Ethereum’s Accumulation Trend Remains Unfazed by Price Downturn

Ethereum’s price underwent a major correction of nearly 16% following the market downturn.

The network has been thriving as user activity skyrocketed, thanks to the DeFi explosion and numerous on-chain metrics demonstrated significant demand for the underlying crypto asset, ETH. Despite the explosive growth of the sector, DeFi did not escape the carnage following Ethereum’s crash.

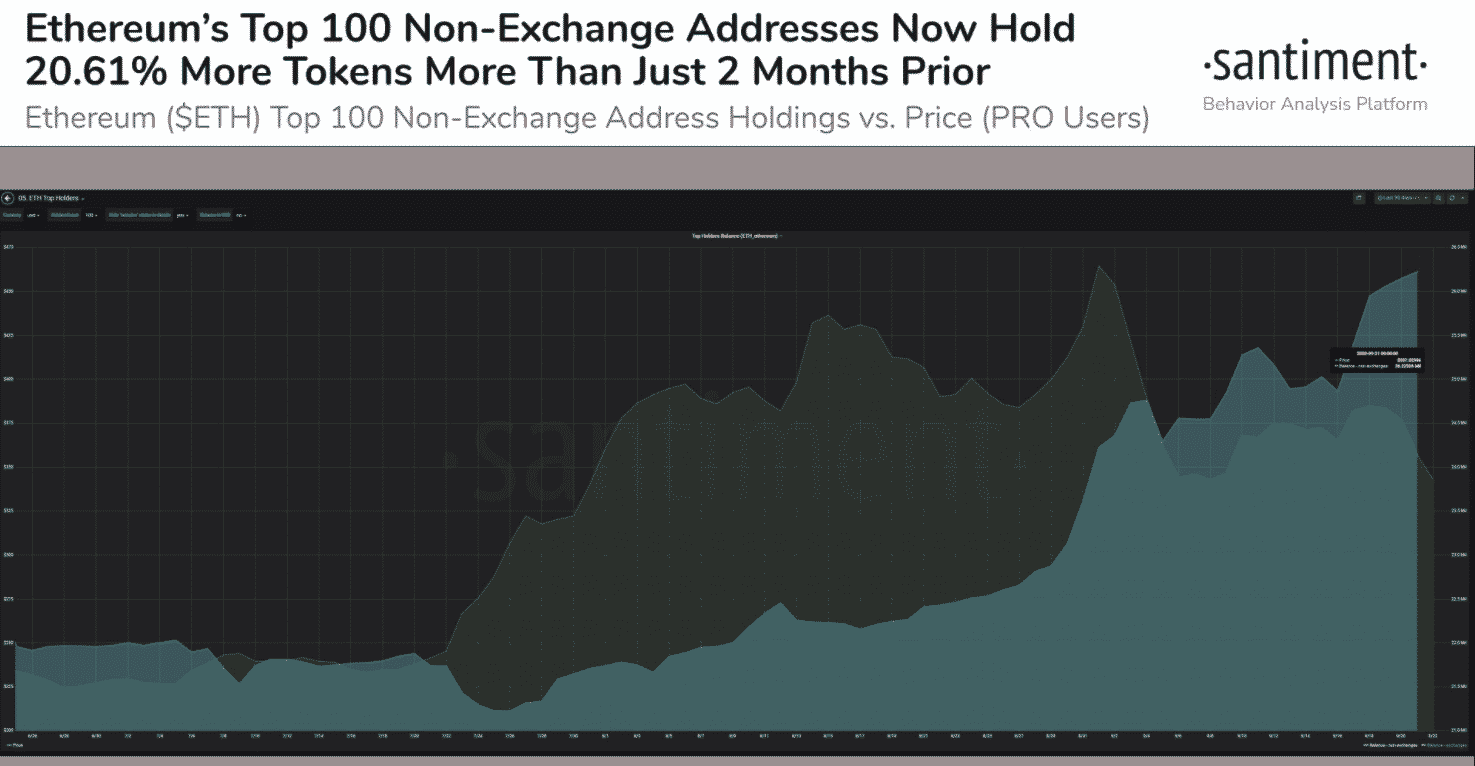

On the brighter side, Ethereum whales were found to have been accumulating. This was noted by the crypto-analytic firm, Santiment which further revealed an increase in the ETH holdings by the whales although the asset has reduced in value. The micro-dip in the price of the second cryptocurrency failed to rattle the investors’ accumulation trend especially the non-exchange whales who have been continuously hoarding larger portions.

“The top 100 Ethereum non-exchange addresses are not slowing down one bit on their accumulation. Santimentfeed data indicates these whales now hold 26.22M ETH combined, a +20.61% increase in cumulative holdings, compared to 21.74M held 2 months ago.”

Respite for Ethereum Transaction Fees

However, this wasn’t the only positive development in the Ethereum ecosystem. Ethereum’s network transaction fee has been a bone of contention for quite some time now. The transaction fee figures skyrocketed on the 2nd of September when it climbed to an ATH of $14.58 owing the mounting DeFi craze which led to a huge scale congestion on the network. After a brief respite, the transaction fee soared again to $11.61 a few days later.

However, at the time of writing, the figures declined to $3.85. To counter the prolong fees issue, Ethereum developers had recently introduced an Ethereum Improvement Proposal, EIP-1599, which aimed to reduce the fees further and, in turn, proposed to increase the gas limit [the unit of account which represents the cost of computing on the Ethereum network] by doubling the current limit.

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter