Ethereum Token Burn: Is there a Timeline to See its Impact on Price?

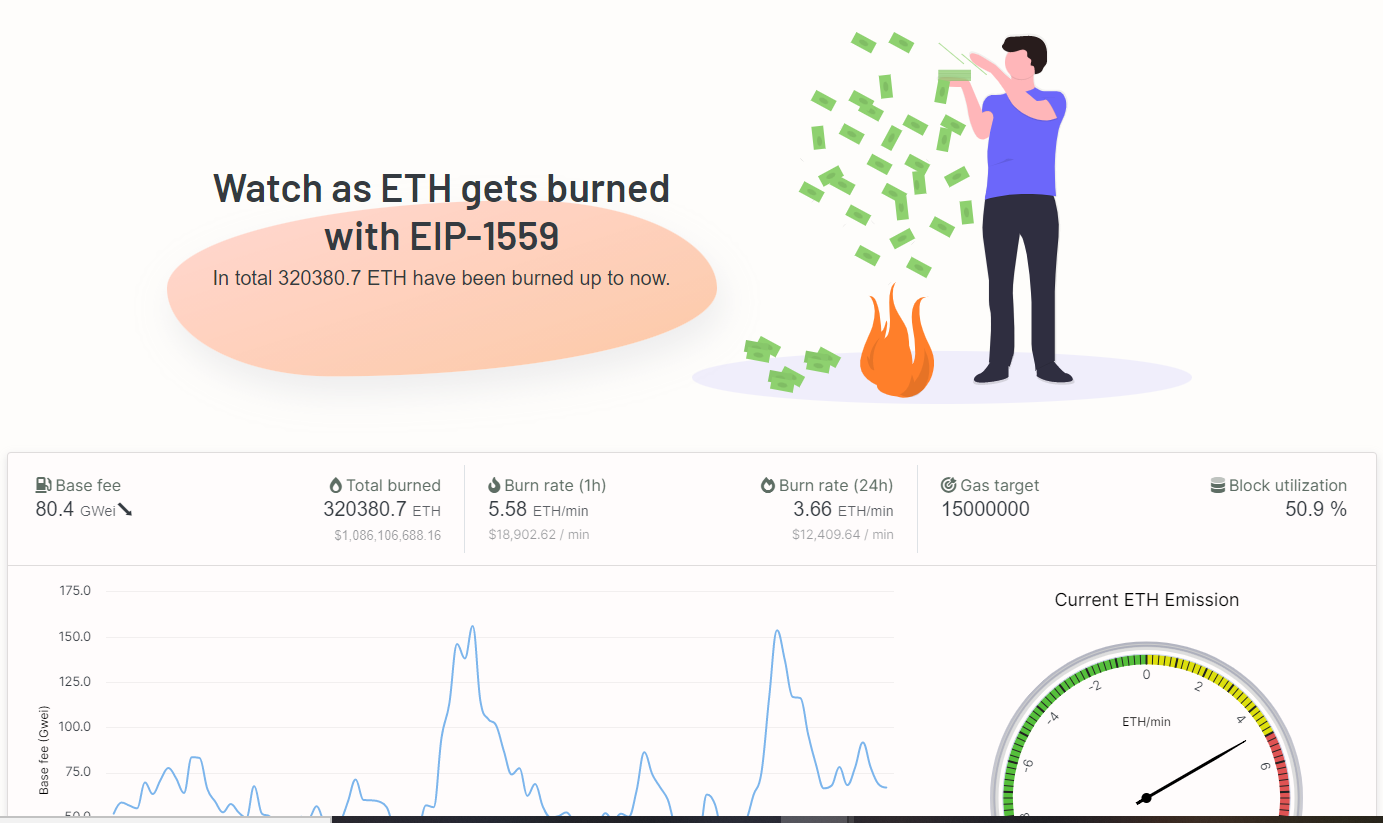

Since the London Hardfork upgrade, also known as the EIP 1559 went live on the Ethereum blockchain, the total number of tokens that has been burnt on has recently surpassed the $1 billion benchmark. Since the hardfork turned the Ether coin into a deflationary digital currency on August 5, a total of 320380.7 coins have been burnt, a number that is valued at $1,103,734,590.75 going by the current price of approximately $3,450.

To gain more context, a token burn event is a way to permanently take off some portion of the circulating supply of a cryptocurrency. The program is often initiated for a number of reasons including to boost the tokenomics of a particular blockchain project, or to reduce the total supply, a move that has the potential to impact the price of the asset positively.

While the token burn rate has continued to stir scarcity in the Ethereum blockchain in a subtle way, many are skeptical about its potential impacts on the price of the underlying asset. Ethereum is one of the major digital currencies with a steady growth rate when compared with Bitcoin (BTC), and the surge from $2,791.17 to the current price of $3,450 may be attributed to other factors beyond the token burning program.

These other factors may come from the increasing buyup of the cryptocurrency as the decentralized finance (DeFi), and Non-Fungible Token (NFT) has continued to see positive momentum in the past weeks.

Ethereum 2.0 to Complement Token Burn Event

Amongst the most iconic plans in the roadmap of the Ethereum foundation is the eventual migration to Ethereum 2.0. Ethereum 2.0 is the Proof-of-Stake (PoS) model designed to replace the current energy-intensive Proof-of-Work (PoW) protocol that has come under intense criticism in the past few days.

Besides the boost to the overall outlook of the Ethereum network, the advent of Ethereum 2.0 will serve as the final complement to all of the positive upgrades the blockchain has experienced thus far, including the EIP 1559 upgrade.

Depending on the nature of the impact that proponents wish to see, the ongoing burn event is notably part of the wide array of fundamentals that is stirring the steady growth we are seeing in the performance of the Ethereum coin.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- TRUMP Coin Jumps as Team Announces Conference With President Trump as Keynote Speaker

- Breaking: Trump Calls For Emergency Fed Rate Cut Before Next Week’s FOMC Meeting

- Breaking: U.S. Senate Passes Bipartisan Housing Bill That Includes CBDC Ban

- Crypto Market Rebounds as Trump Mulls Suspending Jones Act to Ease Oil Price Pressures

- Goldman Sachs Revises Fed Rate Cut Forecast to September as Iran War Threatens Inflation

- What Happens to XRP Price If US Wins War Against Iran?

- COIN Stock Prediction as Crypto Crash Odds Jump as Expert Sees Inflation Hitting 3.4%

- Cardano Price Turns Bullish as ADA Futures OI Hits $416M Ahead Of Key Upgrades

- Dogecoin Price Outlook If Elon Musk’s X Money Integrates Crypto- Is $0.2 Possible This Week?

- Will XRP Price Rally After Ripple’s Strategic Acquisition in Australia?

- Bitcoin Price At Risk of Losing $65k as Iran Warns of “Continuous Strikes” That May Push Oil to $200