Will Bitcoin (BTC) Price Hit $20K or $30K Next?

Bitcoin price invalidated the brief bullish bump witnessed following the release of the United States Consumer Price Index (CPI) data, which showed inflation easing in the greenback nation.

However, there was a surprise sell-off when the Federal Reserve made good on its intention to pause the historic interest rate hikes for the first time since March 2022.

The largest cryptocurrency plunged recording losses of at least 4% following the Fed’s decision on interest rates. Although Bitcoin price is trading at $24,949 on Thursday, the sharp drop extended to $24,835, bringing the cumulative seven days losses to 5.1%.

Why is Bitcoin Price Falling Despite Pause on Interest Rate Hikes?

As reported on Wednesday, at least 76% of the economists interviewed by Dow Jones expected the Fed to halt the long-standing interest rate hikes. Analysts generally believed this would be a boost for Bitcoin price and crypto.

However, according to John Gilbert, a Market Analyst at eToro, while the Fed paused interest rates this month, the regulator signaled the possibility of further increases in the future. This statement blatantly killed investor excitement, especially those considering risk assets like BTC and crypto.

What this means is that this is a temporary pause. On the other hand, investors have been building positive sentiment “on the expectation that inflation will fall and interest rates will peak, and then begin to be cut,” Gilbert said in a statement.

“Inflation is moving in the right direction but the comments from Jerome Powell signify that rates could stay higher for longer, which would put Bitcoin on the back foot,” the market analyst added.

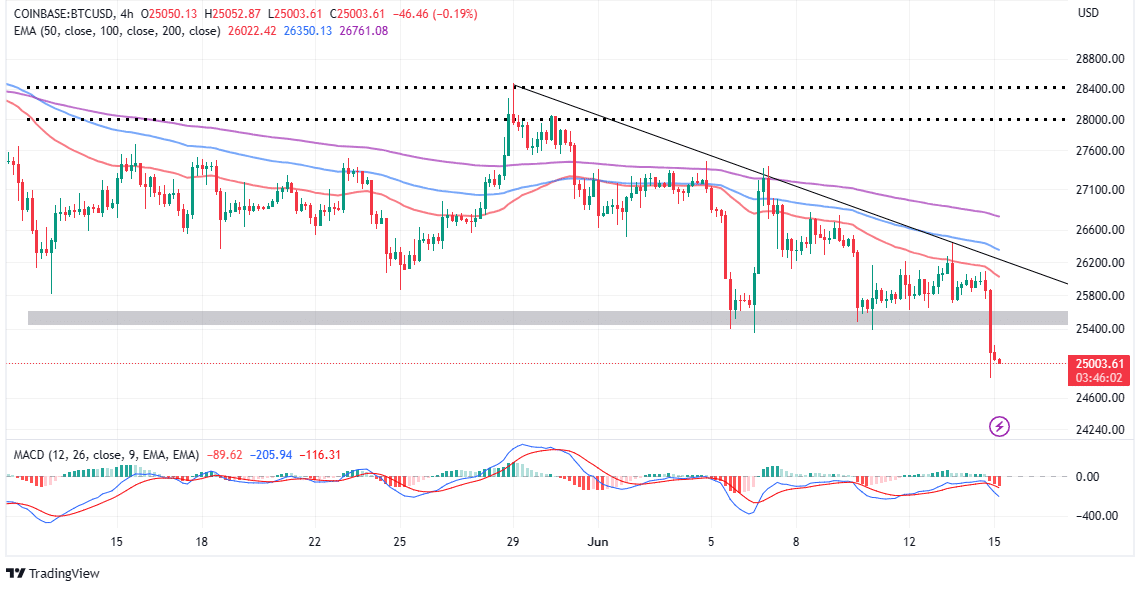

BTC Price Analysis: Bitcoin Bulls Aggressively Searching For Support

Bitcoin price printed a red candle on the four-hour timeframe chart following the Fed-triggered sell-off on Wednesday. The Tentative support areas at $25,400 and $25,000 caved in leaving bears unchecked and losses stretching to $24,835.

Based on the technical outlook of the Moving Average Convergence Divergence (MACD) indicator, is possible these declines will carry on into the weekend. However, we cannot rule out the possibility of bulls arresting the bearish situation by defending support in the area of around $25,000.

The On Balance Volume (OBV) indicator on the same chart indicates that sellers have the upper hand. There’s more money flowing out of BTC markets compared to the volume coming in, and this leaves bulls at a disadvantage.

That coupled with the sell signal from the MACD implies that Bitcoin price is far from finding credible support.

Some analysts like Captain Faibik (on Twitter) believe that the Bitcoin price dip below $25,000 could be a bear trap. If it is a false swing south, traders can start acclimating to a massive rebound as BTC sweeps through fresh liquidity.

$BTC Bulls have lost the 7-Month Major Trendline, Not a good Sign..!!

Is it a TRAP or Bears are Back in the Town?? 🤔

– If it’s a trap and Bitcoin bounces back, Reclaiming the 26.7k Resistance, we could witness a Bullish Rally towards 31k.

– If Bears are back, Bitcoin may… pic.twitter.com/j4ZZeCXuJi

— Captain Faibik (@CryptoFaibik) June 15, 2023

A rebound from BTC’s current market position could reclaim resistance at $26,700 and subsequently move to $30,000, Captain Faibik told his more than 61,000 followers on Twitter. However, investors have been cautioned to consider further declines to $20,000, especially if bears have returned in full swing.

Related Articles:

- US Fed’s Jerome Powell Speech: Strongly Committed To Bring Down Inflation

- Twitter Founder Jack Dorsey Makes New Pledge to Support Bitcoin Developers

- Binance-SEC Settlement Incoming? Ex-SEC Official Predicts How This Case May End

Recent Posts

- Crypto News

125+ Crypto Firms Mount Unified Defense as Banks Push to Block Stablecoin Rewards

Over 125 cryptocurrency companies have joined forces to defend stablecoin rewards programs against banking industry…

- Crypto News

BlackRock Bitcoin ETF Ranks Among Top ETFs In 2025 Despite Crypto Downturn

The BlackRock Bitcoin ETF (IBIT) has emerged as one of the top exchange-traded funds (ETF)…

- Crypto News

Stablecoin Adoption Deepens as Klarna Turns to Coinbase for Institutional Liquidity

Klarna has taken a major step into crypto finance by partnering with Coinbase to accept…

- Crypto News

Ripple, Circle Could Gain Fed Access as Board Seeks Feedback on ‘Skinny Master Account’

The U.S. Federal Reserve has requested public feedback on the payment accounts, also known as…

- Crypto News

Fed’s Williams Says No Urgency to Cut Rates Further as Crypto Traders Bet Against January Cut

New York Federal Reserve President John Williams has signaled his support for holding rates steady…

- Crypto News

Trump to Interview BlackRock’s Rick Rieder as Fed Chair Shortlist Narrows to Four

The Fed chair race is heating up with U.S. President Donald Trump set to interview…