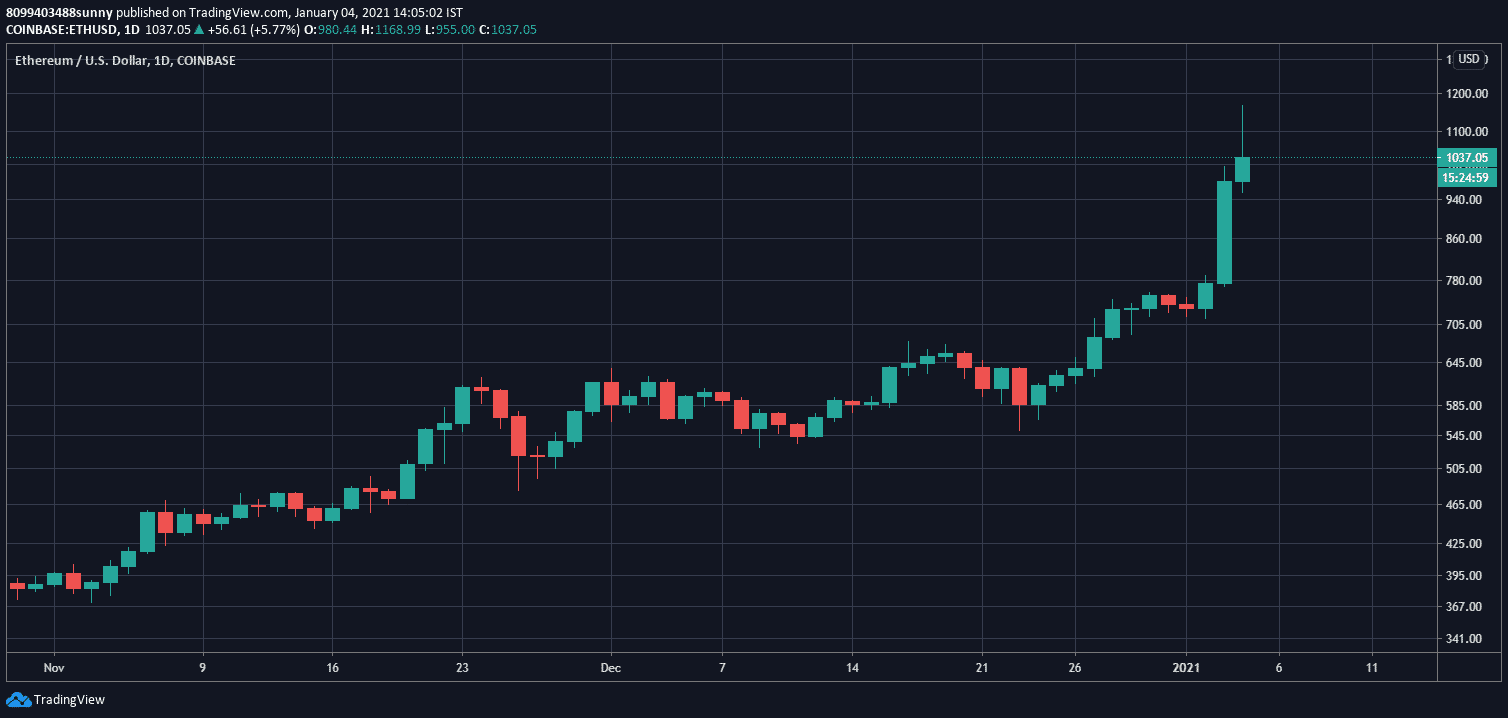

Ethereum Surges Over 30% to Breach $1000, But High Gas Fee Makes Uniswap Unusable

Ethereum, the second-largest cryptocurrency by market cap rose by more than $400 on December 4th to record a new yearly high of above $1000 as its market cap breached the $100 billion mark in nearly three years as well. Bitcoin’s astonishing bull rally might have taken away all the limelight, however, ETH quitely managed to surpass bitcoin on year-to-date returns in 2020.

Ethereum has managed to climb by 10X since its March crash in 2020 with spot volumes on exchanges such as Binance crossing $3 billion in a single session shows the surging demand for the second-largest cryptocurrency. The upcoming launch of Ether Futures by CME is also a key reason behind people hodling ETH, as many belive once institutional influx starts through the futures market, the price of the token would skyrocket new all-time-highs.

As Ethereum started to surge, so did many other platforms and tokens built on top of its especially defi.

When #Ethereum pumps it takes all the markets built on top of it along for the ride. pic.twitter.com/P7PP0iVUn9

— Mati Greenspan (tweets ≠ financial advice) (@MatiGreenspan) January 4, 2021

Gas Fee Spike Makes Uniswap Nearly Unusable

As the price of ETH surged late Sunday, the gas fee for processing transactions spiked too, costing an average of $155 to process a transaction. This also led to a great blockage on Uniswap, a popular DEX platform used for swapping tokens primarily in the defi ecosystem

Trying to use Uniswap right now pic.twitter.com/7QP1wTbxl1

— Joseph Young (@iamjosephyoung) January 4, 2021

Insane Gas Fee on the Ethereum network has led to several congestions on the network in the past year, a key aspect that has troubled co-founder Vitalik Buterin as well. The c0-founder has promised that the new PoS based ETH2.0 would resolve all these issues as it would make use of sharding to allow for parallel processing thus scaling the network on par with centralized processing giants such as VISA.

The first phase of ETH 2.0 was launched on December 1st marking the start of a multi-year roll-out and expected to take approximately 2 years. However, as ETH nears a new all-time-high, the growing gas fee can come back to haunt the network and make it extremely difficult to use.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs