European Union To Ensure Russia Cannot Dodge Sanctions Through Crypto

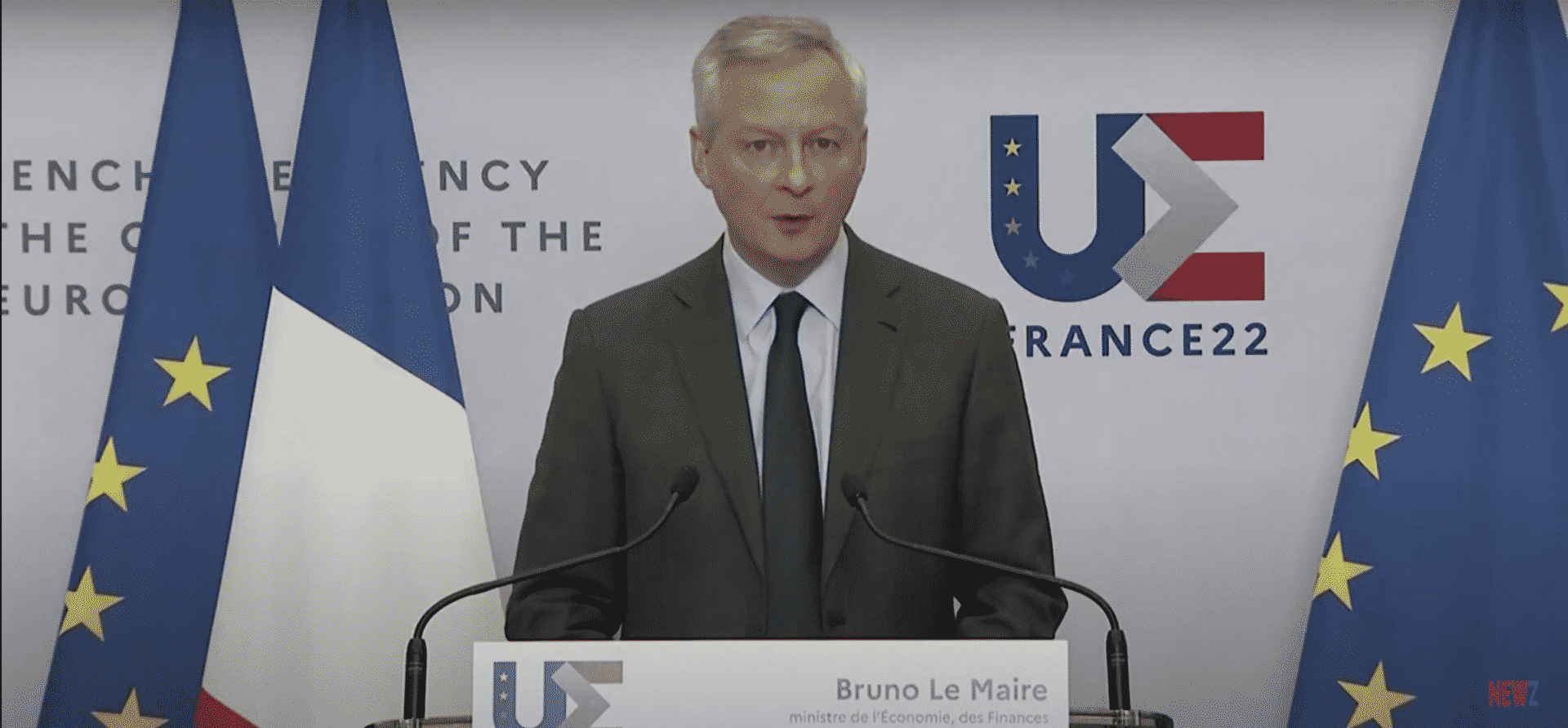

The European Union will ensure that Russia cannot use cryptocurrencies as a means to dodge strict economic sanctions, French Finance Minister Bruno le Maire said. His comments come amid widespread debate on the matter.

Speaking at a press conference after a meeting of European finance ministers, le Maire said the recent sanctions against Russia had disorganized its financial system, and paralyzed the central bank. European leaders also agreed to increase financial aid to Ukraine.

We have decided to work on complementary measures, in order to avoid the bypassing of our sanctions. Concerning the protection of our economies, we want close coordination at a European level, as we did during the covid crisis.

-le Maire

The EU and the United States last week announced strict restrictions against Russian banks and elites, over the country’s invasion of Ukraine. The most notable of these sanctions was Russia’s removal from the SWIFT transactions system, which effectively cuts off the country’s access to the global financial system.

The United States had recently also included digital currencies in its Russian sanctions, and warned exchanges against allowing blacklisted entities.

The Russian central bank had hiked interest rates sharply in response to the move, while President Vladimir Putin also announced restrictions on the amount of foreign exchange allowed to leave the country.

Strict sanctions had also seen several Western companies either exit Russia, or block their services. But crypto exchanges have so far declined to block Russian citizens.

Sanctions push Russians into crypto

Ruble trading volumes against major cryptocurrencies, particularly bitcoin and tether, were seen skyrocketing in the wake of the sanctions. The ruble had crashed against bitcoin, as well as the U.S. dollar. Citizens were likely adopting crypto as a means to avoid a falling ruble and to keep some access to global financial systems. Ukraine crypto trading volumes also spiked during the invasion, while the government began accepting donations through the medium.

But while citizens have turned to crypto, experts are skeptical over whether Russia could use the medium to facilitate billion-dollar transactions. The Bitcoin Policy Institute recently published a report stating that Russians attempting to sell commodities through crypto will push up market volatility, and make it unsustainable as a revenue source.

Sanctioned individuals would also have no means of converting their crypto into fiat currency without alerting regulators.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs