Ethereum’s Vitalik Buterin Warns ETH Reserves Could Become an ‘Overleveraged Game’

Highlights

- Vitalik Buterin acknowledges the growing trend of public companies embracing ETH treasuries.

- Buterin warns against overleveraging risks.

- The ETH treasury companies have hit $11.77 billion.

Ethereum founder Vitalik Buterin shares a nuanced perspective on the growing trend of public companies incorporating ETH into their reserves. Citing the benefits of increased accessibility and adoption, Buterin also warns against the risks of ‘overleveraging.’

Ethereum Founder Weighs in on ETH Reserve Boom

In a recent podcast interview, Ethereum founder Vitalik Buterin expressed his enthusiasm for large companies embracing the Ethereum Treasury. But, he cautioned that irresponsible handling could turn the trend into an ‘overleveraged game.’

Notably, Buterin believes that the increasing number of public companies acquiring and holding Ether is beneficial, as it introduces the token to a wider investor base. The Ethereum founder posited that indirect exposure to ETH through treasury firms offers “more options” for investors, especially those with different financial needs. He added, “There’s definitely valuable services that are being provided there.”

Buterin cautioned that Ethereum’s future success must not rely on taking on too much financial risk. Warning against a potential “overleveraged game,” Buterin noted,

If you woke me up three years from now and told me that treasuries led to the downfall of ETH, then, of course, my guess for why would basically be that somehow they turned it into an overleveraged game.”

Growing Demand for ETH Reserve

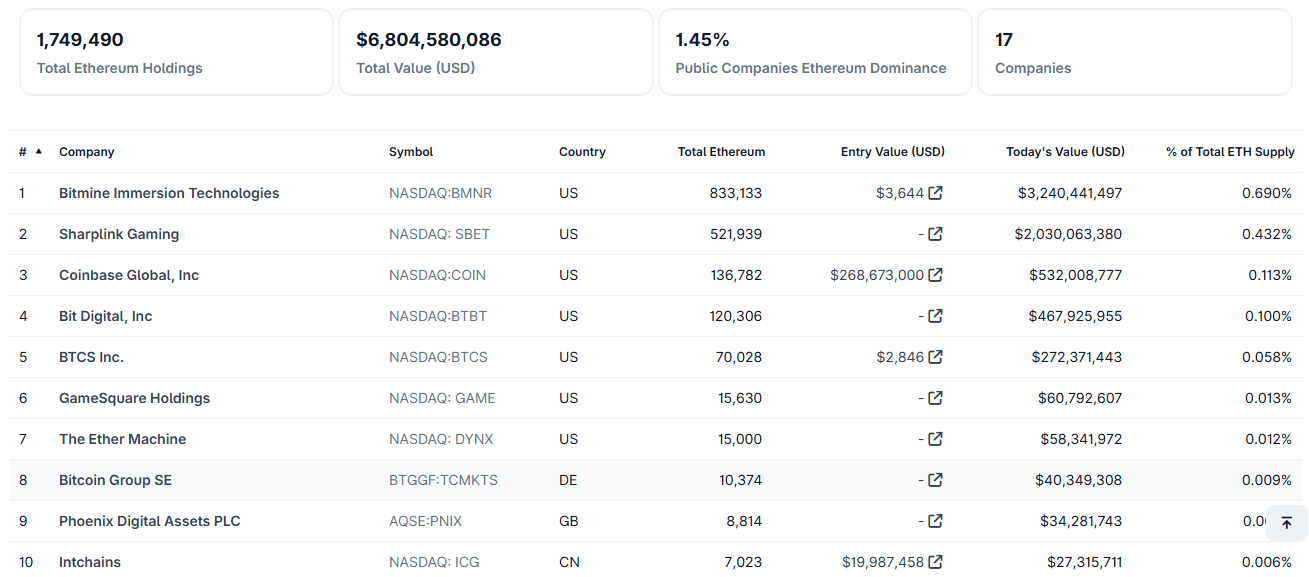

Interestingly, the number of public firms investing in Ethereum has seen a notable surge, which has significantly impacted the ETH price. Ethereum reserves by companies have remarkably grown to $11.77 billion, with BitMine Immersion Technologies and SharpLink Gaming at the forefront. BitMine’s 833,100 ETH, valued at $3.2 billion, puts it in fourth place for largest crypto holdings among public companies.

SharpLink’s ETH holdings have reached a notable $2 billion, while The Ether Machine holds a substantial $1.34 billion. They join BitMine, the Ethereum Foundation, and PulseChain among the top five largest public crypto holders.

Recently, Nasdaq-listed healthcare company Cosmos Health has secured a $300 million financing facility to launch an Ethereum treasury strategy. This strategic move involves a securities purchase agreement with a US-based institutional investor, who will provide funding through senior secured convertible promissory notes.

Standard Chartered’s Geoffrey Kendrick believes Ethereum treasury companies have become highly attractive investments, surpassing U.S. spot Ethereum ETFs in appeal. Kendrick describes these companies as “very investable,” presenting a compelling case for investors. He added, “I see no reason for the NAV multiple to go below 1.0 because I see these firms as providing regulatory arbitrage opportunities for investors.”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs