Fidelity Survey Reveals A Third Of Large Institutional Investors Hold Cryptocurrencies

Financial services firm, Fidelity reveals data from a survey that says a third of large institutional investors own cryptocurrencies. Bitcoin and Ethereum are the top two currencies owned by the respondents.

Europe Scores Big; United States Takes A Back Seat

The latest survey conducted by the financial services company, Fidelity also inclines towards the same. Bloomberg recently reported that the financial services firm carried out a survey with a total of 800 institutions in the United States as well as Europe. The survey confirmed that “a third of large institutional investors” possess cryptocurrencies. About 36 percent of the 774 respondents of the survey in both the countries revealed that they owned either cryptocurrencies or derivatives.

While many authorities in the United States have been looking into digital assets, the number of institutions holding cryptocurrencies in the country has significantly increased since the last year. As per the survey, 27 percent of institutions that include family offices, investment advisers, pension funds as well as traditional hedge funds reportedly own cryptocurrencies in the United States alone. Last year, the platform surveyed just 441 institutions in the country and 22 percent of the respondents confirmed the ownership of cryptocurrencies.

While the United States recorded just 27 percent, about 45 percent of the respondents in Europe suggested that they own cryptocurrencies. In an interview, the President of Fidelity Digital Assets, Tom Jessop said,

“Europe is perhaps more supportive and accommodating. That could be just things going on in Europe right now, you got negative interest rates in many countries. Bitcoin may look more attractive because there are other assets that aren’t paying return.”

While more than a quarter of the respondents possessed Bitcoin, just 11 percent of the respondents held Ether.

The survey was reportedly carried out between November 2019 till the beginning of March 2020 by Greenwich Associates.

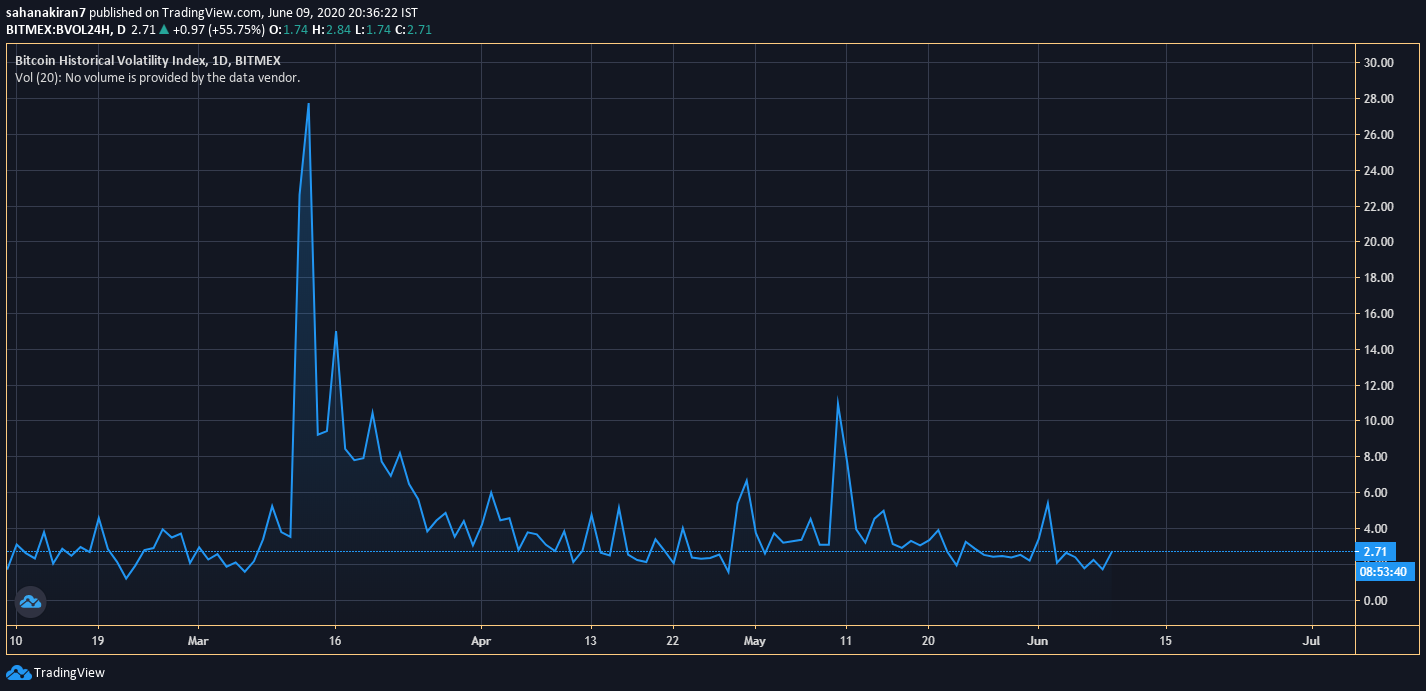

Additionally, the price volatility of cryptocurrencies seemed to be the main concern for the other respondents who hadn’t owned these assets. However, the latest charts reveal that Bitcoin’s volatility is almost at its lowest since March 2020.

Since the volatile nature of cryptocurrencies was one of the main concerns of people who haven’t invested in digital assets, the plummet in volatility could pave the way to further adoption. Jessop added,

“These results confirm a trend we are seeing in the market towards greater interest in and acceptance of digital assets as a new investable asset class.”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils MotoGP-Inspired ‘Smarter Speed Challenge’ for Crypto, Stocks, and Gold Trading in Latest UEX Push

- XRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

- Is World War III Near? Bitcoin Price Drops As UK, France, Germany Consider Iran Action

- Is Bitcoin Dead? Here’s What the Data Really Says

- US-Iran War: Meme Coin Market Plunges After Iranian Drone Hits US Embassy in Kuwait

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs