Ethereum Volume Decreasing on Exchanges, ETHBTC Pair Surpasses Key Resistance

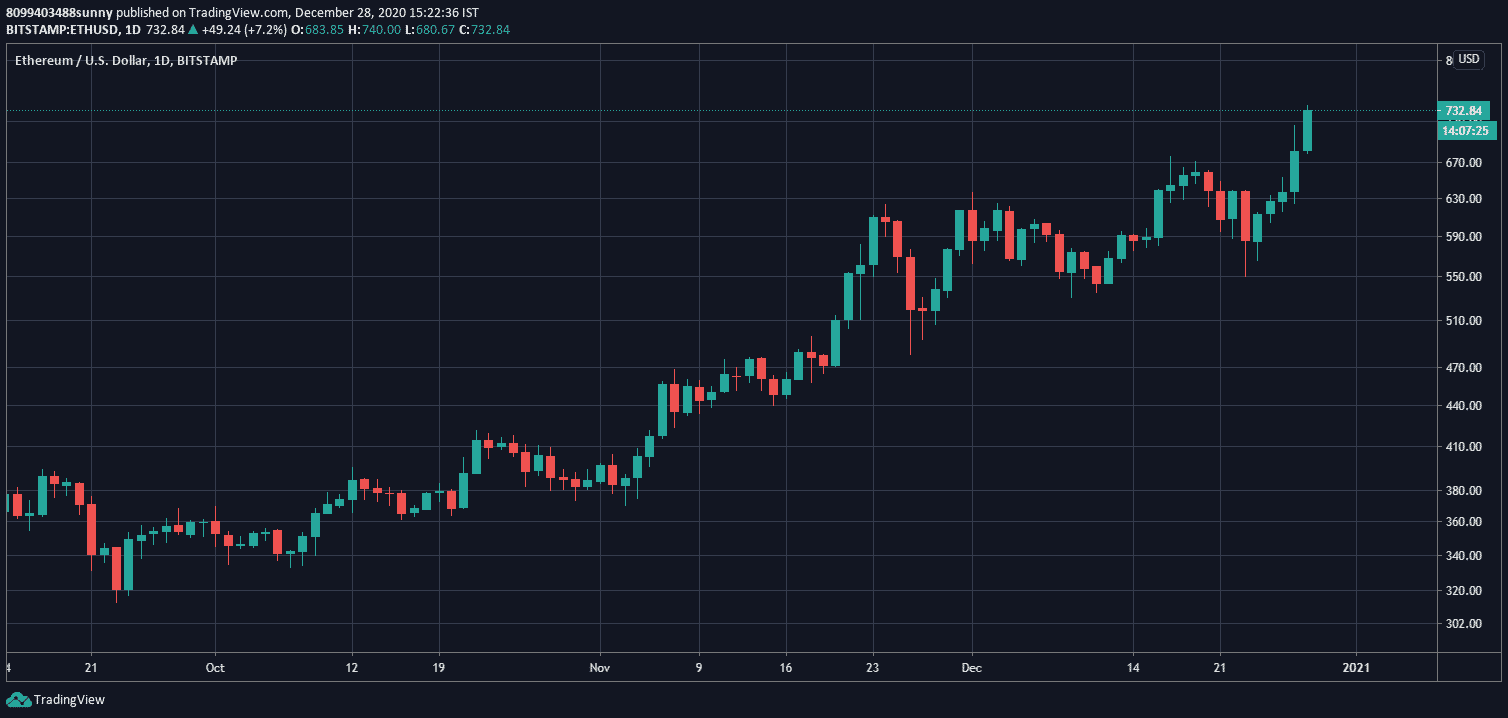

While all the media glare is in BTC, Ethereum price steadily made some major gains too, today breaking past the key resistance of $700 for the first time since 2018.

The second largest cryptocurrency by market has a better year-to-date return figures over Bitcoin despite top cryptocurrency achieving new all-time-highs every other day in the past week. One prominent reason behind the rise is the launch of the first phase of Ethereum 2.0 roll out, the new Proof-os-stake based network which promises to elevate Ethereum’s scalability on par with centralized payment ginats such as VISA.

Is ETH 2.0 Staking Fueling the Ethereum Price Rise?

The new ETH 2.0 network would have staking as the core functionary aspect of the network, where apart from validators traders could also possibly stake their tokens to keep the network secured while earning returns on their staked Ether. While many pundits believed that the 32 ETH staking requirement to become a validator on the network was too high, but looking at the massive flow of Ether to the ETH 2.0 staking contracts proves that miners are highly bullish towards the upcoming ETH 2.0 network.

Millions of dollars worth of ETH is being staked in the ETH 2.0 staking contracts every day creating a shortage of Ether in the market. If we also include the Defi market, a shortage of Ethereum supply could actually play in Ethereum’s favor creating high demand in the market. CME is already launching Ether Futures within 50 days which could also bring in higher institutional interest towards second largest cryptocurrency.

$ETH is flowing out from centralized exchanges.

It might go to DEX, staking contract, custody, etc. Whatever it is, it's good for $ETH as decreasing market supply.

Whales might use DEX for dumping, but at the same time, DEX drives Defi growth.

Chart???? https://t.co/S6nKVygbQe https://t.co/4WhKMh50M1 pic.twitter.com/WU2mAU9q2B

— Ki Young Ju 주기영 (@ki_young_ju) December 28, 2020

ETH/BTC Pair Breaks Key Resistance, Ethereum Price Gains 12% in 24 hrs

Etherum’s ongoing bullish rally has not just breached the key resistance of $700 to record a new yearly high of $736 on several exchanges, it also broke a key resistance point of 0.0263 against Bitcoin seeing its price rise against most valued digital asset.

Pushing through resistance.

This is good. pic.twitter.com/oH9kemgBWb

— The Wolf Of All Streets (@scottmelker) December 28, 2020

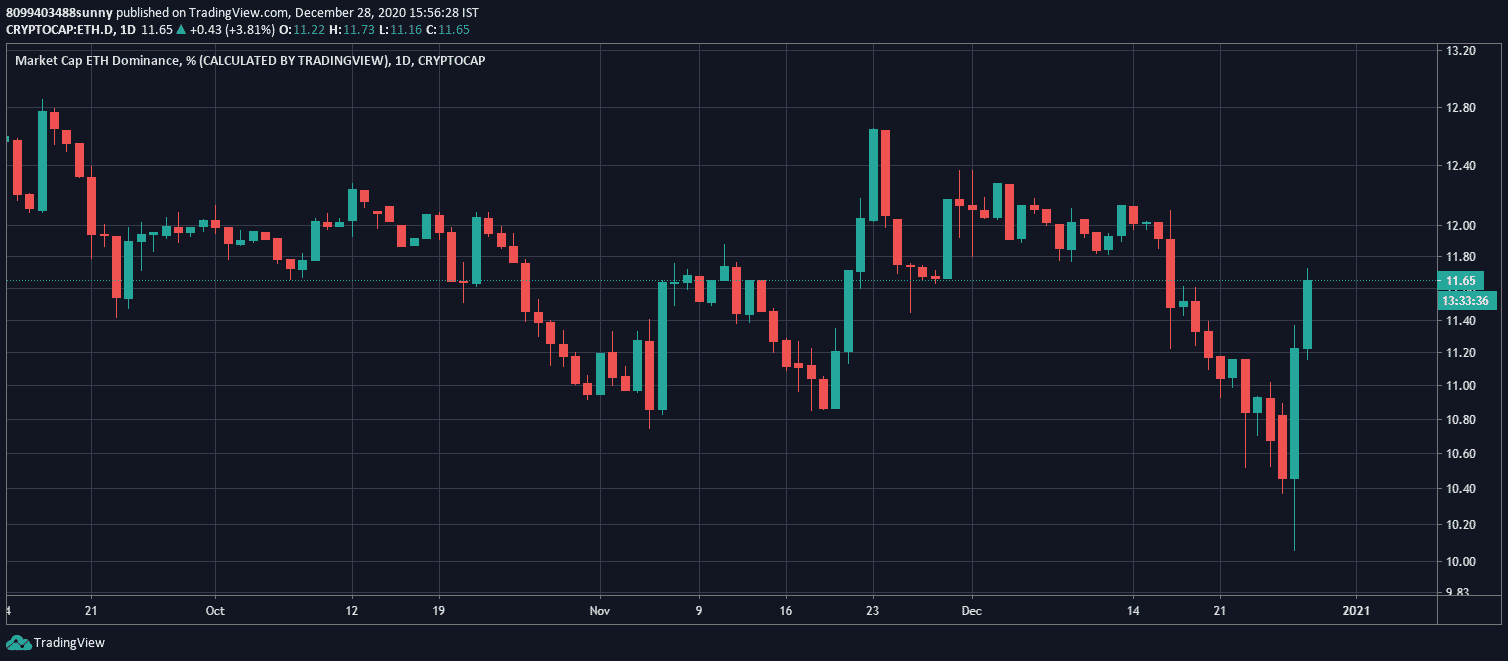

Etherum’s market dominance saw a sharp rise over the past 24 hours moving from below 10 to over 11.65 up until now with over 4% rise in the past 24 hours.

Another factor that has helped Ethereum price soar past some key resistance is the recent retail influx in the market as evident from the price rally on Christmas eve and throughout the weekends. Institutions are active on weekdays and their purchasing power is quite reflective on BTC price especially on Mondays when the market open for these institutions for almost a three-day gap. Thus leading to the belief that it was retail traders who carried the price of bitcoin through the weekend.

Retail players are also known for altcoin push as evident from 2017 bull run, when most of the altcoins achieved their all-time-highs including the Eth, XRP and BCH. Thus, all these factor combined could not just help Ethereum price register a new all-time-high just like Bitcoin, but it may also help in long-awaited alt-season.

- Breaking: Tom Lee’s BitMine Adds 40,613 ETH, Now Owns 3.58% Of Ethereum Supply

- Bitget Partners With BlockSec to Introduce the ‘UEX Security Standard’ Amid Quantum Threats to Crypto

- Breaking: Michael Saylor’s Strategy Buys 1,142 BTC Amid $5B Unrealized Loss On Bitcoin Holdings

- MegaETH Mainnet Launch Today: What To Expect?

- Bitcoin Falters as China Pushes Risk-Off, Orders Banks to Sell US Treasuries

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry