Expert Sees LTC Crashing to $50 Even As Litecoin ETF Approval Reaches Final Stage

Highlights

- Litecoin price needs to break the crucial ceiling at $135 for a sustained rally to $200.

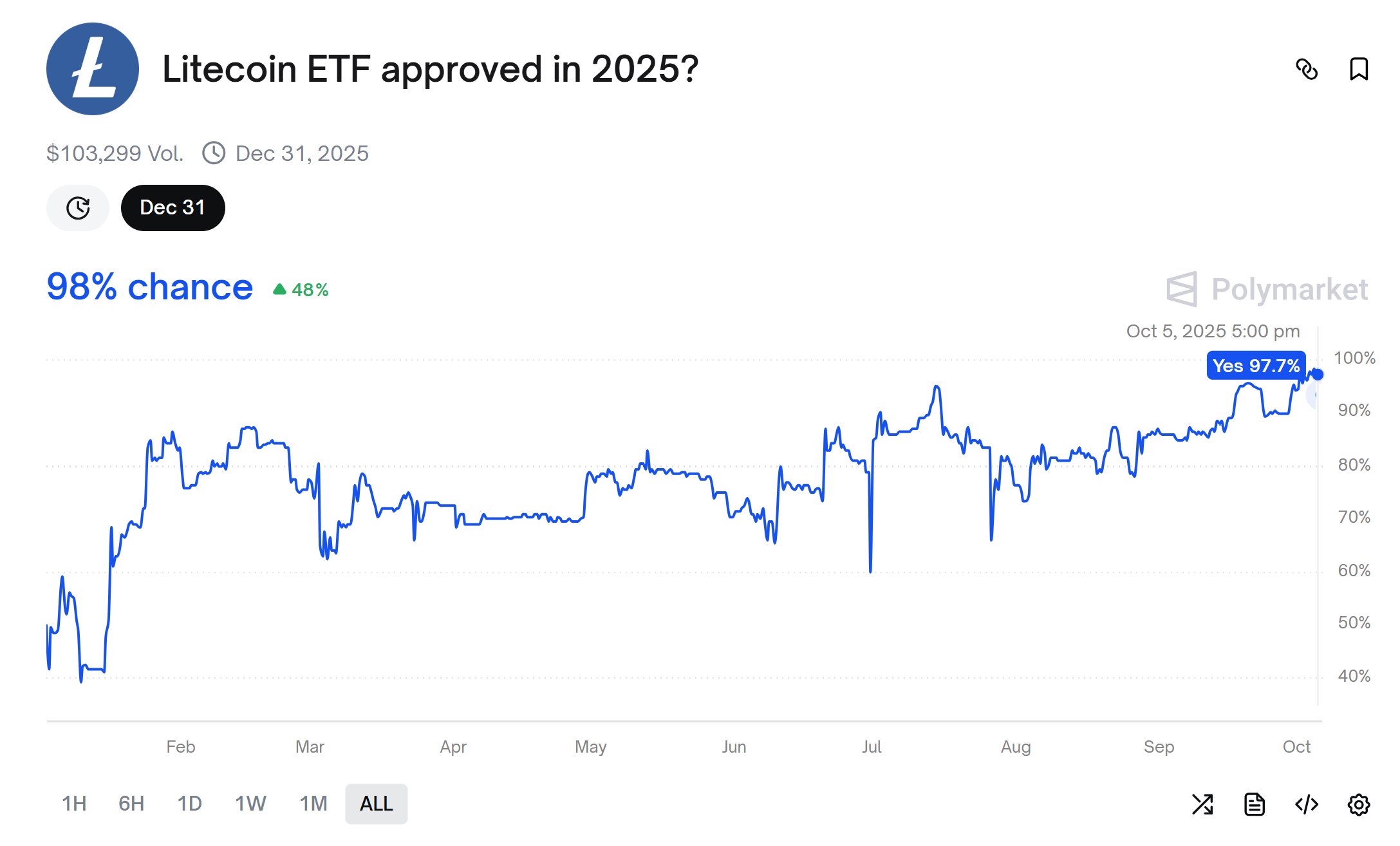

- Canary Capital has filed an S-1 amendment for its proposed Litecoin ETF (LTCC), which comes with 95 bps fees.

- Polymarket data shows a 98% chance of Litecoin ETF approval, reflecting strong investor confidence.

Litecoin (LTC) has been under investors’ radar recently, after a 10% rally over the past week. Amid the broader crypto market volatility, LTC is testing a crucial support at $115. Experts believe that Litecoin is currently in a make-or-break situation as the Litecoin ETF approval reaches its final stage.

LTC Needs to Break Through $135 Ceiling to Avoid Crash to $50

Popular crypto analyst Ali Martinez shared his weekly technical analysis for the LTCUSD trading pair, showing that the altcoin is trading at a crucial resistance level. As per the chart below, LTC’s upper boundary has capped rallies multiple times since 2023, most recently in 2025.

This level represents a critical obstacle for bullish continuation. LTC price has been testing a crucial support at $115, amid the broader crypto market correction.

In his message on the X platform, Maritnez noted that a rejection of LTC at this point could send the price crashing to $50. The lower boundary around $48-$51 range marks a historical accumulation area and major support level tested during market corrections. For the month of October, our LTC price prediction hints at a value around $133.

Litecoin ETF Approval Reaches Final Stage

Bloomberg analyst Eric Balchunas reported that Canary Capital has submitted an S-1 amendment for its proposed Litecoin (LTCC) and Hedera Hashgraph (HBAR) spot ETFs. The filing includes the fees, set at 95 basis points (bps) each, and the official tickers, typically the final updates before launch. The fresh filing comes amid the delays faced last week following the US government shutdown.

Balchunas noted that while the U.S. government shutdown may affect timing, the documents appear largely finalized. He added that the 95 bps fee, although higher than that of a spot Bitcoin ETF, is standard for newer or niche asset classes entering the ETF market.

As per the Polymarket data, the Litecoin ETF approval chances have surged to 98%. This shows that the market optimism around the final approval is high.

Apart from Litecoin, the final deadline of ETF approval for XRP, Solana (SOL), Dogecoin (DOGE), and others are scheduled for October. However, uncertainty around the US shutdown could further delay the approval process from here.

- Michael Saylor Says Strategy Can Cover Debt Even If Bitcoin Crashes to $8,000

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs