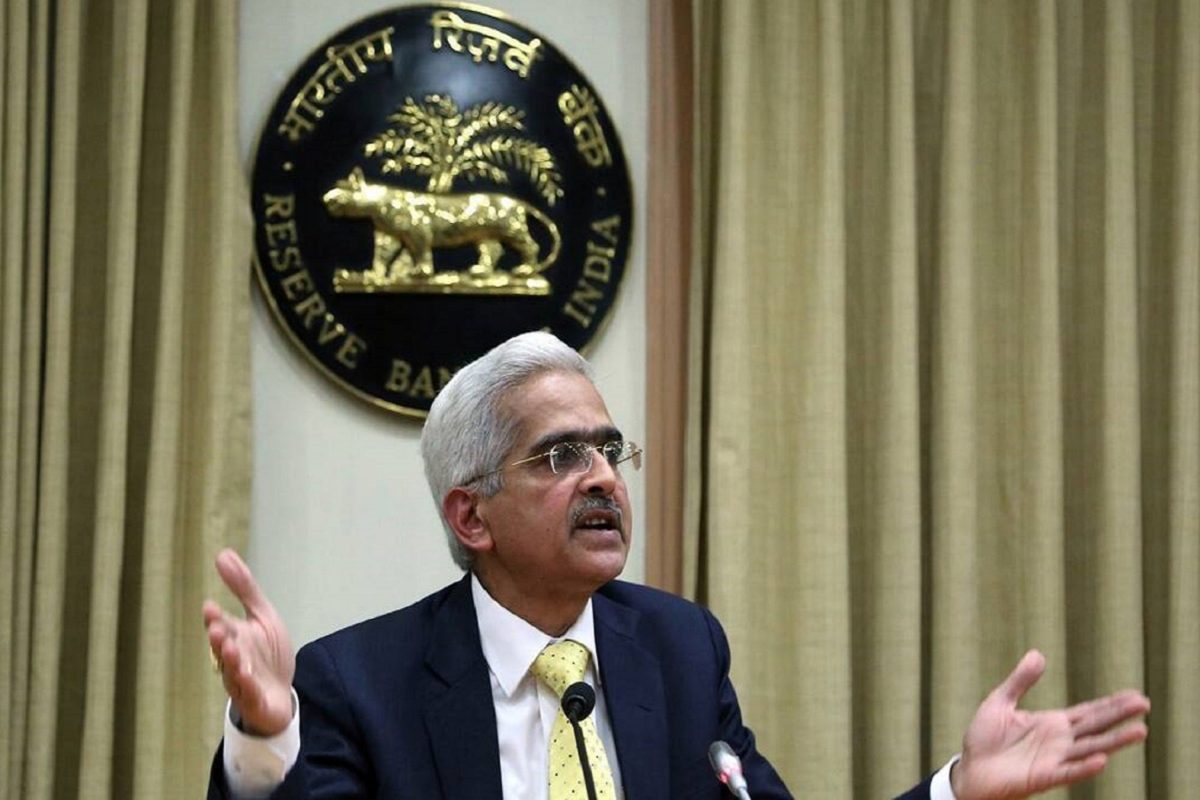

Explainer: What is CBDC? What is RBI’s ‘Digital Rupee’ Pilot Programme?

A central bank digital currency (CBDC) is a digital currency issued by the central bank of a country. It’s under the jurisdiction of the government of that country. Unlike crypto, CBDC is reliant on a central authority. That’s why it is also known as “digital fiat currency.”

The RBI states that CBDC is the legal tender issued in digital form by a central bank. It is interchangeable one-to-one with fiat currency and is the same as fiat currency. Only its form is different.

Despite being directly inspired by Bitcoin, the idea of CBDCs is distinct from decentralised virtual currencies and crypto assets, as they are issued by the government and have the status of “legal currency.”

CBDCs are currently mostly in the hypothetical stage, though some are in proof-of-concept stages. More than 80 central banks are considering digital currencies. The first digital currency to be issued by a major economy was the digital RMB from China. Now, RBI, the central bank of India, has also launched its own CBDC – Digital Rupee

Nine banks, including the State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, YES Bank, IDFC First Bank, and HSBC, are participating in this pilot project.

Also Read: India’s Finance Minister Praises CBDC, RBI to Accelerate the Development

Upsides of CBDCs:

CBDCs give users the ability to carry out domestic and international transactions without the use of a third party or bank.

The introduction of CBDC has the potential to bring about a number of positive outcomes, including a decreased reliance on cash, increased seigniorage (profit made by a government by issuing currency), lower transaction costs, and less settlement risk. The introduction of CBDC can lead to a more reliable, efficient, dependable, regulated, and legal tender-based payment method.

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?