Expert Predicts SOL ETF Approval This Week as Solana ETPs Break All-Time Record

Highlights

- Lark Davis expects the U.S. SEC to approve the pending Solana (SOL) ETF filings later this week.

- Filings from Grayscale, VanEck, Bitwise, and others expect a decision later this week.

- Solana ETPs recorded $706 million in weekly inflows, more than double their previous all-time high.

An expert has predicted that the U.S. SEC could finally approve the pending SOL ETF filings later this week. This comes as Solana ETPs enjoyed record inflows, surging past previous highs.

Expert Sees High Probability of SOL ETF Approval

Crypto expert and Founder of Wealth Mastery, Lark Davis, highlighted that the SEC’s final deadline for the spot SOL ETF decision is only four days away, calling this a “big week for Solana.” Davis noted that given the growing institutional demand and strong recent inflows into the products, “approval this week looks very likely.”

Big week for Solana.

The final deadline for spot $SOL ETF approval is just 4 days away.

High chances we get the approval this week. pic.twitter.com/nAVUr2g7PC

— Lark Davis (@TheCryptoLark) October 6, 2025

Several major issuers, including Grayscale, VanEck, 21Shares, Canary, and Bitwise, are among those seeking the green light. In a notable shift, Bitwise, Canary, and Grayscale recently amended their S-1 filings to include a staking feature. This would enable funds to earn rewards by using the token held in custody.

Building on this, SOL ETF issuers submitted a public letter urging the SEC to approve their liquid staking tokens (LSTs) within ETF structures. Using Solana as a test case, the proposal makes the case that LST integration could turn the upcoming SOL ETF into a prototype for financial products based on blockchain technology in the future.

Solana ETP Hit Record-Breaking Inflows

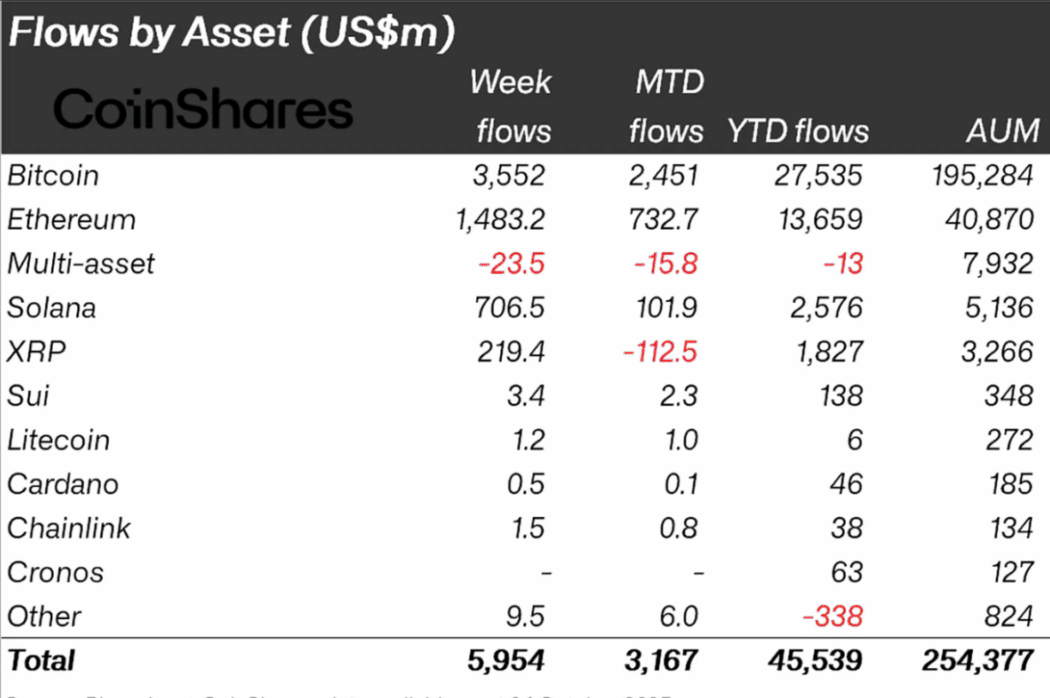

Despite the partial U.S. government shutdown, Solana ETPs are witnessing unprecedented inflows. According to CoinShares, the investment products recorded $706 million in weekly inflows. It pushed total assets under management (AUM) for all Solana ETPs past $5.1 billion. This is more than twice the previous record of $311 million, which was set in July.

A Solana ETP (Exchange Traded Product) allows traditional investors to benefit from the price changes of Solana (SOL) without the hassle of managing it directly. These products typically hold real SOL tokens. They can also earn staking rewards by taking part in the token’s proof-of-stake system.

This rapid expansion indicates that institutional investors are becoming more confident. The only SOL ETF listed in the United States at the moment is the REX Shares Solana Staking ETF (SSK). The product’s AUM of over $406 million indicates that Wall Street is becoming more interested in the token.

Adding to the bullish sentiment, 21Shares has rolled out a new Jupiter ETP (AJUP) on the SIX Swiss Exchange. The physically backed product offers institutional investors exposure to Jupiter, Solana’s leading liquidity hub. The platform handles more than 90% of the ecosystem’s transactions, with a weekly trading volume of over $8 billion and lifetime trades exceeding $1 trillion.

It is also worth noting that futures-based SOL ETFs have already surpassed the $1 billion inflow mark. This essentially highlights the broader surge in investor demand for crypto-linked securities.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Is the Bitcoin Price Correction Really Over or Is This a Bear Market Trap?

- ‘Gambling Is Not Investing’: New Group Pushes Crackdown on Prediction Markets

- XRP News: Ripple Prime to Move Post-Trade Activity to XRPL via NSCC Link

- Fed Rate Cut at Risk: Janet Yellen Flags Inflation Concerns Amid US-Iran War

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs