’s growing ETF inflows, combined with its solid fundamentals, indicate a promising future. With demand-supply dynamics favoring ETH and blockchain activity surging, the asset seems well-positioned to attract further institutional interest.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs