Except Bitcoin (BTC), Every Other Asset Class Failed Against Fiat Devaluation Since 2009

The rising institutional adoption of Bitcoin (BTC) shows that the world’s largest cryptocurrency is making stronger inroads in the mainstream financial market. Over these years, Bitcoin has been compared with every other asset class from gold, commodities, bonds, equities, etc.

Investor Raoul Pal presents an interesting comparison between the G4 central bank balance sheets and the asset prices. Over the last decade, there’s been constant fiat devaluation with a consistent surge in the G4 balance sheets. While the common hypothesis says that the devaluation of fiat leads to a surge in asset prices.

However, the data goes to show that every other asset class, except Bitcoin (BTC), has failed to maintain its purchasing power. Explaining this entire case. Raoul Pal notes:

“Only bitcoin as an asset has ENORMOUSLY outperformed fiat monetary debasement, as it has the twin killer benefits of store of value plus call option on the future”.

But only bitcoin as an asset has ENORMOUSLY outperformed fiat monetary debasement, as it has the twin killer benefits of store of value plus call option on the future… #Bitcoin #irresponsiblylong pic.twitter.com/At2k6qcUYW

— Raoul Pal (@RaoulGMI) December 9, 2020

Well, this clearly strengthens the popular belief that Bitcoin is a strong inflation-hedge against the rising central bank balance sheets. In fact, it seems that even institutional players have understood this fact and have started moving money from other assets (especially Gold) to Bitcoin.

JPMorgan: Gold Will Suffer At the Cost of Bitcoin (BTC)

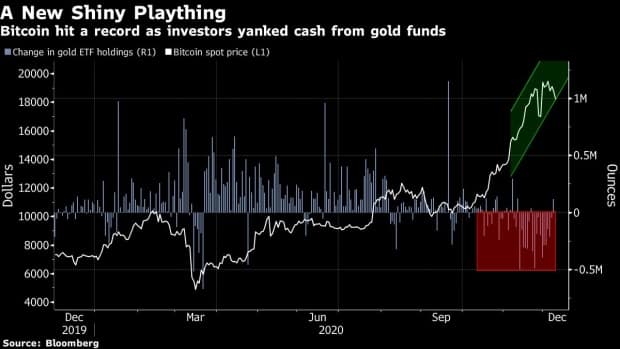

In a bold statement on Wednesday, December 10, JPMorgan strategists said that the rise of Bitcoin in mainstream finance comes at the expense of Gold. JPMorgan spots an interesting trend since October 2020 where money has moved out of Gold but entered Bitcoin Funds.

As reported by Bloomberg, JPMorgan strategists note that the Grayscale Bitcoin Trust (GBTC) has registered inflows over $2 billion since October. During the same period, the outflows from the gold ETFs have been more than $7 billion. JPMorgan thinks that this transfer from gold to Bitcoin could be in billions of dollars worth of cash.

“If this medium to longer-term thesis proves right, the price of gold would suffer from a structural flow headwind over the coming years,” wrote JPMorgan’s strategists.

Many crypto experts think that BTC will outclass gold in the long term. Although the BTC valuations are much smaller than Gold, the journey has just begun.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs